Some debts are fun when you are acquiring them, but none are fun when you set about retiring them.

This week we shall focus on a number of (partially) related stories in lieu of a major theme. The common denominator is debt – how companies, states and even countries deal with the issue will shape the economic landscape for years to come.

According to this Bloomberg article, Sinosteel failed to make an interest payment on $315 million equivalent of Notes maturing in 2017 on Tuesday. It plans to use a payment-in-kind approach (P.I.K) whereby it pays the interest in the form of shares. The yield on the bonds rose 20 percentage points to 25.4% -one might question why they were only yielding 5% prior to that-as the Company also postponed the date at which Investors can get their money back early (the Call Date). Speculation now focuses on which firms are next in the queue as the Chinese authorities battle to contain the contagion.

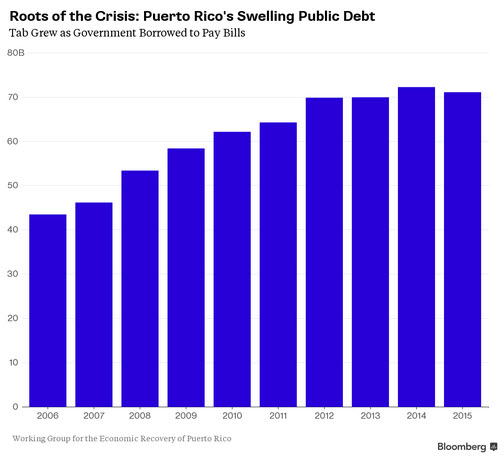

On the other side of the World, negotiations between Puerto Rican state (as first highlighted here) are not going well. The creditors (also referred to as “Vulture funds” to ensure we know which side we should be on), are not keen on the Islands’ plan to restructure the $5.1 billion of debt through a debt “exchange”, together with the prospect of a fresh capital raising of $750-900 million.

This chart shows the extent (and the longevity) of the problem.

Now it appears that Obama is willing to allow Puerto Rico to gain bankruptcy protection not currently available to US Territories. The Republicans appear to allow a limited, strings attached version of the President’s plan, but as one analyst points out, these changes “are going to be extremely hard to get through both the U.S. Congress and the Puerto Rican legislature,” said Matt Fabian, a partner at Concord, Massachusetts-based Municipal Market Analytics. “This is a Congress that gets almost nothing done. So to expect them to get something controversial done at the request of the administration right before an election is difficult”.

But, as usual there is a moral hazard issue. As States are excluded from the Bankruptcy process, they have an incentive to get their house in order. As was mentioned in last week’s newsletter Illinois are in tight spot as well – this could be a way out of making tough decisions for them too… as a call to arms Fitch (the credit rating agency) has downgraded the State to BBB+ (from A-).

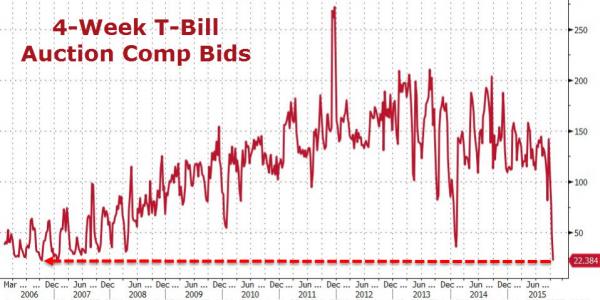

Nearby, there has been a rise in the economic temperature in US politics too. Treasury Secretary Jack Lew warned on Monday that the US will run out of money on November 3rd if the Debt Limit is not raised, which has led to a big sell-off in US T-Bills. The Bills extending post that date have seen large moves (the Bill maturing 18/11/15 has gone from -1bp to 7bps). One day later, the yield was 11 bps…

The collapse in T-Bill prices has led to a lack of interest in Short-Dated paper, as the chart below attests. On Thursday, Bloomberg reported that the US Treasury had cancelled the 2 year Note Auction due next week, citing the risk that it would not settle in time to escape the funding crisis.

To complete the tale of unmitigated woe, it appears that all in not well in Emerging Markets (again). Violence in Turkey, popular discontent in Malaysia, and politics as usual in Brazil, might make one imagine that the World’s end is imminent. But it is not so (unless you own Valeant Pharmaceutical that is); it is easy to conjure up ghosts (and if you are busy, just read the papers to achieve the same end), but the reality tends to be much more mundane.

The prospect of the Chinese authorities risking the contagion effects of wholesale Corporate bankruptcies seems remote. They have already demonstrated their commitment to “stability” (and this Friday’s Rate cut reinforces that sense). It may not work (the cut follows the GDP figures earlier in the week that were better than expectations), but they have plenty of tools in the armoury, and they are clearly not afraid to use them. To assume that they will fail at this point would be premature. Debt “flexibility” is likely the solution -it kicks the can down the road for a while, something we have got used to in the West in the last 5 years.

The Puerto Rico/ Debt Limit issues are connected by the proximity of the next Presidential Election. The electoral demographics mentioned in the blog post above are relevant here. Neither Party can afford to be blamed for the shut-down of Government, or the chaos that would ensue with the bankruptcy of Puerto Rico but they will go on posturing right up to the bitter end (as both sides did in November 2011 and 2013). So the melodrama that is US politics will be played out, to intense disinterest from the population. The rest of the bond market has not dropped in response to either issue, and there is no reason for us to act either.

Political risk/corruption and Domestic unrest in Emerging Markets (- say it ain’t so..!). This is part of the territory and goes to the heart of why we invest in these markets. If they were all beacons of political stability, political honesty and tranquillity,there would be no risk (and thus no Risk Premium). No RP = No excess return. Again, the answer is of course diversification: for every Valeant Pharmaceutical (or Abbey Vie), there is an Apple (or Amazon). There is little one can do in the face of these recent events, but there is even less reason to do so.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.