“We have to work towards free trade because otherwise we will miss out on many opportunities for cooperation, and relations amongst countries will become much more difficult” – Lee Hsien Loong (Prime Minister of Singapore).

In two tweets posted on a Sunday night, (May 5th), Donald Trump shook the markets out of their complacency with regards to the likelihood of a trade deal between the US and China, warning that, without a deal, tariffs on $200 billion of Chinese goods would rise from 10% to 25%, and another $300 billion of additional Chinese goods could see the imposition of a 25% tax [1]; this would leave substantially all Chinese exports to the US subject to levies and marks a substantial escalation of the conflict. Global markets did not take this well and the VIX Index has risen by over 10% as equities fell. Negotiations have not (yet) been abandoned, but investors now are on edge, as they face the possibility of a complete breakdown of relations between the two nations; the regional rivalries (particularly in Asia) could even spill over into actual conflict, over Taiwan for example. China’s threat to retaliate on some $60 billion worth of US exports by 1st June has not calmed the situation; they have indicated that there are 3 outstanding issues to be resolved before they will acquiesce to any agreement, none of which appear likely to be accepted.

All this can be seen as merely negotiating ploys, to increase the pressure on the interlocutor to compromise, but neither side appears ready to back down in what has already been a rather lengthy process, and which is now starting to get heated. The S&P 500 had its’ worst week of the year so far in the last 7 days, but it is worth remembering that it is still less than 5% below its all-time closing highs. You might not have guessed that judging by the breathless “reporting” going on though.

There are 3 possible ways that this plays out. 1) a trade deal is reached in the next month’s window (see below), 2) a stalemate, potentially lasting for weeks or even months, or 3) an all-out trade war; Bank of America has helpfully broken these down into potential scenarios for growth, policy, and markets, (though how useful this will turn out to be, remains to be seen).

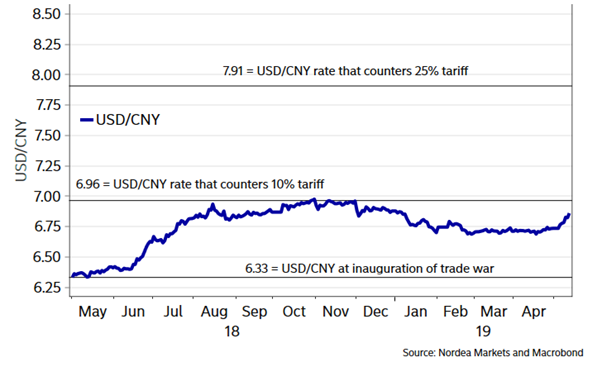

So, who holds the cards? It is a close call either way (even if we ignore the reality that tariffs rarely benefit either side). As the chart below suggests, if the Chinese are not happy with a putative deal, they could engineer a decline in their currency sufficient to wipe out the effect of a tariff hike, (meaning that US consumers would end up paying it themselves via higher prices). They could also decide to sell US Treasuries – they own around $1.2 trillion of them – which could, in theory, put pressure on US interest rates.

But it is not that simple for the Chinese government – they run a large trade surplus with the US, particularly in Electronics and with their economy slowing [3] to 6.4% in Q1 2019, (the slowest pace since the 1990s), there is bound to be concern over the employment implications arising from this. China’s Prime Minister this week warned of the “big pressure” on employment in the country, potentially a sign that senior party officials are starting to get concerned about social stability. Broker Societe Generale has recently estimated that Chinese GDP will fall by 0.5% as a result of the new tariffs alone, double that of the US. With the Chinese banking sector looking increasingly exposed to bad loans – $420 billion as of the end of 2018 – bank loan loss provisions are rising and the country needs US Dollars to cover the $1.96 trillion in external debt. A trade war will not help this process at all, as it reduces Dollar income received.

The problem is that a devaluation of the Yuan would only exacerbate this (until now, this has been their default response). Selling US Treasuries may not have the effect that they desire either – they have been selling for the best part of the last 5 years [4], with no negative effects on US interest rates and there is little reason to think it would be any different now. Meanwhile, the US economy is growing strongly, up 3.2% on Q1 2019, above estimates of 2%, wages are rising and the US stock market is, as mentioned above, close to all-time highs. Although markets may struggle a little for a while, there is always the possibility that the newly-dovish Fed will respond to any further falls by cutting interest rates – and traders are now expecting this to occur in the coming months.

One way to look at this is from the perspective of Game Theory, or what is known as the “Ultimatum Game”. A 2014 University of California experiment suggested that when played by skilled negotiators, (as opposed to the general public), the results showed that, to get an offer accepted, they would have to make a higher offer (or receive a higher offer to accept it)[2]. Therefore, BOTH sides will have to give more ground than they currently perceive as acceptable to arrive at a deal; so far, there is no indication that either side yet understands this reality, which explains the rising tensions between the two sides – but a winner takes all approach will not work here.

It may take some time for this to resolve itself, but resolve itself it will; some sort of compromise will eventually be reached (and both sides will claim victory no doubt). The key is not to react to headlines – with the stakes for both sides so high, there will inevitably be some twists and turns, but neither side wins from a continued stalemate – Trump, after all, has an election to win next year, whilst President Xi needs to re-balance the Chinese economy – both have important jobs to attend to, and sooner or later they will have to turn their attention back to these issues.

Just don’t expect an imminent resolution…

[1] It is important to note that the US has imposed these tariffs on trade not yet agreed – this, allowing for the c.30 days it takes for Chinese made goods to reach the US gives a one month window for an agreement to be reached. The clock is therefore now ticking.

[2] Interestingly a Chinese/German study into the same game found that Chinese players (regardless of age) all made higher offers than in the US version of the experiment, but also required even higher offers to agree. So there may be a cultural element to this process; perceptions of “fairness”, rather than outright profit maximisation may be the critical guideline for reaching a (or any) deal.

[3] Even this may be overstated. Chinese economic statistics are, shall we say, not the most reliable.

[4] Note, Belgium is often used by Chinese authorities to “mask” their activity in US Treasuries; it is a conduit through which they attempt to buy and sell unnoticed, though, as markets have caught on to this, it is added to the “official” numbers reporting their transactions.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.