“Those who are easily shocked should be shocked more often.”

― Mae West

I wrote a blog piece 18 months ago, looking at the possibility of Jeremy Corbyn winning the next General Election. It seemed daft at the time, but if recent history has shown us anything, it is that shocks are the new normality. Corbyn has claimed “victory”, (which given the shortfall in Labour seats relative to the Conservatives does raise concerns about the future course of the economy under his leadership), but in truth, it was the Conservatives who “lost it” (in both senses).

Some are not happy at all, but in truth, it is easy to be shocked by the fact that people are angry from an air-conditioned City office. YouGov’s post-election analysis suggested that older electors are still disproportionately more likely to vote, but the “Youth” turnout was up significantly, at 59% compared to 43% who voted in 2015. The real “killer” for Theresa May, however was that, the Tory announcement of a cap on the amounts of money the Government would pay for long-term health care (dubbed a dementia tax” by some), made worse by the chaotic u-turn just hours later, cut the Tory lead in the polls almost immediately and ensured that many older voters either didn’t vote, or switched their votes away from her party.

This has left her in a bit of a pickle- deprived of any majority, she has been forced to go to the default option, that of a “Confidence and Supply” agreement with the DUP in Northern Ireland, who have some, ahem, anachronistic views on social issues, such as gay marriage and abortion. This, in turn, has led to some of the great constitutional scholars of our time (and Gerry Adams of Sinn Fein), to cry foul; in addition, the DUP are not in favour of a “Hard Brexit”, wanting to keep the border with the South customs-free, which would no doubt be an impediment to May’s original policy vis-a-vis leaving the EU.

Brexit negotiations are expected to start very soon, but will the EU want to negotiate with her? After the disastrous decision to call an election, many Tory MPs’ are deeply unhappy, with the only thing saving her (for now) being the total lack of appetite for another election (a view probably shared in the country as a whole). But she is a dead woman walking and it’s difficult to see the Eurocrats taking seriously a leader that will in all likelihood not be around much beyond year-end. Complicating matters still further, there is the German General Election in September- maybe there will no one at all to negotiate with anyone! (This assumes that the Government has arrived at a negotiating position, which seems dubious at best). May has claimed that no deal is better than a bad one on Brexit; it looks increasingly likely that she will get her wish on this at least.

So we now have the prospect of protracted, messy and acrimonious talks on how we get out of Europe, led by someone who has neither a “mandate” nor the credibility to extract any concessions from Europe. Compared to this, the Millennium Dome could be nostalgically considered to be an unadulterated triumph…

What of markets? They don’t seem to be concerned in the slightest as both Equities AND Bonds march ever higher (despite the inherent contradiction in this state of affairs). There appears to be a major bull market in worry at the moment, with commentators, when not blaming Passive Investors for Active Management failures, are constantly on the look-out for the next calamity; one day, like a broken clock, they will be right, but they add to the bullish fuel (after all, someone who has sold or shorted an asset must, at some point, buy it back pushing prices still higher).

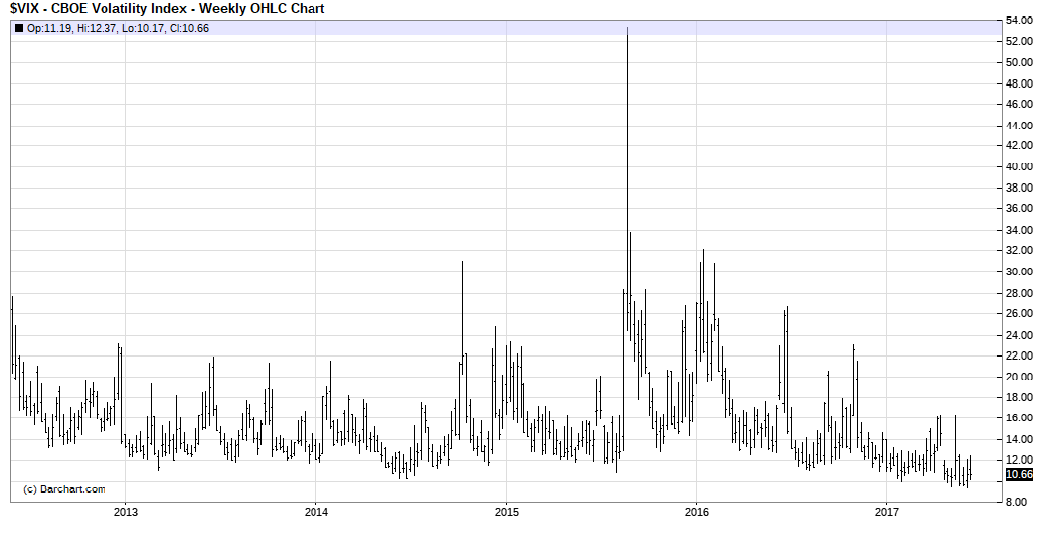

For now, the VIX Index (which measures “fear” in US markets) has continued to flat line for close to 5 years now; in the UK, FTSE 100 options prices (for September) imply that the market is expecting just 114 point moves in the FTSE 100 Index on a weekly basis; we know not when it ends (and it will), but in the meantime, being Bearish/Defensive has cost a fortune in under-performance (and big losses for those funds who have “shorted” stocks and bonds).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.