Sustainable Investing

Awarded Best

Value for Money 2025

ebi’s Earth Suite Awarded Best

Sustainable/ESG Investment Portfolio 2025

Awarded Best

Outsourced Investment Manager 2025

What is sustainable investing?

This is an approach that covers is a range of practices that seeks financial returns whilst promoting environmental, social and corporate governance values. It involves the consideration of ESG data and metrics when evaluating the sustainability performance of companies. Extra financial factors such as environmental practices (e.g. carbon emissions), relationships with employees and local communities (e.g. inclusion and diversity policies), and how companies are governed (e.g. board composition) are evaluated and considered.

The Global Sustainable Investment Review 2020 reports that global sustainable funds reached $30 trillion at the end of 2023, following rapid growth over the past decade.

The 3 pillars of ESG

At the core of Sustainable Investing are the pillars of Environmental, Social and Governance (ESG). These three pillars of ESG investing combine to define what most people would categorise as good business practice. Environmental issues cover how companies interact with the environment, Social issues cover companies’ conduct towards their internal and external communities, and Governance issues cover how companies behave in their business activities.

Environmental

• Air & Water Pollution

• Biodiversity & Deforestation

• Climate Change

• Energy Efficiency

• Waste Management

• Water Scarcity

Producing more output with less natural resources, energy, water, waste and pollution.

Social

• Community Relations

• Customer Satisfaction

• Employee Engagement

• Gender & Diversity

• Human Rights

• Labour Standards

Improving relations with key stakeholders: employees, customers, suppliers.

Governance

• Audit Committee Structure

• Board Composition

• Bribery & Corruption

• Executive Compensation

• Lobbying Activities

• Political Contributions

Reducing risk through board

oversight and risk controls.

ESG screening approaches

There are a range of ESG screening approaches; below we provide an overview of the two main styles:

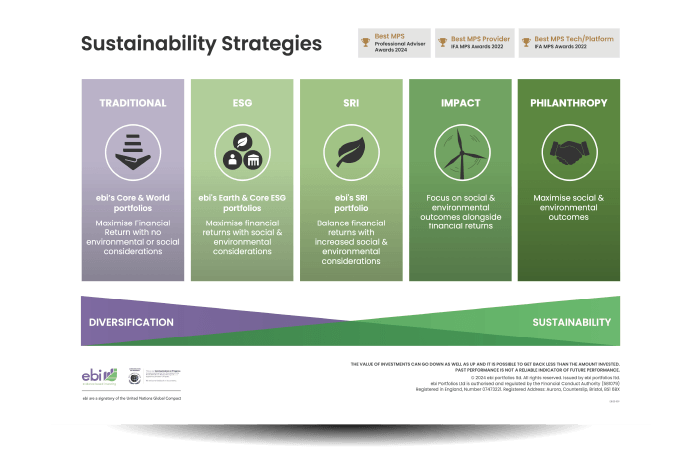

Sustainable investing strategies

Download our Sustainability Strategies infographic

An easy to understand infographic detailing the core principles of Sustainability Strategies.

Further information on our sustainable portfolios

Earth Portfolios

The Earth Portfolio Suite embodies ebi’s investment philosophy, offering a globally diversified, ESG-screened, and factor-tilted investment approach.

These portfolios are designed for investors seeking a balance between sustainability and financial growth.

The suite invests in index-tracking and rules-based funds screened for ESG criteria. Bond exposure is tilted to a shorter duration than the broader market, enhancing risk management while maintaining alignment with sustainability goals.

Core ESG Portfolios

The Core ESG portfolios suite include a range of market-indexed portfolios with Environmental, Social and Governance (ESG) screening. Each portfolios within the Core ESG suite represents a passive, low cost investment, aiming to provide capital appreciation through global diversification.

The portfolio range is more appropriate for long-term holding periods and for investors aiming to gain broad global market exposure using low-cost passive investment funds that incorporate ESG screening.

SRI Portfolios

The SRI portfolios are a range of globally diversified, market-based portfolios with a Socially Responsible Investing focus, and integrated ESG screening. The SRI equity portfolio element invests exclusively in the top 25% of companies ranked in ESG terms relative to their sector peers, and meets the EU Paris Aligned Benchmark minimum requirements.

The portfolio range is more appropriate for long-term holding periods and for investors aiming to gain exposure to a range of market-indexed funds that seek to provide increased ESG characteristics in comparison to the broad global market.

Our Wider Portfolio range

ebi has created a range of low-cost, diversified, passively managed portfolios.

Greenwashing

What is Greenwashing?

Greenwashing is the exaggeration or unsubstantiated credentials of investment products, services or companies.

Also known as ‘green sheening’, greenwashing can be inadvertent, or a cynical ploy some companies use to jump on the ESG bandwagon, taking advantage of the lack of clear definition of what sustainability or green actually means.

A good example of greenwashing is when a plastic bottle is labelled 100% recyclable. This doesn’t mean it will be, or even likely to be recycled, which is misleading to the consumer.

The FCA’s Sustainability Disclosure Requirements regulation addresses the risk of greenwashing.

The importance of ESG Data

ESG data is crucial in addressing greenwashing. Quality ESG data is clear, measurable and verified. It improves decision making when considering the sustainability of companies, and investment funds.

How is it being tackled?

The answer is simply look at the evidence;

- Does the company in question back up their claims with data?

- Have they institutionalised sustainability within the company?

- Do they have a board or committee that monitor and report on green issues?

- Additionally looking at targets the company sets for itself can tell a story. Are they achieving their targets easily, or finding it difficult to meet them?

The stewardship efforts of fund managers helps to push back those companies that overstate their ‘green’ credentials.

Our webinar with Julia Kochetygova, Head of EMA Stewardship for Northern Trust, ‘How Fund Managers influence companies for sustainability’ discusses sustainable investing, stewardship, and how fund managers influence positive change within companies.

Emissions Calculator

Try our emissions calculator, a valuable tool in demonstrating the benefits of sustainable investing to clients.

Enter your investment amount, choose the ebi Earth, Core ESG or SRI portfolio and the comparison ebi portfolio, and find out the annual carbon savings in metric tonnes.

The calculator also provides equivalent examples, such as the comparable number of miles driven in an average car, or how many viewings of the ‘Friends’ complete series boxset!

² ebi webinar, Georg Kell, Decarbonisation, Digitalization and Sustainability’, 2021

³ Market Business News, ESG definition [online]