“Aging seems to be the only available way to live a long life”- Kitty O’Neill Collins. (US Author).

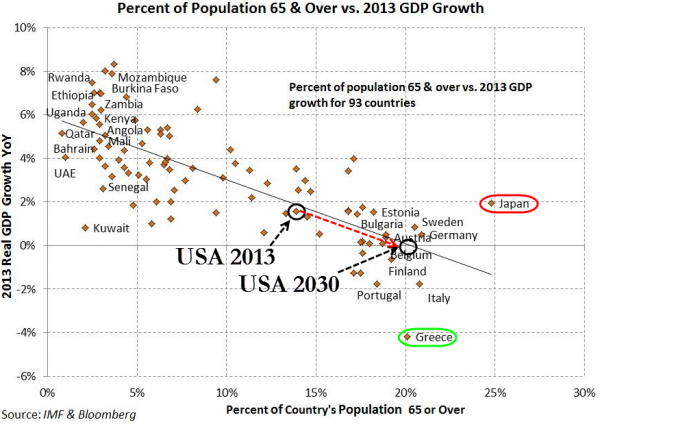

There has been a lot of talk (partly from us!) about the decline in Productivity in the Western world, which accounts for the glacially slow pace of wage growth and the consequent backlash against the “Establishment” both from Left and Right. But there is another angle to this, namely the rapid aging of the Western world’s population, as “Baby Boomers” approach retirement. If the chart below is to be believed, within a decade, 20%+ of the US population will be over 65 years of age and this scenario is being replicated across the Western world; GDP growth correlates strongly with the percentage of the population over 65 (as one might expect-the more people who have retired, the less there are available for productive enterprise.). Notice that the two outliers, Japan and Greece have already experienced at least a decade of economic stagnation, (whether self-inflicted or not) [1].

This all feeds into the “Secular Stagnation” thesis, that has been popular recently amongst Economists, (some of whom were in charge during the crisis that is said to have precipitated it). It appears that we are repeating the Japanese experience since 1990, when markets peaked, interest rates declined and nothing appeared to work to re-start growth, whilst at the same time the budget deficit exploded. The Japanese Central Bank now routinely intervenes in Asset markets, such that it is now a major holder of both Japanese stocks and 40% of the Bond market. JGB trading has, at times, almost completely dried up.

Of course, this is good news for existing holders of financial assets, if not future potential buyers; a constant prop under asset prices via an unlimited amount of buying power is obviously bullish for asset prices, which may explain why both equities AND bonds have done so well over the past 5 years. In the last month or so, Central Banks have started to talk about reducing the size of their Balance Sheets (that is, not buying new bonds with the proceeds of maturing issues), which has caused an increase in market volatility, albeit from very low levels. Despite worries over inflation, bonds have more than held their own, since there are relatively few left to buy!

Share buy-backs have performed a similar role in the equity space, shrinking the available supply, such that even stable demand leads to rising prices (and the rise of Passive funds has meant that demand is much better than just stable). So asset owners have been in a Golden Age, with returns to match.

But this does little to boost growth for those who dont own equities and anyway, opinion is divided on whether the “Wealth Effect” applies to equities at all; if it does have an effect, it appears to be small- only around 3% over two years and it may not even be that high if investors do not “trust” those gains to be permanent. But the Bankers are powerless to prevent people aging, which leaves them unable to do much to get their economies out of this rut. So, they continue on the current path, presumably in the hope that something will turn up, (a variation upon the Micawber Principle) though noone appears sure what that “something” actually is. Meanwhile, economies remain stagnant, with anemic growth and near zero inflation. As the inflation rate falls towards nil. the real interest rate on new debt rises, further discouraging borrowing for investment purposes. And so on, and so on.

The chart above suggests that for all their brave talk of recovery and the need to raise rates, Central Banks are in a bind – as those retirees look to liquidate their investment funds to enjoy their golden years, there could be continual selling pressure in financial assets, which means that the Fed, BOE and the ECB may never be able to step away from the market, scared witless by the resulting market declines that would occur if they did. If you are in doubt, consider the market’s reaction to Draghi’s “hawkishness” on Tuesday of this week; within 24 hours “sources” were saying that the market got it wrong about what he said and a price decline was promptly reversed. The Bank of Japan spends time almost daily trying to talk up, (or down) the Yen acutely aware of the market consequences of a “disorderly” (their favorite word) move in the Japanese currency.

As The Vapors sang (in 1980 unbelievably), are we are all Turning Japanese…?

[1] As an aside, the nations at the top left of the chart are all at a similar stage of economic development (which is to say, minimal for now). But they will want their share of the global economic pie at some stage and this demographic advantage will propel their economies forward in time. For now, these countries would be described as “Frontier Markets”, but they will likely become “Emerging Markets” in time. This long-term perspective is (partly) why EBI has been and will continue to be structurally overweight in EM- in the Long Term, the tailwinds are all behind these economies, in contrast to the headwinds being experienced in the West. If there is to be world growth over the next 20 years. it is much more likely to emanate from this source.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.