The last month or so has seen a gut-wrenching fall in oil prices (and most asset prices in general). Declines so far have been (relatively) orderly – a 5% move for oil for example is par for the course – but some strange things have been happening in ETFs and ETNs . They should trade at fair value – that is, at a zero premium to the value of their assets. If they didn’t, there would be an opportunity for risk-free profits (known as arbitrage). But, as this Barron’s article relates, this has not been happening.

First, let’s remind ourselves what an ETF is and what it does

One of the key features is the ability to buy/sell units immediately from the ETF issuer, exchanging one’s units for the underlying assets, (ETF.com runs through the process in a reasonably clear fashion), or, if appropriate, executing an arbitrage programme, to buy the underlying shares, delivering them to the issuer and selling the ETF, thus keeping the prices of the two in line with each other. Unlike “closed end” funds, units can be constantly created/redeemed to meet demand, and the costs of new unit creation for OEICs, mutual funds and so on are met by the fund itself, (which means the existing holders , unless some sort of dilution levy is imposed). The costs of this for ETFs are met by the AP (Authorised Participant) and those actually buying and selling the ETF itself, which seems a much fairer way of operating.

So far, so good; what could possibly go wrong? As it happens, quite a bit, as the Barron’s article above explains, but other events have highlighted the dangers for retail investors. The first occurred during the “flash crash ” of 24/8/15, when steep declines in the S&P 500/Dow Jones etc, led to pricing delays, and wild variations in the premiums and discounts of the ETFs with their underlying assets. (This Vanguard article explains it in full.) The second occurred in January, as the oil price swings really started to get going.

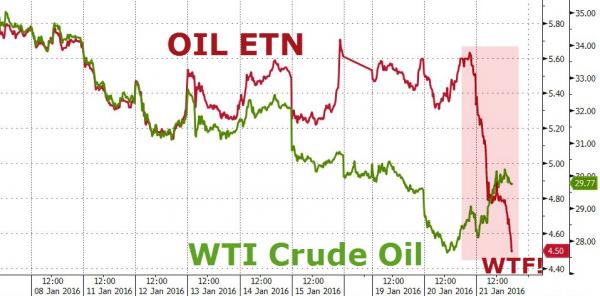

As the chart below demonstrates, the premium to fair value on the iPath Oil ETN (1) reached a mammoth 35% in mid-January, Barclays Bank had limited the creation of new units, thus preventing the arbitrage process that keeps ETF/ETN prices in line with the underlying value, with the below results.

The consequence was predictable – when new unit creation was recommenced, the ETN plummeted (-17%) on huge volume as retail investors were left with heavy losses as the price reconnected with fair value, even as the oil price actually rose. Institutional investors, of course, were unaffected, as they had sold the issue to their retail customers…the artificial inflation of the price led to massive losses for those short the issue in the run-up to a 35% premium, and then equally large losses for those unlucky (or imprudent) enough to be holding the issue when it finally collapsed.

Of course, Barclays had carefully ensured that it had no liability for this. It’s product summary contains the important disclaimer “Trading Market for the ETNs May Not Develop: Although the ETNs are listed on a U.S. national securities exchange, a trading market for the ETNs may not develop and the liquidity of the ETNs may be limited, as we are not required to maintain any listing of the ETNs”.

How to deal with these situations? We do not believe that this constitutes a fatal flaw in ETFs/ETNs in and of themselves. As with many things, it is the use something is put to, rather than the tool itself, that is the problem. Here at EBI, we have no real interest in commodity investing (as we see it, it is at best a zero sum game), but we are open to the possibilities that ETFs etc. provide. But it is vital to do the homework – there is no substitute for analysis, and we would absolutely never pay a premium to fair value for an ETF. Indeed, were it to happen in any of our holdings, we would most likely sell them, and buy an alternative, regardless of our views on the asset class concerned. Individual investors don’t necessarily have access to the data needed to make informed choices (or else Barclays et al would not get away with this behaviour), but we do, and so this should not happen. We aim to track our chosen indices, not beat them, so a premium/discount is a warning bell for us in itself..

Caveat emptor applies in these situations, but it is informed analysis that will prevent us falling victim to these scams (for that is what this was).

(1) ETN: An exchange traded note. See here for definitions, and the distinction between ETFs and ETNs.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.