In the wake of the Fed’s non-decision on Interest rates last week, the markets have remained highly volatile and there are now questions being raised about the Fed itself.

As Vanguard’s Chief US economist put it, “we are concerned with the Fed’s acknowledgement of recent market volatility in its decision. The Fed runs the risk of being held captive to the markets as, paradoxically, much of that volatility is due to the anticipation and uncertainty around when the Fed will move“. [1]

A similarly circular dilemma presents itself if we take the view that the Fed missed its window to hike and is now creating more nervousness and uncertainty with each meeting that passes without lift-off. Here’s how former Treasury economist Bryan Carter put it to Bloomberg: “short-end rates move higher as the Fed gets closer to hiking, and that causes the dollar to strengthen, and that causes global funding stresses. They are creating the conditions that are causing the external environment to be weak, and then they say they can’t hike because of those same conditions that they have created“. [2]

So, if the Fed raises rates, EM assets fall, which would then feed back into DM Asset prices, which raises the prospect of further Fed easing to avert another crisis. The Fed is meanwhile contributing to that volatility by NOT raising rates. What a mess…

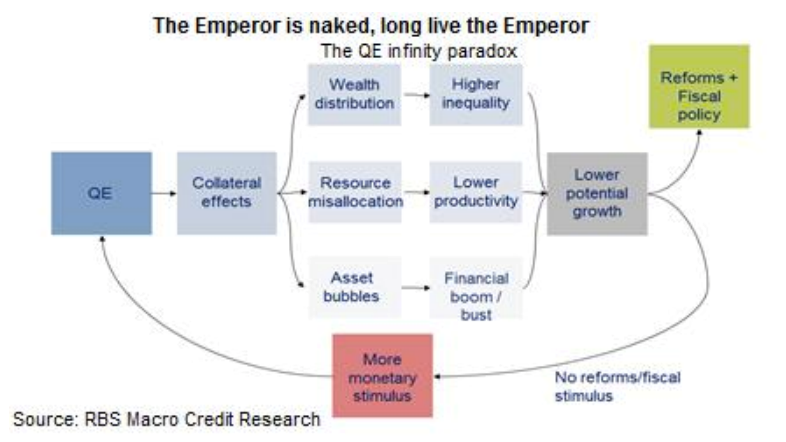

It is a problem of the Fed’s own making however. The following charts show the inherent problems with the whole QE policy, and how it ends (or in this case doesn’t).

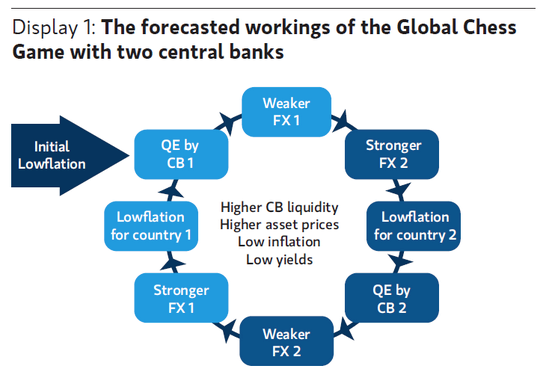

Not only that, it creates an iterated Prisoners dilemma between Central Banks, as each tries to respond to the actions of others…

Source: Morgan Stanley

Seen in this light, the QE policies introduced by the Bank of Japan, the Fed and the European Central Bank, begin to make (some sort of ) sense. But, as Bill Gross[3] points out,” low interest rates are not the cure – they are part of the problem. The premise is simple. By keeping rates artificially suppressed, the central banks of the world effectively make it impossible for the market to purge itself of inefficient actors and loss-making enterprises. As a result, otherwise insolvent companies are permitted to remain operational, contributing to oversupply and making it difficult for the market to reach equilibrium. The textbook example of this dynamic is the highly leveraged US shale complex which, by virtue of both artificially low borrowing costs and the Fed-driven hunt for yield, has retained access to capital markets in the midst of the oil slump and has thus continued to drill contributing to the very same price declines that put the entire space in jeopardy in the first place“.

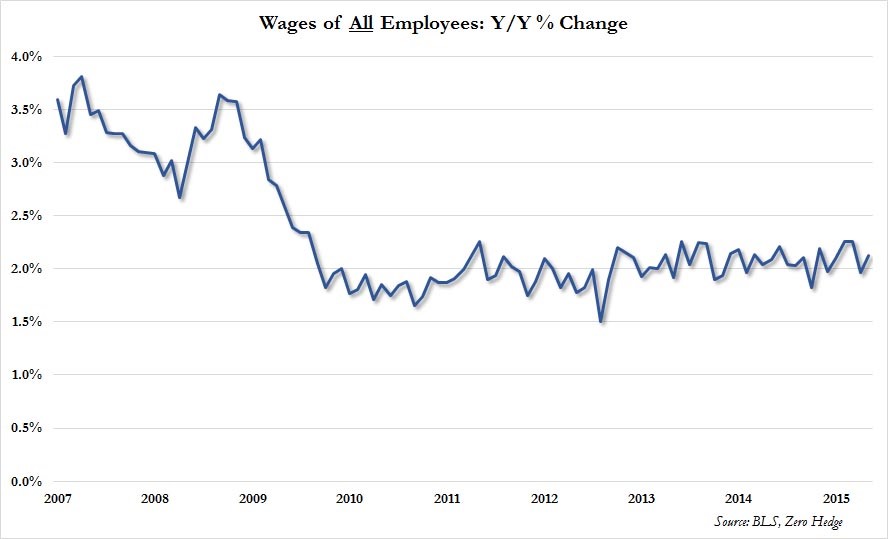

The World is awash in commodities such as Cotton, Iron Ore, Oil (but also labour) as those with access to cheap money over-produce, but with the economy not seeing demand from those who don’t benefit from this process (i.e. most people), the inventory piles up. Meanwhile, those credit-worthy companies that survive this cut-throat competition are forced to cut hours, wages and benefits as they struggle to survive. The following charts demonstrate the pressure that wages are under, in the US…

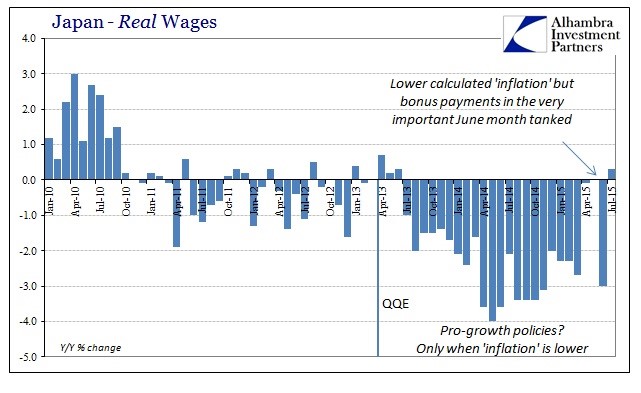

And as an analogue of what may be to come, in Japan too.

What to do?

The premise behind raising rates was to give the Fed “ammunition” to fight the next downturn. Indeed, we may already be close to that point, as the Wall Street Journal points out for the third year in a row, the rate of growth in global trade is set to trail the already sluggish expansion of the world economy, according to data from the World Trade Organization and projections from leading economists [4] . But, maybe the premise is false. CAN the Fed really raise rates ? The market is becoming increasingly sceptical as this Bloomberg article suggests, with Inflation break even rates still falling.

The OECD and the Asian Development Bank have expressed similar economic concerns. It may only take a small economic “shock” to tip the World back into recession. Predictably, brokers have a solution – both Macquarie, (Australia’s largest investment bank), and more recently, Citigroup are now predicting/demanding the introduction of “Helicopter drops” of money [5]. The theory is that putting money directly into the public’s hands will have a greater economic effect, (money multiplier in the jargon), as the poor tend to save less, and are in greater debt. It would by-pass the Banking system, avoiding the current position, whereby Banks leave the money at the Central Bank and don’t lend it out to businesses, (there is approximately $3 trillion held on deposit at the Fed – as of June 2014 , which could have been invested productively in the real economy).

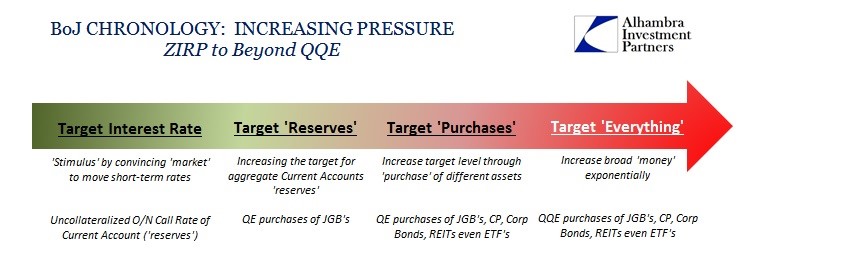

As before, we should look to Japan for how this plays out. Alhambra Investment Partners (see their blog) imagines a truly dystopian scenario- as the flow chart demonstrates, the Bank of Japan could end up “targeting” everything…

It would not take too much imagination to see this leading directly to Weimar Germany (not necessarily immediately, but very certainly).

Conclusion

The Chinese economy is central to this problem. Most Economic theory is concerned with shortages and assumes that over-supply is not possible (though this book challenges that notion) [6]. China has been the buyer of last resort of commodities for several years, and the recent troubles may put an end to that paradigm. The huge indebtedness of Western governments more or less preclude the possibility of large-scale public expenditure (even if the appetite for debt was there) [7].

The following quote [8] sums up the problem, though offers no solution (possibly because there is none) “Cheap, easy credit has created moral hazard and nurtured magical thinking throughout the global economy. According to polls, the majority of Greek citizens want the benefits of membership in the Euro/EU and the end of EU-imposed austerity.The idea that these are mutually exclusive doesn’t seem to register. This is the discreet charm of magical thinking: it promises an escape from the difficulties of hard choices, tough trade-off’s, the disruption of vested interests and most painfully, the breakdown of the debt machine that has enabled the distribution of swag to virtually everyone in the system (a torrent to those at the top, a trickle to the majority at the bottom, but swag nonetheless)“. The reluctance of Governments to tell the electorates this unpalatable truth reflects their fear of electoral disaster.

As we come up to the end of the Quarter, Global Equity market capitalisation has fallen below $60 trillion for the first time since February 2014, as it appears that the QE policy isn’t working…

Source: Zero Hedge.com

If the general population ever cottons on to what is happening, our previous blog post speculation could come to pass.

- [1] Roger Aliaga-Diaz

- [2] ZeroHedge.com 24/9/15

- [3] Formerly of PIMCO, but now at Janus Capital. Newsletter 30/7/15

- [4] Wall Street Journal 14/9/15

- [5] This phrase is a reference to a famous Ben Bernanke speech which decried the possibility of deflation

- [6] The Age of Oversupply: Overcoming the Greatest Challenge to the Global Economy

- [7] Though how much of it would be productive is open to question anyway!

- [8] C. Hugh Smith, oftwominds.com 29/6/2015

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.