Vantage: Award-Winning Model Portfolio Service

for Financial Advisers

ebi’s Vantage Model Portfolio Service (MPS) is an evidence-based discretionary investment management solution built specifically for financial advisers in the UK.

Built on decades of peer-reviewed academic research—including Nobel Prize-winning insights—Vantage combines disciplined asset allocation with tolerance-based rebalancing to create an efficient, cost-effective solution.

Our approach has been recognised across the industry, with multiple awards celebrating our innovation and service.

What is a Model Portfolio Service?

A Model Portfolio Service (MPS) is a discretionary investment management service where a provider (usually an investment manager or discretionary fund manager) creates and manages a range of pre-constructed, risk-graded portfolios.

Each portfolio is built around a specific risk/return profile and investment objective. Advisers can then recommend the most suitable model to their clients, based on the client’s individual circumstances, objectives, and risk appetite.

The provider maintains responsibility for:

Asset allocation

How money is spread across different types of investments.

Ongoing management

Making adjustments in line with market conditions and the model’s strategy.

Rebalancing

Keeping the portfolio aligned with its intended risk level and objectives.

Why choose a Model Portfolio Service?

A Model Portfolio Service (MPS) is a discretionary investment management service where a provider (usually an investment manager or discretionary fund manager) creates and manages a range of pre-constructed, risk-graded portfolios.

1. Save Time & Scale Your Business

Outsource day-to-day portfolio management so you can spend more time on what matters most –

building client relationships and growing your practice.

2. Access Professional Investment Expertise

Give your clients the confidence of portfolios built by a dedicated investment team,

applying evidence-based research and robust risk controls.

3. Support Consistent Client Outcomes

Our risk-graded portfolios provide a transparent, repeatable investment process. This helps make client reviews and suitability assessments clearer, more structured, and efficient — supporting consistent and appropriate outcomes aligned to each client’s risk profile.

4. Supporting Consumer Duty Compliance

Demonstrate value for money, access clear reporting, and rely on FCA-authorised discretionary management to evidence good client outcomes.

5. Support Consistent Client Outcomes

Competitive fees, efficient rebalancing, and a range of solutions (such as ESG screened, factor tilted and deeper green strategies)

help you meet diverse client needs without complexity.

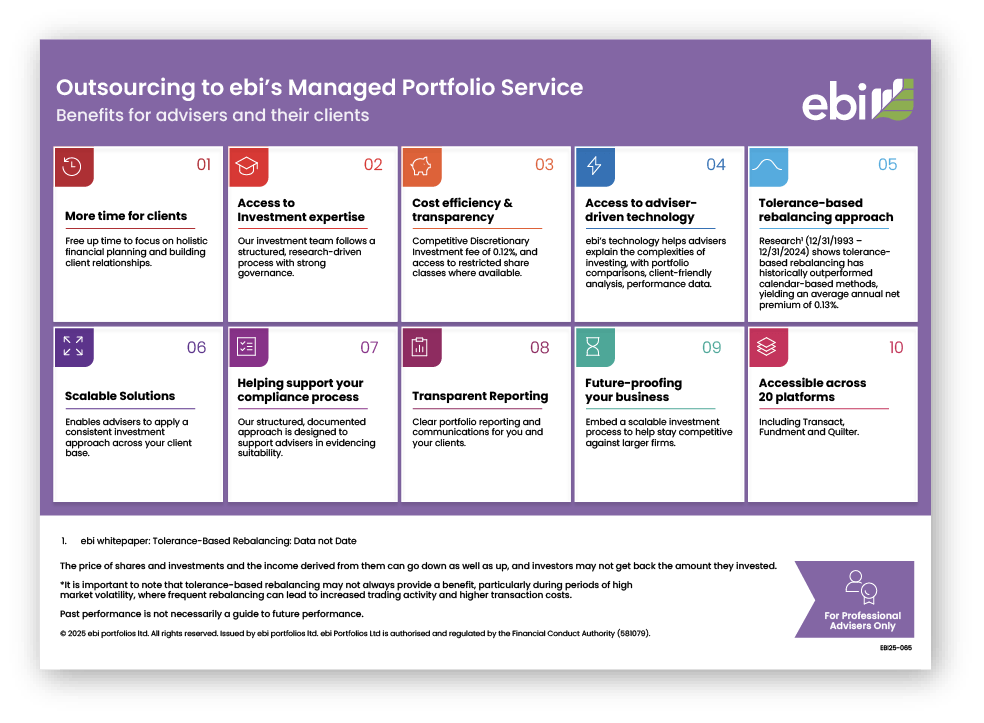

Download our Benefits of an

MPS Solution Infographic

Download our infographic to discover the benefits of outsourcing to ebi’s managed portfolio service.

Why Choose ebi’s Vantage MPS?

Cost-Effective Outsourced Investment Management

Competitive DIM fee of 0.12%. Additional charges, including platform and transaction fees, may also apply.

Discover more about ebi’s tolerance-based rebalancing approach here.

Built for Advisers — scalable solution designed for IFAs, backed by award-winning support and intuitive technology.

- ebi whitepaper, Tolerance Based Rebalancing: Data or Date.

In our earlier example, a portfolio with a 50% equity target, TBR would rebalance only if equity allocation moves beyond a 57.6% upper or a 41.7% lower threshold. This dynamic strategy ensures efficient portfolio management without excessive trading.

Disclaimer

This information is intended for financial professionals only. It is not intended for use by, nor should it be distributed to retail clients under any circumstances.

All investments involve risk, and the value of investments may go down as well as up. Past performance is not a reliable indicator of future results. Always seek professional financial advice.

Please note that tolerance-based rebalancing may occur more frequently than calendar-based rebalancing, depending on market conditions.