As the world is now embracing a low-carbon economy at a record pace, this blog examines how this could impact fossil fuel investments.

Topics we cover:

• What does a world that is more focussed on climate change mean for fossil fuel companies?

• What does it mean for investors?

• How are ebi positioned to deal with this possibility

Historically, Fossil Fuel companies such as oil, gas, and coal companies have had a constant place within an investment portfolio. While this is currently the norm, the world is now ushering in a new era, one that is seemingly focused on combating climate change.

The planet’s climatic system is getting more unstable, and the primary drivers of global temperature rise are greenhouse gases. The Paris Agreement became one of the first global stepping stones to fight climate change as 197 countries agreed to keep the global temperature increase to well below 2°C and to pursue efforts to limit it to 1.5°C above pre-industrial levels. Since then, the topic of emissions has become a major focal point in policy changes. This structural trend has been supercharged over the last 2-years, the first catalyst proved to be the Covid-19 pandemic and the second green shoots came from the back of the Russian invasion of Ukraine. With countries around the world now looking to cut their dependency on Russian commodities, it also triggered a serendipitous effect, one that is pushing economies to become greener and the goal of achieving net-zero has been fast-tracked. This transition is also occurring within the investment world, in 2018 around $25billion poured into sustainable funds; in 2021 this was $357billion[i].

What does it mean for investors?

Many of the recent events aforementioned have accelerated the pace of renewable technologies, which could cause a sharper and quicker loss in the value of fossil fuel companies. The fear is that many current portfolios hold a big position in fossil fuel assets and this could cause huge financial losses to investors. This may come from tighter climate action regulations and a faster pace of transition to net-zero could cut the valuations for these companies. While this structural trend has increased pace, investors should be aware rather than alarmed as it’s also worth noting that transitions such as these are not instant and rather staggered – Rome wasn’t built in a day.

How is ebi positioned to deal with this threat?

ebi’s portfolios are already ahead of the curve in regards to stranded assets (assets that suffer unanticipated or premature large devaluations). The ESG metrics used in the construction of the ESG funds we employ assess the risks associated with the underlying companies based on a wide range of ESG issues, including their exposure to fossil fuels and stranded assets. We have worked with fund managers to push for a 50% reduction in carbon emissions versus the funds’ respective benchmarks.

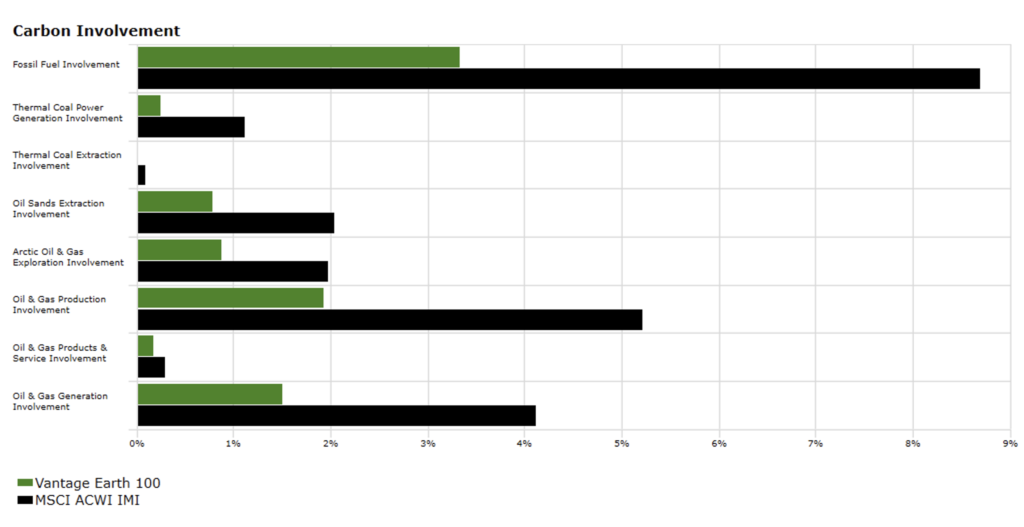

ebi does not invest in any commodities and has no funds that directly target fossil fuels. The equity portfolio has a 1.3% exposure to the energy sector compared to the global equity market exposure of 4.7%, due to the ESG overlay.

The chart below compares the carbon involvement of the Earth equity portfolio against the MSCI ACWI IMI, a proxy for the global equity market, we can see that in all measures the Earth portfolio has a lower exposure to companies that derive revenue from fossil fuels. Hence the portfolio is better protected against these risks than a vanilla market portfolio.

Conclusion

Timing an exit is difficult and something that evidence suggests is unrewarding. In the short term, the world will need fossil fuels to continue. However, long-term investors should be cautious about excess weighting towards these companies as the world begins to wean away and head toward greener pastures.

[i] https://citywireusa.com/professional-buyer/news/esg-funds-enjoy-another-record-breaking-year-winning-69bn-of-new-money/a2379110

Blog Post by Joshua Clarke & Raj Chana,

Investment Analysts at ebi Portfolios.

What else have we been talking about?

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025

- October Market Review 2025