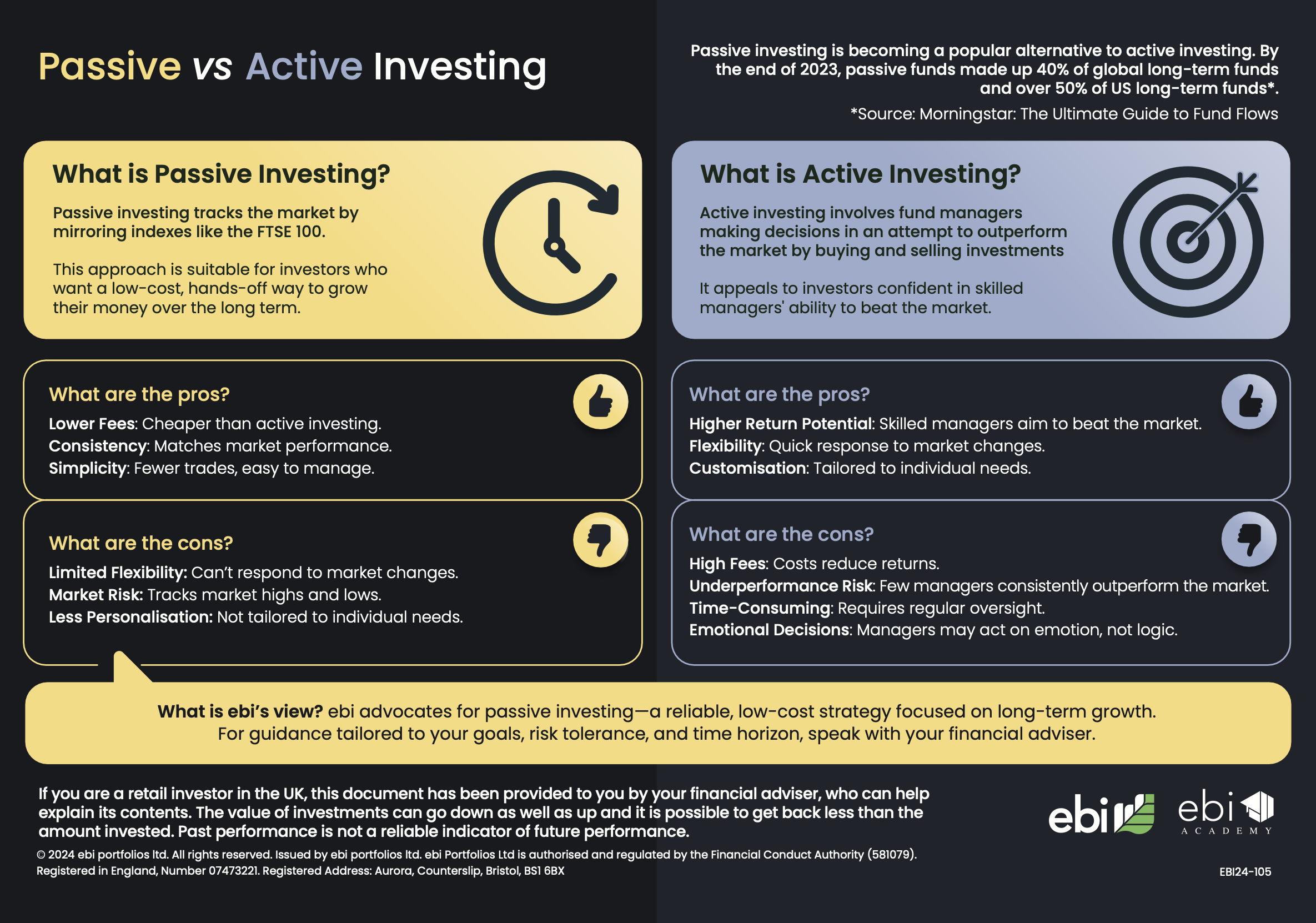

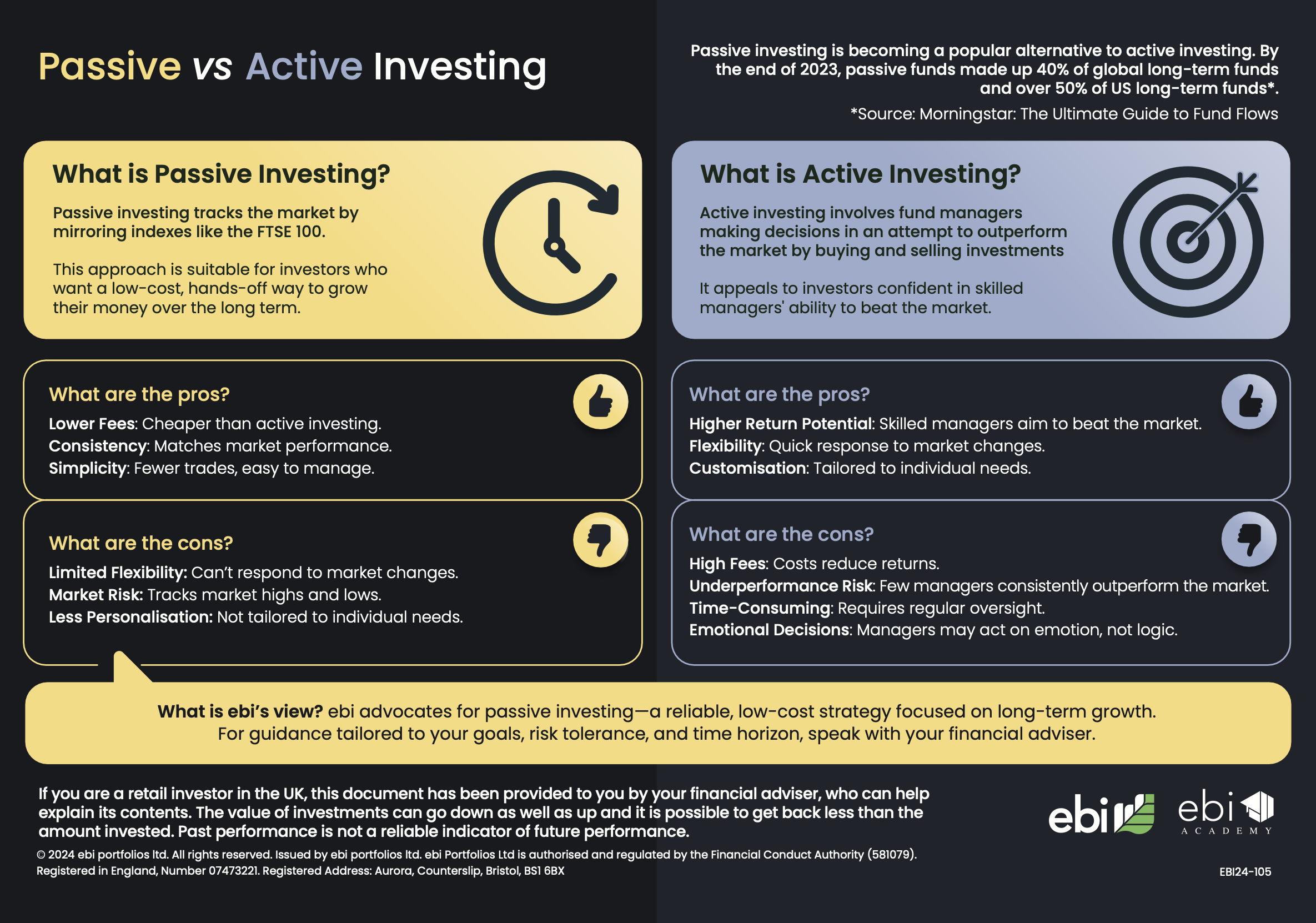

Passive vs Active Investing

Awarded Best

Value for Money 2025

ebi’s Earth Suite Awarded Best

Sustainable/ESG Investment Portfolio 2025

Awarded Best

Outsourced Investment Manager 2025

Passive Investing vs Active Investing Guide

Passive investing is becoming a popular alternative to active investing. By the end of 2023, passive funds made up 40% of global long-term funds and over 50% of US long-term funds*.

*Source: Morningstar: The ultimate guide to fund flows.

Download our Passive vs Active investing infographic

An easy to understand infographic detailing the core differences between Passive and Active investing.

What is passive investing?

A guide for financial advisers

What is passive investing?

Passive investing focuses on tracking market indexes, like the S&P 500 or FTSE 100, offering clients a lower-cost, hands-off approach to long-term growth. It appeals to clients who value consistency, simplicity, and cost-efficiency.

Key Benefits of

Passive Investing:

Lower Fees:

Reduced costs mean more of the

return stays with the client.

Minimises trading:

Staying invested through good times and bad.

Consistency:

Matches market performance over time.

Simplicity:

Fewer trades, less complexity.

Considerations for

Passive Investing:

Limited Flexibility:

Less responsive to short-term

market movements.

Market Risk:

Exposed to market highs and lows

What is Active investing?

Key insights for financial advisers

What is Active Investing?

Active investing relies on skilled fund managers making strategic decisions to outperform the market.

This approach suits clients confident in a manager’s expertise and comfortable with higher costs and risks for potential outperformance.

Key Benefits of

Active Investing:

Higher Return Potential:

Managers aim to beat the market.

Flexibility:

Adapt quickly to market changes.

Customisation:

Strategies tailored to individual needs.

Considerations for

Active Investing:

Higher Fees:

Increased costs can impact net returns.

Underperformance Risk:

Few managers consistently outperform the market. Potential for timing and trading errors.

Emotional Decisions:

Human behaviour can influence outcomes.

Lower diversification:

As the strategy involves stock picking.

ebi’s Perspective: Evidence Based Investing

At ebi, we advocate for evidence based, passive investing as a more reliable, cost-efficient approach to long-term growth. Our well diversified portfolios are designed to support financial advisers in helping to deliver consistent outcomes for clients.

For an in-depth comparison and to access actionable insights, explore our detailed Passive vs Active Investing infographic below.

Download our Passive vs Active investing infographic

An easy to understand infographic detailing the core differences between Passive and Active investing.