“Some calamities – the 1929 stock market crash, Pearl Harbor, 9/11 – have come like summer lightning, as bolts from the blue. The looming crisis of….. the demographics of an aging population, its causes, timing and scope are known”. George Will – Political Commentator for the Washington Post, NBC et al.

Over the next decade or so, the Developed World faces the prospect of their populations shrinking at an increasingly fast rate, whilst at the same time the Developing World is seeing continued strong rises in fertility. This fascinating website shows it all in real time, (well not exactly in real time but you get the drift).

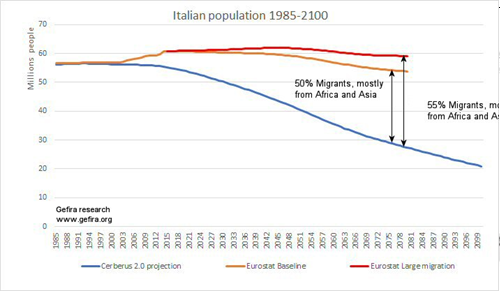

However one dices it, the numbers look stark – to take just a few examples, despite the current optimism regarding Eurozone growth prospects, according to this article, Germany will, by 2019, have more people over 60 years old than under 30, whilst Italy is in danger of almost disappearing, with projections for the Italian population falling to just 20 million by the year 2100, compared to c.60 million at present (assuming that the current birthrate is maintained and that immigration is zero). The population drop since 2000 has been entirely filled by migrants (from Asia and Africa) as the chart below shows.

But it is not just Europe – the South Korean government’s own projections forecast that, on current trends in birth rates, (it has the lowest fertility rate, 1.17 births per woman in a given country, for the 16th year in a row), in 7 years time, the population will start to shrink and South Koreans could be extinct in the future! [1]. Even in Russia, the population has been dropping around 750-800,000 per year since the c.149 million peak in 1991, in this instance, as a result of emigration (and the abnormally high death rate). China’s population is also now getting very old (and very fast!), as the legacy of its “One Child Policy“, intended to curb population growth under Mao, comes home to roost. Japan has been on this road for even longer.

It appears that the growth of urbanisation, the increased labour force participation of women, along with the measures taken by (mainly Asian) governments to reduce population growth in the past have created most of the current problems. The rising costs of living, including housing and education has meant that for many, starting a family is either too costly or just not a desirable option.

Policy-makers are fully aware of this situation, however. The Refugee Crisis post 2014, has seen nearly 2 million people enter Europe; but if it was a plan all along, it has recently run into political difficulties. In Germany, the September election saw gains for the AFD, whilst in Italy, anti-establishment parties have made considerable gains and could be on their way to governing. In both cases, the local populations are becoming increasingly concerned by the numbers of new arrivals, which to them appear imposed. There is now talk amongst those political parties of deportations, with even the architect of the original inflows, Angela Merkel, now proposing limits on new immigration. Whether this will be enough to placate the populists remains to be seen.

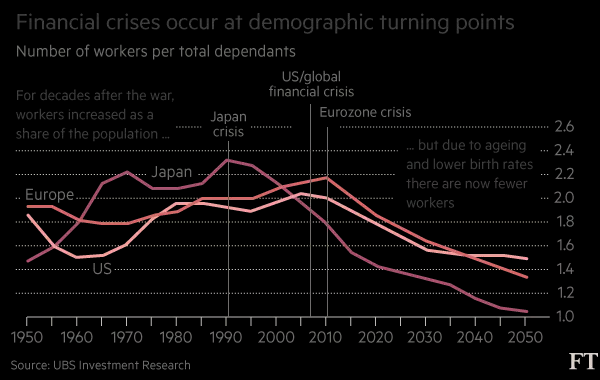

What are the economic implications of these trends? As a rule of thumb, the larger the working age population, the larger the consumption and production base is. As people reach the “decumulation” phase of life (aka retirement), the economy needs new (younger) people both to replenish the workforce AND to create demand for products which ultimately spurs investment and growth [2]. The chart below highlights the idealised pattern.

As the tax base (and thus revenue) falls, debt becomes an even greater issue, with Governments forced to borrow more to keep living standards just where they are – tax rises are increasingly difficult to implement, both due to their demand sapping effect (but more importantly, because the old, who are the most inclined to vote, reject them). Japan currently has a debt which is more than double the size of their economy, whilst the UK and the US are well on their way to reaching that worrying milestone. Increased pensions and healthcare costs mean that money will have to come from other departments within government; but where? Raising the retirement age will only get one so far (and is deeply prejudicial to a politicians’ hopes of re-election). Given the low savings rates that already pertain, cost of living rises result in yet lower consumption (and thus growth).

.png)

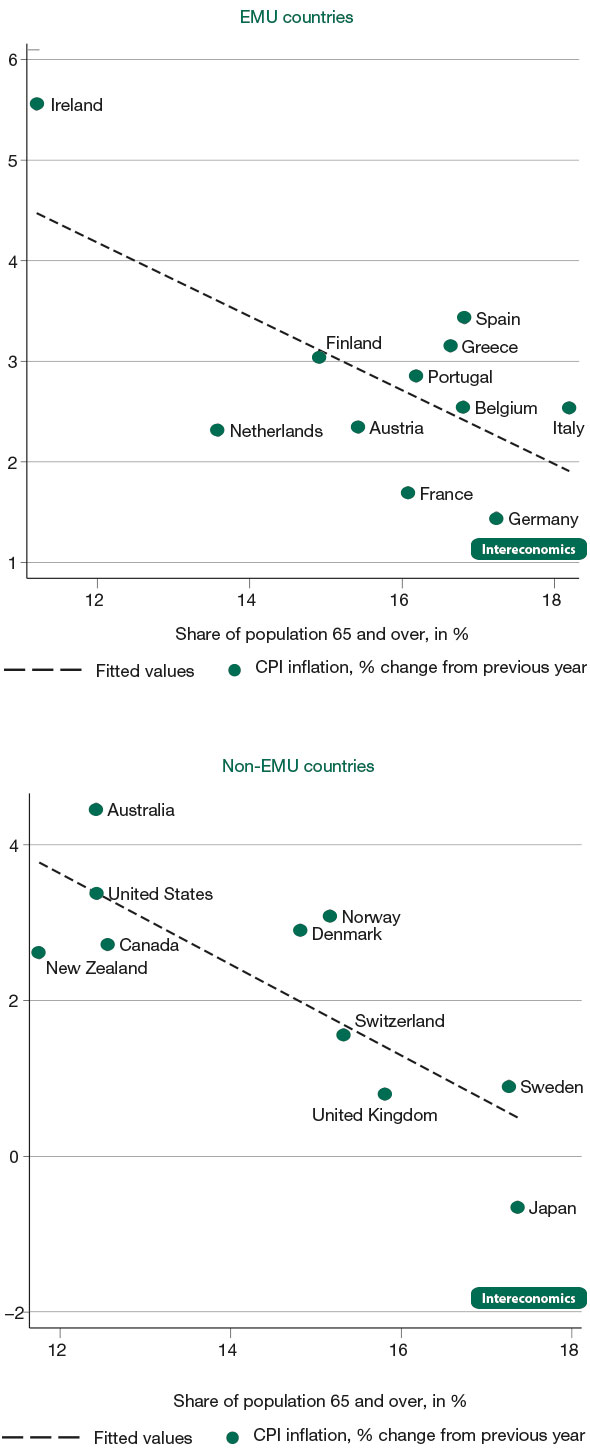

If you have lower growth, all other things equal, you have lower inflation (as pricing power diminishes). It is no accident that Japan, Germany and Italy occupy the lower right side of the following charts from Inter economics. According to a Federal Reserve Research Paper (from 2016), “demographic factors alone account for a 1.25 percentage point decline in the natural rate of real interest and real gross domestic product growth since 1980”. If true, it implies that the Fed may not have he scope to raise rates without causing major (damaging) effects on both the old (who rely on their assets to provide income in retirement) and company’s, who see their costs of capital go up. This is a good environment for bond markets to thrive; for equities, the effect is much less certain.

As the final chart shows, there is a connection between Demographics and asset prices – markets are discounting mechanisms; are they looking to the future and not liking what they see? Maybe bonds won’t be the “Certificates of Confiscation” that many are currently suggesting. Indeed, they may serve investors well. The events charted below were NOT bond negative at all. The past may indeed be prologue.

[1] For comparison, Niger, Angola and Mali, have female fertility rates of over 6.

[2] Long-term economic growth is a function of the changes in the working age population and growth in productivity. Simply put, the change in population plus the change in productivity = change in GDP. Currently, both are moving in the wrong direction, despite the positive boost from technological advances in recent years.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.