ebi Global Factor Fund of Funds range

For professional advisers only

What are the ebi Global Factor Fund of Funds?

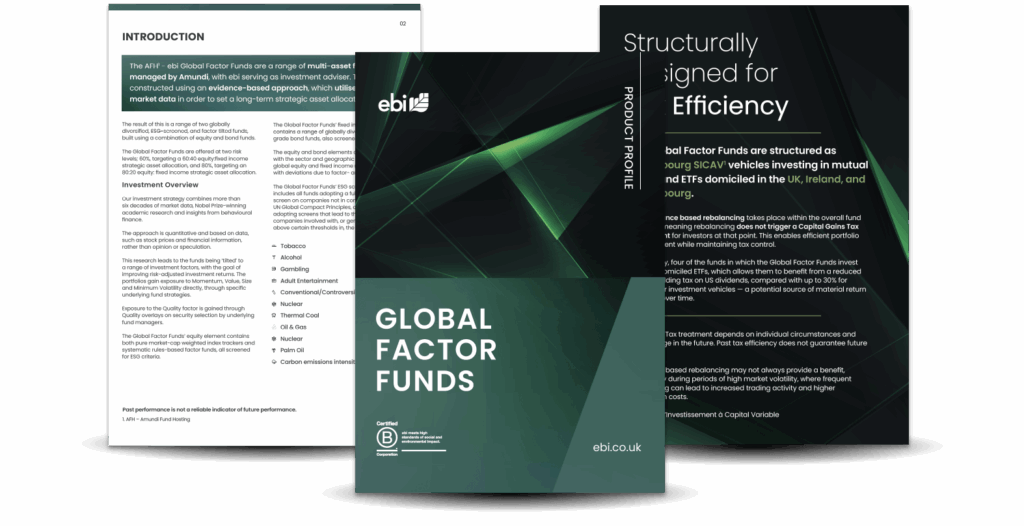

Launching in late 2025/early 2026 the AFH1 – ebi Global Factor Fund of Funds are a range of multi-asset funds provided and managed by Amundi and ebi. They are structured as fund of funds, with each of the Global Factor funds investing in a range of underlying funds.

1. Amundi Fund Hosting

What is a Fund of Funds?

A Fund of Funds (FoF) is a single investment solution that invests in a carefully selected range of underlying funds. Instead of holding just one fund, or trying to pick and manage multiple funds independently, advisers and clients gain diversification and professional oversight in one investment product.

In simple terms: it’s a fund made up of other funds — blending funds targeting different asset classes and managed by different investment managers, to create a well-rounded investment.

Fund of Funds

Fund 1

Fund 2

Fund 3

Benefits for Financial Advisers

Efficiency and

time-saving

Leave the research, fund selection, and ongoing monitoring to ebi. Free up your time to focus on building stronger client relationships.

Access to

Expertise

Our investment team applies rigorous analysis and oversight, ensuring your clients’ portfolios remain aligned with long-term goals.

Clear Client Conversations

A single, diversified product makes it easier to explain investment strategy, risk management, and performance to clients.

ㅤ

Due Diligence & Governance

Benefit from institutional-level due diligence and governance, reducing the risk of unsuitable recommendations.

ㅤ

Benefits for Clients

Effective Diversification

By investing across multiple funds, investors reduce the impact of any single market, asset class or sector underperforming.

Professional

Oversight

Our investment team monitors the portfolio and its constituent funds on an ongoing basis.

ㅤ

Cost-Efficient

Process

Clients gain exposure to a broad range of investments without the need to buy multiple funds individually.ㅤ

Transparency

and Trust

Regular reporting provides clear insights into where money is invested and how it’s performing.

ㅤ

Capital at risk. Investments can go down as well as up.

The ebi Global Factor Fund of Funds range delivers the same disciplined, ESG-screened, and factor-tilted methodology behind our award-winning Earth portfolios — now in a single, unitised structure designed for tax efficiency and easier platform access.

Tax treatment depends on the individual circumstances of each client and may be subject to change in future.

Adviser Benefits of ebi’s Global Factor Fund of Funds Range

Our Earth portfolios, recognised in the Investment Week Sustainable Investment Awards, are a core part of ebi’s proposition – offering a disciplined, evidence-based approach.

The new Global Factor 60 and 80 Funds of Funds build directly on this foundation, maintaining the same ESG screening and factor-tilted philosophy as Earth. The difference lies in the format: by delivering these strategies in a unitised, tax-efficient wrapper, advisers can access the same trusted process and philosophy in a structure that is easier to use across platforms, while providing clients with continuity, diversification, and long-term oversight.

✔ Tax Efficiency

Capital Gains Tax (CGT) treatment

Rebalancing within the Fund of Funds is carried out inside the fund structure, so it does not create a CGT liability for the investor when the portfolio is rebalanced.

Practical benefit

This can make portfolio management more efficient, as allocations may be adjusted without the investor crystallising gains on the underlying holdings.

ㅤ

Important note

CGT may still arise if the investor disposes of their own units in the fund, and tax treatment will depend on individual circumstances. Tax rules may change in the future.

ㅤ

✔ ESG-Screened, Factor-Tilted Strategy

The Global Factor 60 and Global Factor 80 employ an ESG-screened, factor-tilted methodology, combining sustainability screening with exposure to factors such as value, quality and momentum, which academic evidence suggests may influence long-term returns. This allows advisers to deliver a differentiated, evidence-based investment approach within a regulated fund-of-funds structure.

✔ Accessible, Unitised Structure

Continuity Through Flexibility

The funds are unitised versions of our award-winning1 Earth 60 and Earth 80 portfolios, giving advisers continuity of process in a more flexible, widely accessible wrapper.

Built for Broad Compatibility

Available in GBP and EUR share classes, with both Accumulation and Income options, ensuring compatibility with a wide range of client objectives.

1. Investment Week’s Sustainable Investment Awards 2025: Best Sustainable/ESG Investment Portfolio Range

✔ Select between two Risk-Aligned Multi Asset Solutions

Global Factor 60

Moderate risk profile, aligned with the Earth 60 strategy.

ㅤ

ㅤ

ㅤ

Global Factor 80

Higher growth orientation, aligned with the Earth 80 strategy.

ㅤ

ㅤ

ㅤ

Streamlined Portfolios

Both deliver multi-asset diversification through a single fund, simplifying portfolio construction and client communication.

✔ Professional Oversight & Governance

Expert Monitoring

The portfolios are actively overseen by our investment team, with robust due diligence, ongoing monitoring, and timely rebalancing.

As with all investments, outcomes are not guaranteed, and funds may underperform expectations

Frequently Asked Questions

1. How do the Global Factor funds differ from the existing Earth suite?

The Global Factor 60 and 80 Funds of Funds are unitised versions of our Earth 60 and Earth 80 portfolios. They use the same investment process and team oversight, but managed within a single fund structure in which rebalancing can occur within the fund without triggering a Capital Gains Tax (CGT) event for the investor at that time. Additionally, the fund structure may be easier to access on certain platforms.

2. Will performance be the same as the Earth portfolios?

The Funds of Funds follow the same disciplined, factor-based methodology as the Earth strategies. While outcomes cannot be guaranteed, the aim is to deliver comparable risk and return profiles over the long term.

3. What are the tax implications of investing in the Fund of Funds, and will clients always benefit from the tax efficiency?

Rebalancing within the Fund of Funds takes place inside the fund structure, so it does not trigger a Capital Gains Tax (CGT) event for the investor at that time. This can make portfolio management more efficient.

However, CGT may arise if a client sells their own units, and the overall tax treatment will depend on each client’s individual circumstances. Importantly, tax rules may change in the future, so the tax benefits are not guaranteed and should not be assumed to apply universally.

4. Are the ESG and factor tilts consistent with the Earth strategies?

Yes. The Funds of Funds employ the same ESG screening and factor-tilted approach as the Earth strategies, combining sustainability considerations with exposure to factors such as value, minimum volatility, size, quality, and momentum.

5. What share classes are available?

Both Global Factor 60 and Global Factor 80 are available in GBP and EUR share classes, with Accumulation and Income options, providing flexibility for different client objectives.

6. What level of risk do the Funds of Funds carry?

Global Factor 60 has a moderate risk profile, while Global Factor 80 is positioned for higher growth. Both provide multi-asset diversification within a single fund.

Download our Global Factor Funds Product Profile

Disclaimer

Capital at risk. The value of investments can go down as well as up, and you may not get back the amount you invested. Past performance is not a reliable indicator of future results. Equity investments are subject to market fluctuations, which can result in significant capital losses. Bond prices are sensitive to interest rate changes. If interest rates rise, bond prices typically fall, which can result in capital losses. ESG investments, while aiming to consider environmental, social, and governance factors, may not outperform traditional investments. High-risk investments carry a greater risk of capital loss and may not be suitable for all investors. This information is for financial professionals only.

Tax laws may be subject to future change.

Investor Information

Prospective investors should read the Fund’s Prospectus and Key Information Document (KID) carefully before making any investment decision. These documents contain important information on the Fund’s objectives, risks, and charges and should be reviewed in full to ensure the investment is suitable for the investor’s circumstances.

The Fund of Funds invests primarily in other collective investment schemes that are UCITS-compliant. As a result, the Fund’s performance and risk profile will depend on the performance of those underlying funds and the investment decisions made by their managers. Investing through a fund of funds structure may lead to indirect exposure to certain asset classes, markets, or counterparties, and may result in overlapping investments or concentration in particular areas. The Fund will bear its own charges in addition to the fees and expenses of the underlying funds, which may increase the overall cost of investment.

The Fund’s ability to meet redemptions depends on the liquidity of its underlying investments. Although the Fund aims to invest in daily-dealing UCITS funds, some underlying funds may deal less frequently or restrict redemptions during periods of market stress. In exceptional circumstances, underlying funds may apply liquidity management tools such as redemption gates or suspensions, which could delay or limit the Fund’s own redemptions.