Evidence Based Investing

Evidence Based Investing – The process of systematically reviewing, appraising and implementing academic research findings to aid the delivery of optimum investment solutions to investors.

Awarded Best

Value for Money 2025

ebi’s Earth Suite Awarded Best

Sustainable/ESG Investment Portfolio 2025

Awarded Best

Outsourced Investment Manager 2025

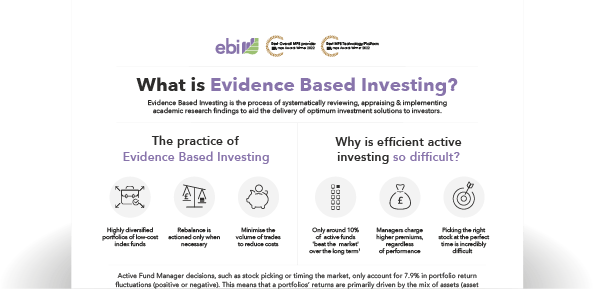

What is Evidence Based Investing?

Evidence Based Investing – The process of systematically reviewing, appraising and implementing academic research findings to aid the delivery of optimum investment solutions to investors.

Markets are hard to beat in the long-run. Attempting to consistently pick the right stock, and perfectly time buying and selling, is incredibly difficult, costly, and often leads to losses over time. Overall, active investment approaches are of little benefit to all but a few investors, but of great benefit to all but a few fund managers, who will continue to charge premiums regardless of performance. Evidence shows that only around 10% of traditional funds beat the market in the long-run, net of costs. ebi’s evidence based investing style is grounded in understanding world leading scholarship, long-term observations and extensive in-house research, removing the need for the traditional speculative investments.

The practice of evidence based investing is to buy and hold a highly diversified portfolio of low-cost, index funds and, other than rebalancing when necessary, trade as infrequently as possible to minimise costs.

A landmark study* updated in 1995, showed that asset allocation policy was the overwhelmingly dominant contributor of the variability of total returns of an investment portfolio (93.6%). Selection of the right stocks or funds accounted for only 2.5%, with market timing even less relevant, representing only 1.7%.

In short, the name of the game is to invest in as broad a range of funds as possible, and minimise costs by trading as little as possible over the course of the investment.

Download our Evidence Based Investing infographic

An easy to understand infographic detailing the core principles of evidence based investing.

ebi‘s Asset Allocation Strategy and Factor tilts

Why are markets so hard to beat?

Markets are basically efficient

Prices in global, free trade markets represent the knowledge of millions of buyers and sellers of stock. Any new information, e.g. latest performance reports or press releases, are immediately compounded into prices. With data transfer speeds and the sophistication of trading platforms ever increasing, out pacing the market is nigh impossible.

Investing is a zero-sum game

Every out-performing fund manager must be offset by an underperforming fund manager. If one investor profits from buying a mispriced stock, then another must lose out on the other side of the deal. As all investors constitute the market, the average investor will receive market returns, minus costs. As the implied costs can have a substantial impact on returns, over time the average investor will experience below market-rate returns.

Risk and reward go hand-in-hand

To achieve a higher level of return an investor must assume a higher level of risk. The Capital Asset Pricing Model (CAPM) describes the relationship between market risk taken and the level of expected return, and is a much debated tool for researchers and investment practitioners. It is widely accepted that a strong relationship exists between risk and returns which can be exploited by investors through the risk reducing benefits of diversification.

Helping our advisers succeed

“ebi’s assistance and helpful attitude has been instrumental in creating a robust approach for our clients’ needs. ebi also provided a hefty ‘snowball’ which enabled us to pick up even more for our own professional development and knowledge.”

David, Isle of Wight