Just as with Carlsberg, we don’t do predictions at EBI, but if we did they would probably be the best in the World…

I am sure you have already had your fill of predictions for 2017, but just in case you haven’t here are some more, but with a slight twist – these are the opposite of the consensus view, taken precisely because of that fact. Call it a control experiment – how right can one be simply by saying the opposite of the pundits? We shall check back in approximately 350 days…

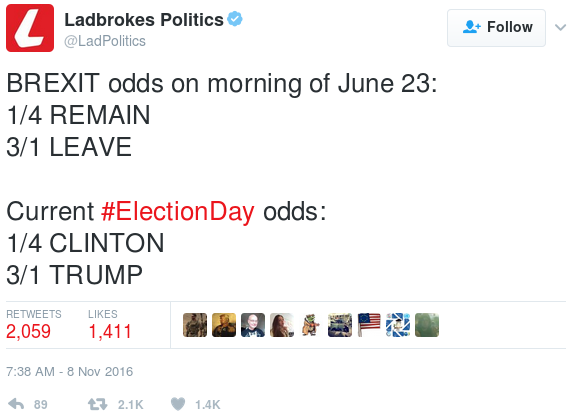

2016 was a normal year in most senses – pundits got it wrong, as usual, but this time the magnitude of failure was spectacularly large: not just the puditocracy though. As the screenshot below shows the Bookies got it badly wrong too, and it cost them real money.

So, as a thought experiment, I will lay out some contrarian ideas for 2017. Not through exhaustive analysis, deep thought or insider knowledge, all of which are distinctly lacking here at EBI; I shall merely take “the other side of the trade”. That is, I shall predict the opposite just for it’s own sake. There is no obvious reason why I should be any more wrong than the cognoscenti; indeed the bar there is extremely high…

Let us start with markets, before considering interest rates, global trade and overarching investment philosophy:

1) At the start of the year, Barrons host a round table (available behind a paywall) where the great and the good of the Investment world opine on the year to come. They appear to be “cautiously optimistic” [1], but they all seem to agree that, despite rising bond yields, and rising interest rates, stocks (in the US and by extension, globally), will do well (at least in the first half of the year, especially so in Japan). This consensus view is espoused in most parts of the Western World.

[Me]: VIX shorts are now at record levels ahead of the Trump inauguration, and NYSE Short Interest has fallen to the lowest levels in 3 years, suggesting both bearish capitulation AND excessive complacency [2]. Thus, it is more likely that we see the opposite – a decline followed by a “V” shaped rally, as excessive positions are quickly unwound. A market decline quickly gets investors nervous; they sell, traders go short in large amounts, and the cycle reverses once again, this time to the upside…

2) Inflation is headed higher with Bond yields set follow, according to most experts, and this is echoed in UK outlooks. The Fed is expected to raise Interest rates 3 times in 2017, suggesting bond prices will fall sharply, ending the near 25-year global bond bull market.

[Me]: Rates have already risen, yet actual inflation remains broadly quiescent. Why? Maybe due to a structural shortage of demand; ultimately, consumers can only spend what they earn (or they borrow). Wage growth is still sluggish, so price resistance will be fierce. The Japanese deflationary mindset (whereby they wait for prices to fall, thus ensuring that they ultimately do), is now a Western phenomenon, and the rise of Aldi, Lidl etc. is a symptom of this. Apple has just announced a c.20-25% price rise in the cost of their UK apps (ostensibly due to the falling pound); let’s see how that goes. I suspect it may be a “Marmite” moment for the firm. So, as rates rise, consumer spending falls, the Central Banks panic, and rate cuts/QE are put back on the table once more. Bonds may not rocket, but reports of their death has been somewhat exaggerated. In the US, one Fed Governor has already warned that Government spending could cause a change in the Fed’s attitude towards faster re-adjustment of their Balance Sheet (i.e. more tightening), a clear message to Trump not to overdo the fiscal expenditure. He will listen because rate rises hurt his natural voter constituency hard.

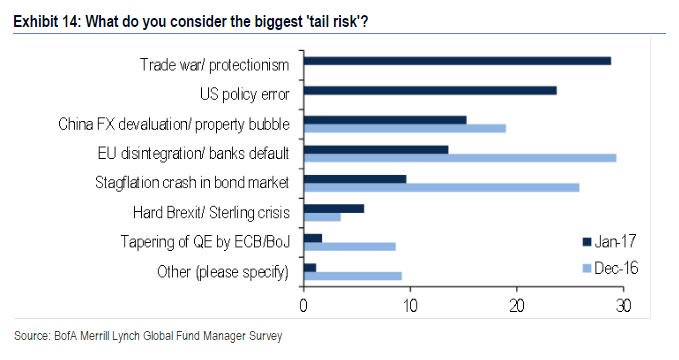

3) Many investors and traders worry that Trump’s increasingly anti-China trade rhetoric could lead to a trade war and even a global recession, as both sides dig in, and retaliate tit for tat, jamming up global trade (see chart below).

[Me]: Both sides know what is at stake in this fight, and both are aware of the downsides of their actions. Neither can afford the economic consequences of a trade war, so are much more likely to reach a deal.

4) Active management will finally triumph over Passive in 2017. See here and here for yet more examples of the increasingly desperate refrain that has dominated the (wishful) thinking of Active Managers everywhere. More volatility and less intra-market correlation will allow stock picking skills to be deployed to the benefit of investors, they aver!

[Me]: This is the easiest one to contradict: more volatility will create more chances to be wrong. Lower market correlations will do the same. We have not seen out-performance in bear markets from Active managers (after all, selling may be well-timed, but the job is not complete until the Manager is back in the market again, and this is the real problem). Most often, they remain in cash for too long, remaining “terrified” to invest at the lows, thus missing out on the subsequent rebound. It is extremely common for managers’ underperformance to arise from being in cash too long, rather than from being over-invested. We have a bank of charts in the EBI Repository (login required) showing how Tactical Asset Allocation funds start to lose ground after a market rebound, because they remain market-skeptical. Despite the bravado, the cost/benefit advantage remains with Passive funds, so it would be safer to assume that so too will performance.

This is by no means an exhaustive list. I am merely presenting an alternative view, using the same basic facts – that two opposite viewpoints can be constructed using the same reality highlights the “value” of listening to talking heads etc, who know a lot but are aware of little (or none). If this list turns out to be more right than analysts, commentators and “experts” etc. then it serves to underscore their superfluity.

Just don’t invest on the basis of my “predictions” – I don’t know anything either…

[1] Have strategists been anything else? I don’t recall any “recklessly pessimistic” predictions from any analyst since I have been involved in markets.

[2] The VIX index is calculated using Index Option prices and attempts to measure market sentiment- the lower it gets, the more bullish investors are, and vice versa. If the Index falls too low, it indicates Investors have no downside concerns (as Volatility tends to rise as markets fall). Short Interest measures how many Investors have sold shares they do not own (expecting price declines). Again, the lower the level, the more bullish investors are.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.