If one turns on the TV almost any time of day, one will see a litany of property related programmes, “Homes Under the Hammer”, “Location, location, location “and countless others adorn our screens in an almost non-stop barrage of lifestyle envy. As of February 2016, Channel 4 had no less than 12 property shows on its screens and this is almost certainly below where we are now. The property market has gone mainstream and has gone Global.

EBI wrote about this subject back in November 2015, showing how the attempts by European Central Banks (Sweden, Denmark, etc.) to keep their respective currencies from rising against the Euro led to them cutting interest rates to sub-zero levels. It did not take a PHD in economics to foresee what would happen next and sure enough, house prices across the globe have responded, going north in a hurry. It all looked like “a bubble in search of a pin” as we said at the time, but we cautioned against assuming that it was all going to end in tears immediately. It still hasn’t (yet).

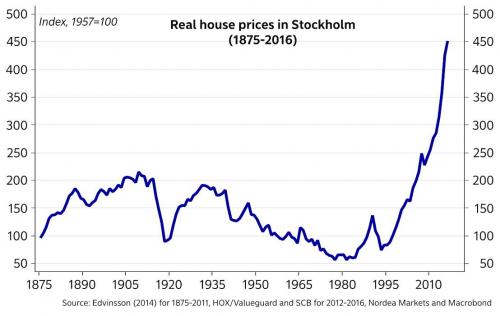

As has become customary over the last decade, Central Banks (CBs) have been the major protagonists in this saga. Years of ultra-loose monetary policy has led to money, which was intended to go into the real economy, being pushed into asset prices. Still scarred by the 2007-09 crash, retail investors have preferred to invest in bricks and mortar rather than shares, whilst Banks, keen to be seen to be investing in something other than shares, have been happy to oblige. In Sweden, the result has been striking (see below).

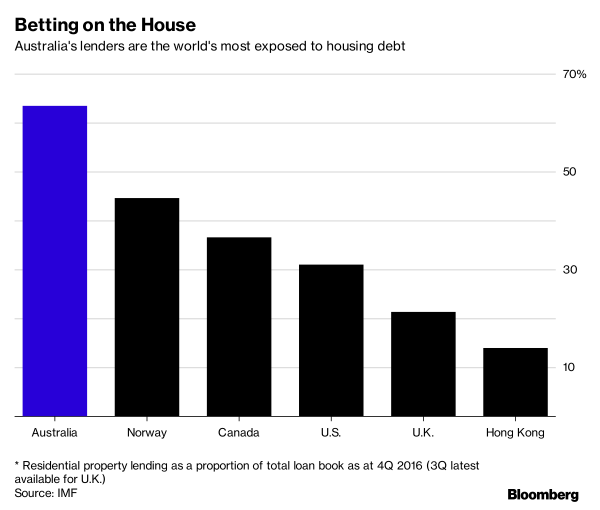

But for every asset there is a corresponding liability and now several of the World’s Banking sectors are now heavily exposed to the health (or otherwise) of their respective domestic housing markets, illustrated by the graph below. Australia stands out, but according to a Swedish Central Bank, 2017 Financial Stability report , their banking sectors have 70% of exposure to residential lending. Figures do not appear to be available for Ireland, but may be lower, as around 60% of all transactions are in cash, according to an internal Irish CB report.

But there are signs of trouble ahead:

1 – The Swedish Central Bank has tried to slow things down – they have raised Capital Requirements for Bank lending, lowered the Loan to Value maximum for new borrowers and called for the phasing out of tax relief on mortgage debt. But political considerations (the minority government faces a general election in 2018), has so far created paralysis, but many are now seeing the writing on the wall. The SEB House price indicator fell sharply in October 2017, and again (to -5) in November and the number of Swedish households expecting prices to fall has gone from 16% in October to 41% in December. Interestingly, this sentiment is mirrored in Ireland, where 38% of respondents think property prices will crash.

2 – Looking at the UK, the average house price is now nearly 8 times the average wage (around £28,000 as of 2017), but much worse in London, where prices are considerably higher. Thus far, according to Rightmove, (a UK property website), prices have risen by around 0.7% in January, but sales have dropped 5.5% on the year. With affordability being stretched by falling incomes and rising inflation, (which is still above 3% compared with a 2% annual target), the time taken to sell a property has also risen to 67 days (from 55 days last summer). Estate agents expect “broadly flat” values in 2018 (as they nearly always do), but absent yet more credit growth it is hard to see a return to the days of 2005-06.

3 – In Ireland the position is complicated by Brexit – Dublin commercial property prices (and rents) have been boosted by the potential influx of Bankers moving to Ireland to escape tougher regulations in the event of the UK being outside the EU; building, and office take-up have risen, whilst vacancy rates in the city have fallen to 4.5%. Last year, average rents rose 13.5% year-on-year leaving rental yields between 6-8% per annum, far above the 1% available on bank deposits. The elevated level of cash-only transactions (see above), makes it hard for the authorities to do much about it, at least in the short-term.

4 – Both Central Banks and politicians across the globe, have moved to convince Investors that there is no need for alarm. But the Australian market may be a blueprint for the near future. As the ratio of the Housing market to GDP has surged to over 4 times, price rises have slowed to just 4% p.a. (half the growth of 2015) and actually fell in December 2017 (0.3%), the first response has been to set up an Inquiry into the Banks conduct. How this will address the real issues remains unclear, but it provides cover for both politicians and Central Bankers to avoid their share of the blame – nobody loves the banks anyway….

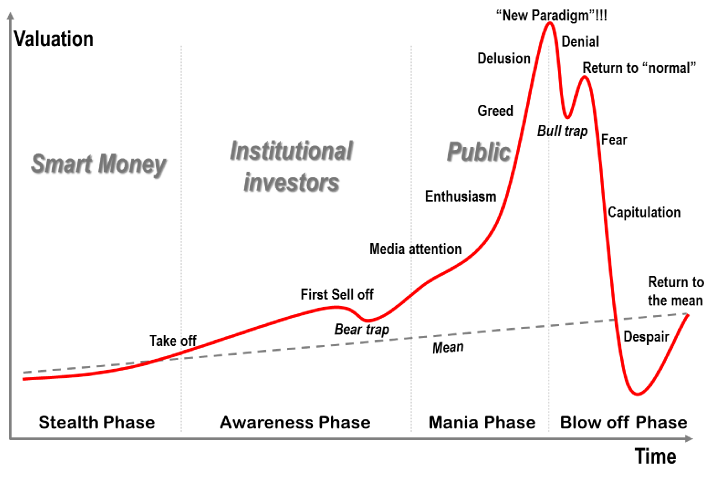

Nothing provokes more heated discussion (both personally and professionally) than the subject of house prices, people’s perception of what is going to happen is governed to a considerable extent by what they hope will happen. The chart below may be a roadmap for the future, though how far along this path we are may well depend on the individual region/market. But there is little doubt that we are closer to the right-hand side of the chart than the left. Getting out at the top is very unlikely however and investors may well forfeit substantial gains if they sell early, as many have advised over the last decade or so. We all need somewhere to live, so unless there is an attractive park bench available in your area, it may be better to avoid trying to time the market altogether – ask yourself, what do you know about the property market and future prices that everyone else doesn’t? In my case, the answer is very little…

Stylised view of how a Bubble progresses:

This article was originally published in the free investment publication for investors, The FM Report – Sharing Experts’ Insights to Investors.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.