In March 2018 it appeared that global growth would exert pressure on interest rates, forcing the rate of inflation ever higher, making bonds a weaker investment prospect. Things have not worked out quite as market participants then might have expected.

The Fed’s policy changes and quantitative tightening in 2018, combined with the high existing global debt levels snuffed out any inflationary impulse. Following the COVID-19 fuelled stockmarket crash bond yields all over the world are now 1% or less.

So why might it be different this time? At the risk of tempting fate, there are some differences as well as similarities between the current situation and those of post-2009. QE has returned, now dubbed QEI, or QE Infinity, but earlier QE never significantly influenced overall economy-wide inflation rates because it is essentially an asset swap [1], and the newly acquired cash stayed in the financial system. The real economy saw little or none of it in the form of newly created credit.

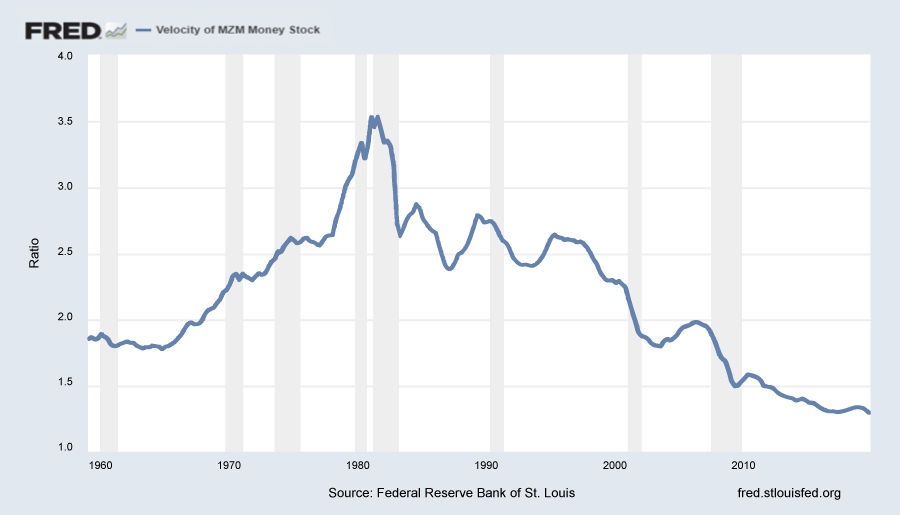

The theory advanced by Ben Bernanke that increasing the money supply would boost economic growth failed to generate either growth or inflation, because as money supply rises, the price of money represented by the interest rate falls, which means that the opportunity cost [2] of holding cash correspondingly falls, thereby reducing the velocity of money in an almost exact proportionate amount, offsetting the inflationary effects of a rise in money supply.

As the next chart shows, money velocity has been on a substantial long-term downtrend following that of interest rates. Note that the 1981 peak also coincided with the peak in US interest rates. Money velocity peaked at 3.54x in Q1 1981 and as of the most recent period (Q4 2019) it has fallen to just 1.29x [3], a drop of two thirds (63%).

A major difference between the GFC and now, in the UK at least, is that this time, there is direct state support for UK employees and small businesses caught up in the Coronavirus crisis, albeit limited to £2500 per month for employees and loans of up to £5 million to small and medium sized businesses.

As individuals need to eat, this money is much more likely to be fully spent; but this may not be the mechanism by which goods price inflation takes hold. As we stated in a previous corona-related post, asset markets, by falling sharply, have at least begun to discount a demand shock, but one person’s demand is another’s supply. Assuming that economies do re-open at some point, will there be any supply for goods being demanded? How will restaurants fare by being forced to double the space between clients thereby halving the number of those diners? Or how will airlines deal with spacing out passengers around half empty planes? Hiking prices may have to cover the margins lost. If that happens in a large proportion of the economy, UK and global inflation rates will not long remain below the Bank of England’s 2% target.

So, the evidence is finely balanced as to whether we see goods inflation as opposed to the asset price inflation that we have become accustomed to over the last decade or so. It depends on whether the marginal utility of goods rises, relative to that of money, or vice versa. If material things become more in demand, relative to that of money, prices rise; if the other way around, prices tend to fall [4].

One of the major determinants of this is the pace of government expenditures, as increased state spending raises the amount of liabilities issued by the state regardless of whether it is via bond issuance or by printing money, whilst lowering the amount of goods available to other economic actors in the economy. As we know, government spending is likely to rise sharply in the next few years across the world.

Whichever way it turns out on inflation, the implications are significant, though rather different.

Assuming that we see no rise in general goods prices, an investor’s strategy and asset allocation can remain unchanged provided that risk levels are appropriate. Current income and expenditure requirements can be expected to remain largely unchanged, leaving the investor with no need to make any significant adjustments. Should we start to see a rise in generalised goods prices relative to that of money [5], an investor with a large bond exposure might suffer, as income would fall in relative terms compared to the cost of living, resulting in a drop in inflation adjusted living standards. Equity holdings should, subject to the caveat that equities maintain pricing power, keep their relative value.

But for those with income requirements, the dilemma is acute. Raising the amount consumed now by increasing the amount withdrawn from a portfolio to cover increased daily expenditures reduces that available in later years. How this is resolved is a matter for each individual and is not an easy choice to make.

1] Counterparty A sells bonds to the local central bank which gives them cash in exchange. No new money is created unless the receiving institution decides to invest in the real economy.

[2] Opportunity Cost is merely the forgone interest that could have been earned by leaving one’s money in a bank. As rates fall, that cost of holding cash falls; as it rises, the economic benefit of investing, as opposed to holding cash increases.

[3] So, every Dollar was spent 3.5 times in 1981, but only 1.29x in 2019. Using the monetary exchange equation, (M x V = P x Q) we can see that they offset each other, partly explaining why inflation never took root.

[4] The Great Depression of the 1930’s was characterised not by a scarcity of supply but by the catastrophic collapse in demand for goods and services. The frantic demand for money due to cashflow and credit concerns overwhelmed the rapid rise in the money supply and the reduction in overall demand in that period.

[5] As an aside, house price gains over the last 20 years can be seen as the value of money falling, relative to the value of land rather than houses becoming more valuable in themselves.