In what seems to be a depressingly familiar story, we have been made aware of another banking scandal involving the mis-selling of unsuitable products to investors, this time by the venerable institution Coutts. It is by no means the first (or last) time this will happen – a Forbes article highlights the biggest scandals of 2012 (what does it say about an industry that can have at least 10 “scandals” per year?). Typing in scandal to ETF.com produces circa 6,000 hits, so it can be truly said that Industry has a FIFA-like track record in mis-behaviour. The question is therefore begged as to why investors still use (let alone trust) these firms to work on their behalf. We shall get to that later, but first the details.

The Guardian[1] reports that Coutts had begun reviewing customer files going back as far as 1957, to begin a review of the suitability of investment advice given in the UK. “A large part of our previous weakness lay in our record-keeping, much of which was paper-based,” it said, adding that its front-line staff had previously carried out two “complex” roles simultaneously: general banking and wealth management advice. According to the FT[2], the cost could run to £110 million (which includes the cost of the review and the costs of customer redress).

This is not the first time the bank has fallen foul of the regulator (let alone any fiduciary standards). In 2011, the company was fined £6 million for misleading investors over the risks of an AIG fund[3], which the firm said was a cash fund, but which turned out to be investing in asset-backed securities and floating rate notes in order to enhance yields. The article stated that “there were a catalogue of errors committed by Coutts in selling the fund”. And that the FSA found:

- “Coutts informed customers that the fund was a cash fund which invested in money market instruments and could be seen as an alternative to a bank or building society account;

- Failed to have an adequate sales process in place for the fund. Advisers were given inadequate training about the risks and features of the fund. Nor did Coutts’ sales documentation accurately describe the fund;

- Recommended the fund to some customers even though it may have exposed them to more capital risk than they appeared willing to accept;

- Many customers were advised to invest a large proportion of their overall assets in the fund and there is a risk that their investments were not appropriately diversified;

- Failed to respond appropriately to the changing market conditions in late 2007 and during 2008 when there was a greater risk of the fund suspending redemptions and of customers suffering a loss.

- Despite having been aware of these issues affecting the fund, Coutts failed to make the necessary changes to the way in which it sold the fund, and did not ensure that advisers who sought to reassure existing customers enquiring about their investment in the fund provided a fair explanation of the risks;

- Coutts failed to properly deal with questions raised from December 2007 around its past sales of the fund, including about whether it had explained the fund’s risks to customers adequately and whether their investments were appropriately diversified;

- Failed to undertake an effective compliance review of its sales of the fund after the fund was suspended and customers complained. The review failed to adequately address suitability and disclosure issues and was not completed in a timely manner”

In a masterful understatement, Coutts said: “In order to address the possibility identified by the FSA that unsuitable advice may have been given in relation to the AIG Enhanced Variable Rate Fund in 2008, Coutts will undertake a past business review of its sales of the product”.

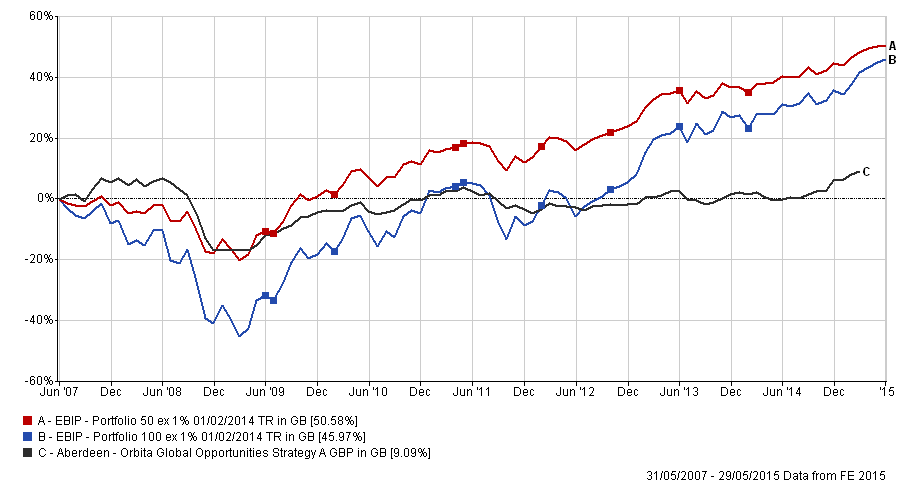

In the light of this and many other infractions, we need to try to understand why investors still use these and other institutions. Mere gullibility is unlikely to be the whole story, and so we need to turn to other factors to rationalise these decisions. As one can see from the chart below, the period under FSA consideration was not a glorious one for one of the funds under review namely; Orbita Global Opportunities.

I have never been to a Coutts office, but I am sure that they look impressive, which is, of course, a deliberate ploy. It feeds on a number of logical fallacies, which serve to strengthen and perpetuate the myth of the “expert”, who has all the answers, and to whom you can entrust your savings, without fear (or risk). It relies simultaneously on both an appeal to authority (we know more than you) and an association fallacy (look at how sumptuous our offices are – we must know what we are doing). This itself, of course, is a circular argument – we are wealthy, therefore if you want to be wealthy too, invest with us! The opposite is also true: those that don’t invest through us, don’t have access to our knowledge and therefore are not wealthy(!). It also feeds into our confirmation bias – a man (for it always thus), in a smart suit creates a favourable first impression, through which we then filter information, in a way that supports our initial view. We therefore have a skewed frame of reference, in which we gloss over certain facts (like the costs of the investment) in favour of the desire to be accepted into an “elite” group. The company appears to have a large number of very intelligent people in it, we think, which means that they must be good investors. If we have little investment experience, it is tempting to follow the “herd”, especially if it provides bragging rights at the local golf club.

The smooth patter of the representative also fosters confidence – this of course, can lead to overconfidence on both the part of the investor (investing more than is prudent) and on the fund manager who may trade too often. There is plenty of literature that suggests the perils of overconfidence[4], but it affects both the manager and the investor. Active management is a negative-sum game. Long term outperformance is extremely difficult to maintain, especially when allied to high charges. The chart above highlights the poor long term performance, yet the fund won an award in 2011[5].

This story is primarily about unsuitable investment advice, but it serves as a general warning of the risks of active investment itself. The desire to be “in the know” is widely prevalent amongst humans, and it is a key element in the persuasion process. It requires a strong mind to resist these pressures – using an evidence based process is key in avoiding these traps, so as to avoid taking unnecessary risks, which can lead to under-performance (at best) or actual losses, which can ruin the investment plans of investors.

Addendum

For reference, an outline of the legal position and the options available are here. (Obviously, we cannot recommend the source or the recommendations made therein).

- [1] 6TH June 2014

- [2] 29TH August 2014

- [3] This Is Money 8th Nov 2011

- [4] “Volume, Volatility, Price, and Profit When All Traders Are above Average, T.Odean, The Journal of Finance December 1998, for example.

- [5] European Fund of Hedge funds Awards, Hedge Fund Review, November 2011.