“Consumption is the sole end and purpose of all production; and the interest of the producer ought to be attended to, only so far as it may be necessary for promoting that of the consumer” – Adam Smith (the Wealth of Nations).

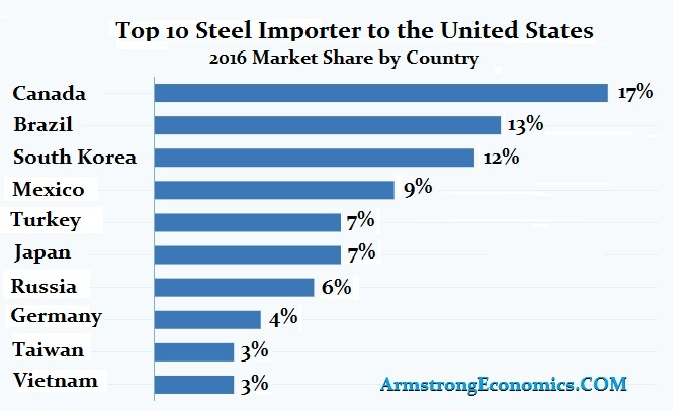

Markets have been on edge for the last few weeks as the prospect of a trade war (and thus ancient memories of trade wars past) has been revived. President Trump has announced a series of tariffs on Steel and Aluminium imports, said to be worth around $50 billion. The chart below shows who would have lost the most from this policy, but Trump then promptly exempted nearly everyone from it, making it clear that he was really aiming at China. They responded by proposing retaliatory levies on (mostly agricultural) products, aiming at those perceived to have voted for Trump.

There are many, including those not necessarily on Trump’s political side, who argue that Chinese trade practices have been unfair for a long time (and the bi-lateral trade surplus suggests this is the case). Macron of France said as much, whilst on a state visit to China in January.

The Chinese Government routinely restricts access to Chinese domestic markets and forces inward investors to transfer technology to mainland firms if they want to invest in China. The theft of intellectual property [1], (widespread within the Electronics industry, particularly in semiconductors), makes it increasingly unappealing to invest in R&D in this sector. They (China) heavily subsidize exports (of hot rolled steel for example) leading to complaints of the dumping of artificially cheap products onto overseas domestic product markets, affecting not just US manufacturers, but those in Europe and the UK too. In any event, the $50 billion or so in announced tariffs only amount to around 2% of global trade flows (about $2.4 trillion per year) and represent just 0.2% of US GDP. In fact, many US Presidents have taken the same or similar actions in recent times.

What worries markets is the prospect of escalation – a move to raise trade barriers on cars, electronics, oil etc, would create genuine problems (not least for consumers, but they don’t appear to be part of any calculation at present; it always revolves around producers it seems) [2]. Higher prices affect living standards for a far wider share of the population compared to those whose livelihoods depend on the Steel industry for example. How will US voters react to having to pay more for their consumer electronic gadgets if the US goes after the Chinese manufacturers? This cuts straight across one of the basics of economics, namely Comparative Advantage; you concentrate on what you can do best (or cheapest) and let others do the same. The problem is that the US Trade deficit implies that nobody wants whatever it is that the US does best!

In a further sign of the de-facto veto that US financial markets appear to have over US policy, (which we touched on a fortnight ago), over the weekend, it was announced that the US and China were in talks to try to avert the imposition of tariffs and try to reach a “reasonable solution”. This came after a near 1500 point Dow collapse the previous week; markets duly stampeded higher, (the Dow was up 700 points on Monday this week), appearing to confirm the impression that Wall Street, not Washington controls the agenda.

Markets will no doubt continue to gyrate as the news develops, but nobody can say how it will all play out. Donald Trump likes to shake things up, and the (early) signs of Chinese concessions may be enough for him to claim victory and back off. The fact that it is the US that runs the trade deficit (which implies everyone else is gaining), may cause others, (particularly the Chinese) to try to appease him, at least at first, since they may have more to lose. On the face of it, the US appears to have the least to lose of all the G10 nations.

The Steel/Aluminium tariffs were due to take effect on the 23rd March, but the broader process is likely to take several weeks, or even months to fully play out, so the immediate impact will probably be limited; but it has not stopped howls of anguish from establishment economists and fund managers warning (as with Brexit) of the dire consequences for markets. One consensus view is that the Dollar would weaken (as implicitly, it implies a preference for a lower Dollar, since bi-lateral trade balances will not improve if the currency remains at current levels). But even this may not play out as expected, given the already large Dollar shorts established in the last year.

We shall have to wait and see. Nothing (good) will come of trying to react to (or anticipate) the torrent of news, so watching and waiting is by far the best response. Like many other sources of recent market angst, this one could easily blow over, leaving the bears once again frustrated. If this is another storm in a teacup, the issue will fade from investors minds as quickly as it arose.

[1] On one estimate, IP Theft costs the US around $300-600 billion a year, mostly to China.

[2] Boeing, for example, has already expressed their opposition to tariffs, but not out of concern for the consumer – China is one of their biggest clients, and they derive 55% of their revenues from outside the US, compared to c.30% from the typical of the S&P 500 firm. It’s near 10% Dow weighting may concentrate minds both in the executive suite AND in the White House – but consumers do not feature in their thinking to any extent at all.

For future reference (maybe), here is a breakdown of the top Exports and Imports by Product and by Trading Bloc. Hopefully, we will never need to look at it again.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.