Introduction

Put simply, compound interest is the interest you earn on interest.

As compound interest includes interest accumulated in previous periods, it grows at an ever-accelerating rate. For example, a £10,000 investment which returns 5% per year (compounded annually), will be valued at £10,500 at the end of year 1, £11,025 at the end of year 2, and £11,576.25 at the end of year 3. Thus, the value of interest accrued increases year-on-year, with year 1 generating £500 in interest, year 2 generating £525, and year 3 generating £551.25. There is no secret to compound growth – if you get started and stay invested over the long-term, it takes care of itself. The longer you remain invested, the greater the potential returns on what you’ve already invested.

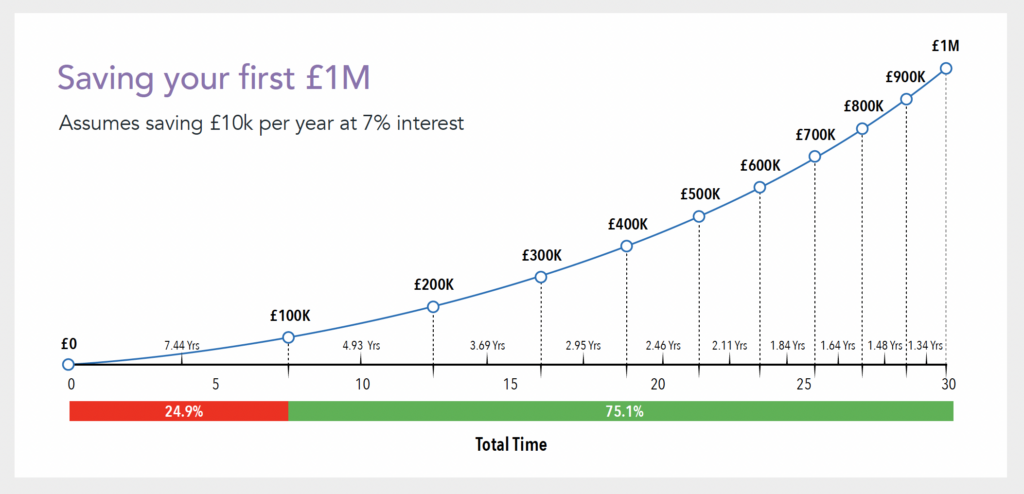

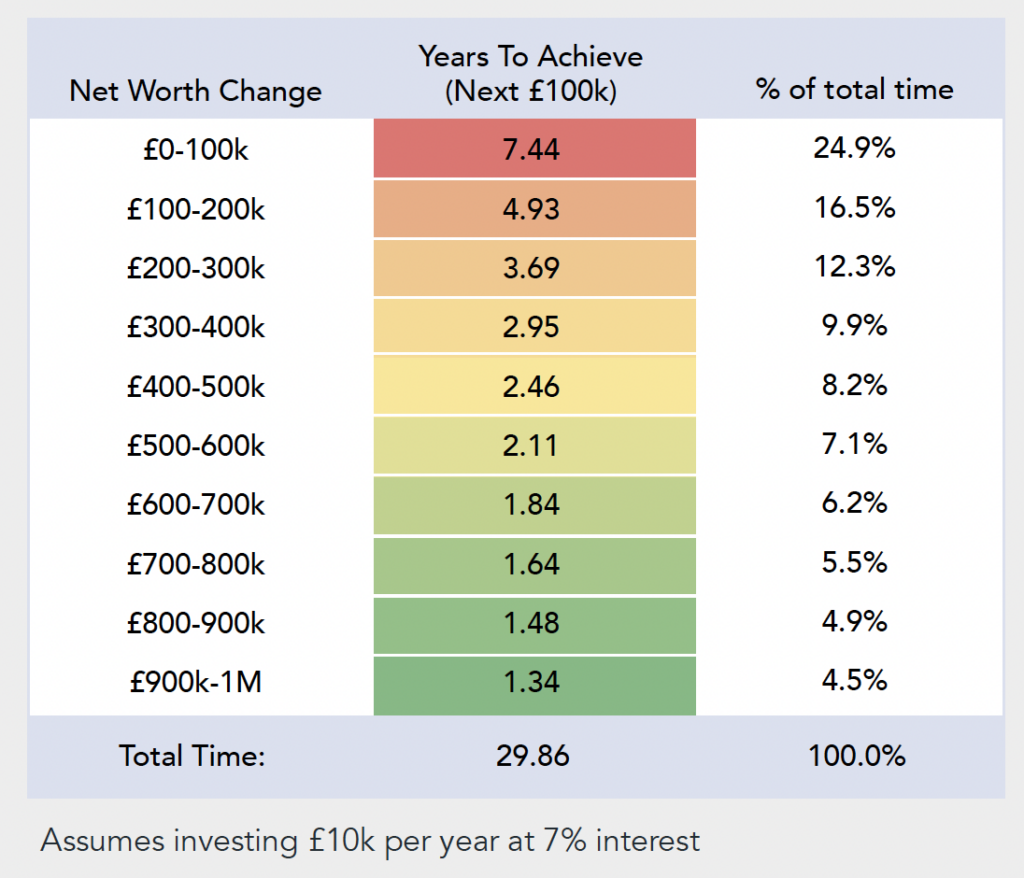

Example: £10,000 per year invested at 7% interest

As shown in the example below, the power of compound interest is unequivocal – the longer you remain invested, the quicker your money grows. On the road to £1million, your first £100k would take 7.44 years to save, however the final £100k (going from £900k to £1million) would only take 1.34 years. This is attributable to compounding, the interest you earn on interest, helping your portfolio grow at an increasing rate year to year.

Assumptions:

- Returns

It is also important to consider the impact of your return assumptions. As your returns increase, the time it takes to save the next £100k will decrease. For example, starting on £0, at 2% per year it would take 9.04 years to save the first £100k. Alternatively, if we assumed a return of 12% per year, the time taken to save the first £100k falls to 6.43 years.

- Portfolio Value

Similarly, the portfolio size will play its part. Lets assume a return of 2% per year; when starting on £0, the first £100k will take 9.04 years to save, however, if we started with £1 million, the first £100k would only take 3.24 years to save.

- Compounding frequency

Our assumptions have assumed annual compounding (and £10k invested at the end of each year), however the frequency of interest payments may be monthly, quarterly or biannually. If the interest period is not annual, then the total amount of interest paid across the year will be higher, due to interest being paid on the interest accumulated in those smaller periods.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team

- The FCA lifts its ban on Cryptocurrency ETNs

- September Market Review 2025