Monkey killing monkey, killing monkey

Over pieces of the ground.

Silly Monkeys, give them thumbs

They make a club and beat their brother down.

“Right in Two”- Tool

Things appear to be hotting up in the Middle East once again. The European refugee crisis has focussed attention on the on-going civil war raging in Syria, and the potential for escalation in fighting if the Turks and the Saudi’s get drawn into the battle for control of the country.

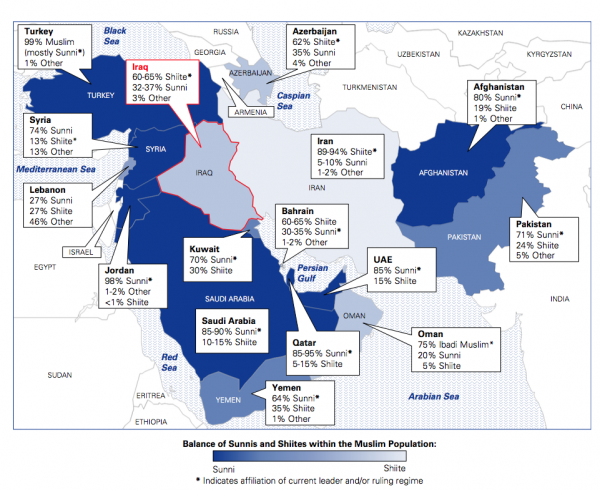

Let us look at the broader picture first. The chart below shows the balance of power within the Middle East between the two rival Islamic sects. This divide will become important as we digest the recent events in the region. It is important to note that the interests of the parties do not necessarily coincide- the variety of reasons for involvement add to the complexity of the situation: the US-backed Kurds are fighting ISIS, whilst being at daggers drawn with NATO member Turkey, who are allied with US ally Saudi Arabia against Iran and Russia, who are backing Assad in the civil war against ISIS, whom the US has said has no future in power. [I am not sure I follow all that– what markets are to make of it defies description]. The potential for mis-calculation is thus enormous.

The fate of Bashar al-Assad, the (current) Syrian President is linked to the above map, featuring the Russians and the Iranians (Shiite) on one side and the Saudis and Turks (Sunni) on the other. At stake is the control of the country (and the putative new gas pipeline that the Iranians wanted to pass through Syria to supply the Europeans, directly challenging Russian dominance of that market). The progress of the war has now raised the worrying prospect (for Turkey), of both a Shiite-dominated Syrian government and a resurgence in Kurdish demands for Independence which they have made clear both they and the Saudis are ready to invade to prevent. The fall of Aleppo (see below) would probably mean the end of the anti-Assad rebellion, something both Turkey and the Saudi’s want to forestall. For Turkey, failure would almost certainly increase the pressure for a Kurdish state (which would involve the loss of Turkish territory). Recent events have brought forward the decision point, and given a potential pretext for an invasion.

Note the black line on the chart above represents the Syria/Turkey border.

An invasion would be hugely risky for all sides. A straight Turkey/Saudi versus Russia/Iran fight could easily spin out of control- who (if anyone) would prevail is impossible to say, as both sides have by now had ample time to prepare their plans and military assets. Hostilities with Russia could lead to the US and NATO being dragged into the conflict; once involved it is extremely difficult to see how the protagonists can extricate themselves without significant loss of life (and prestige) on all sides.

The disconcerting sense is that this is reminiscent to the lead-up to World War One. Back then, as this site demonstrates, “the countries of Europe thought that the alliance system would act as a deterrent to war; in fact it tied the countries together so that, when one country went to war, the others felt themselves obliged to follow”.

[Note: Turkey is a NATO member; Article 5 of the Treaty, commits each member to consider an attack on one state to be an attack on them all].

So far, NATO has managed to steer clear of any involvement, but it is not clear how long they will be able to remain aloof. What happens then could have a very serious impact on asset prices in general. It is a low risk/high impact possibility, (a form of Taleb’s Black Swan)(1), but it is not obviously avoidable.

Under “normal” circumstances an eruption of fighting in the Middle East would be expected to lead to a surge in the Oil price (and judging by historic correlations with equities, a sharp fall in prices of the latter). But in recent times, the correlation has been positive, and in any case inventories of oil have soared in recent months as oil producers try to generate cash flow to offset the lower prices. According to a Wood Mackenzie study, just 4% of total global oil supply is non-viable at $35 per barrel, compared to an estimate last year of 13% (mostly in the US). A significant lowering of production costs has rendered that report out of date, signalling that the “Prisoners Dilemma” between the various OPEC members could go on for quite a while yet. There is no sign of “capitulation” by any of the parties and thus no real effort being made to rein in production. Maybe only a wave of bankruptcies will actually shrink output, which would be expected to take the pressure off Emerging markets’ currencies, and thus their Equities.

As always, it is the timing of events that will catch investors out, which may explain both recent casualties, and the long term fund flows to Index products.

(1) Of course, the fact that I am posting on the subject renders it not as “unexpected” as the metaphor might imply.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.