- This blog discusses the benefits of implementing and staying true to investing passively in emerging market equity.

- Both empirical evidence and key factors such as fee disparities, holding periods, and fund manager skill level are compared for emerging market equity strategies that use an active approach and passive fixed-income approach.

- The blog ends by stating ebi’s position on emerging market equity and their beliefs.

My previous commentary discusses the benefits of implementing a passive fixed-income strategy over an active approach. The main takeaways derived from the empirical evidence found in the fixed-income sphere are also prevalent in emerging market equity. There is evidence to suggest that the majority of actively managed emerging market equity mutual funds produce a negative excess return relative to their respective benchmarks over a long-term return period. There remains evidence to suggest that fund manager skill does not persist in the long run, and the fee disparity between actively managed and passively managed mutual funds continues to affect overall net returns for investors.

Market Inefficiency

Emerging markets in general have additional types of underlying risks; fragile economies, less stable political and policy frameworks, and weaker legal protections. Emerging market investors need to pay particular attention to how the value of their ownership claims might be expropriated. Among the areas of concern are standards of corporate governance, accounting and disclosure standards, property rights laws, and checks and balances on governmental actions. Considering the relevant risk factors and with emerging markets being less price efficient than developed markets, one would expect there to be long-term sustainable alpha generating opportunities.

So, as an investor why should you stay true to investing passively in emerging markets equity?

Fees Matter

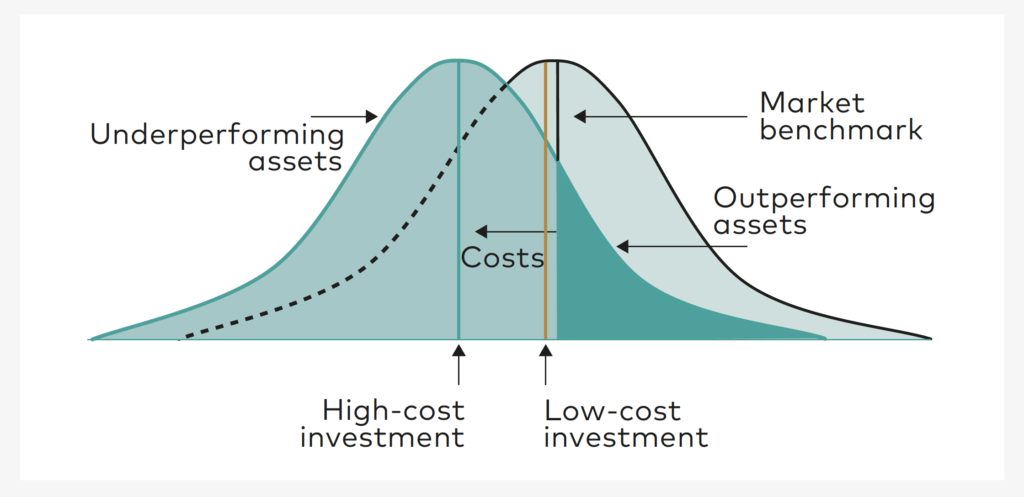

There remains a fee disparity between actively managed emerging market equity funds and those that are passively managed. Actively managed funds are subject to higher management fees and transaction costs, and particularly in the emerging market landscape, the effect of lower liquidity increases implicit costs including wider bid-ask spreads and the potential for price impact relative to developed markets. All of these additional costs can have a significant drag on an investment’s performance, they might not seem like a big deal initially, but they add up, compounding along with your investment returns and reduce net returns over time. An outperforming asset using an active approach will more than likely shift towards the left on the return distribution and become an underperforming asset relative to the market index.

Empirical Evidence

The implementation of an active emerging market equity strategy is far more difficult in practice than in theory. A key reason for this is that identifying and choosing a skilled manager is more difficult and the ‘does skill persist’ argument is still relevant.

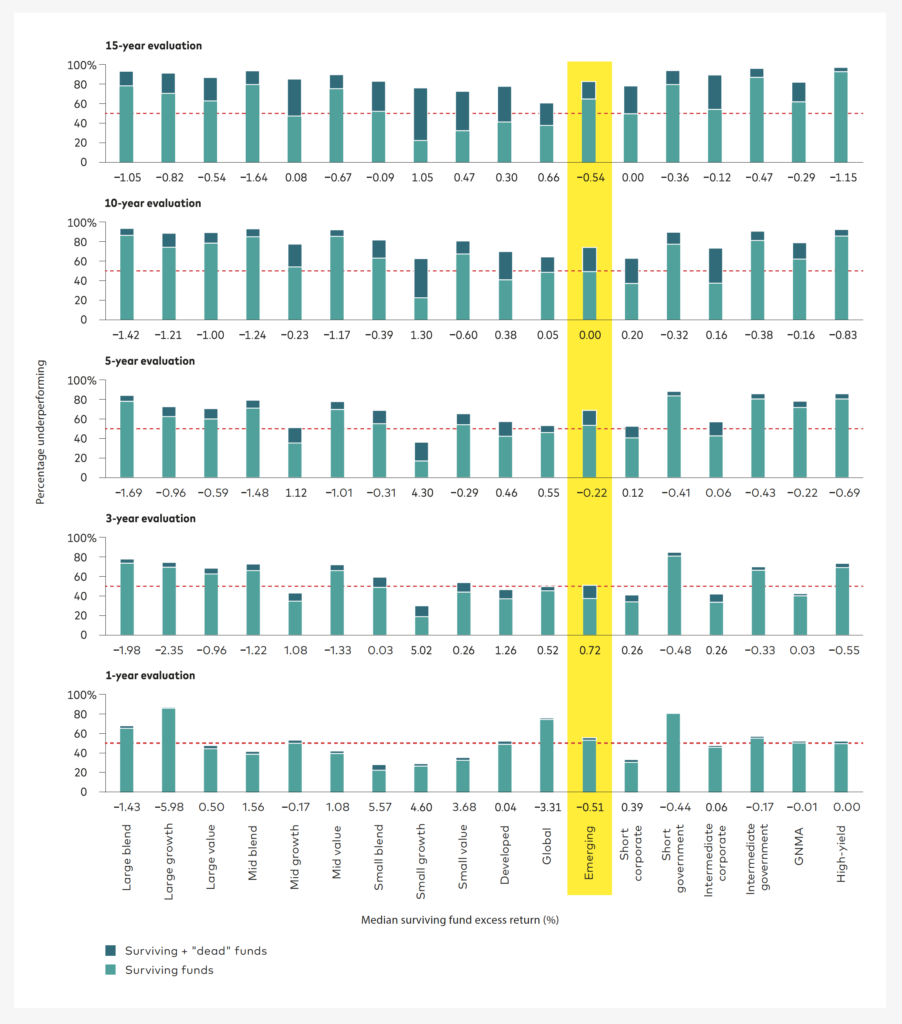

There are some key inferences to be made from the figure above:

- By evaluating the entirety of the actively managed asset classes it is apparent that the number of ‘dead’ funds increases over time. These are funds that have not been able to survive (whereby the inflows (assets) do not match the outflows (liabilities) of the fund over time which makes the fund unsustainable.

- Over time, there is an increasing amount of active funds that underperform their benchmark. Over a single and 3-year period around c., 50% of actively managed emerging market funds underperform their respective benchmarks. The research also shows that c.80% of active emerging market equity managers (once you include closed funds) underperformed the benchmark over 15 years. The median underperformance was 54bps.

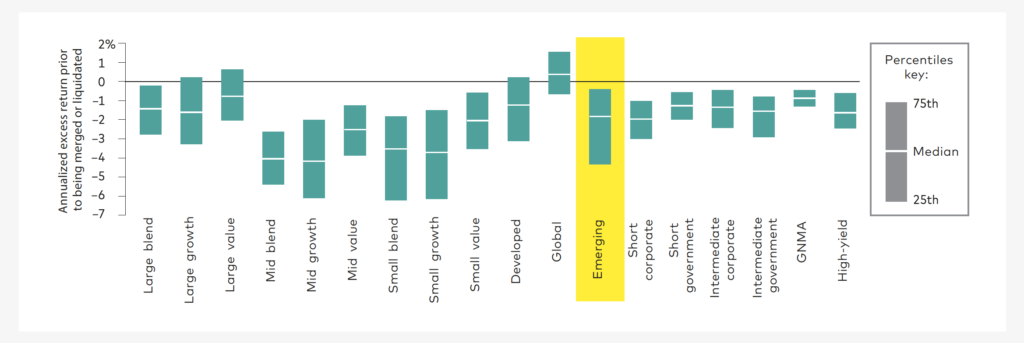

It is important to note that there is a survivorship bias when including merged or liquidated funds into the dataset, as does the ‘surviving + “dead” funds’ in figure 2. These types of funds tend to be underperformers and can skew the results for surviving funds to appear better relative to a benchmark. However, evidence also shows that before closing, “dead” funds they show underperformance relative to their benchmarks. There is often a trend that follows, and it is a matter of time before an underperforming actively managed fund becomes a “dead” fund.

Figure 3 displays nearly all of actively managed asset classes underperform their benchmarks prior to being merged or liquidated. The annualised excess return for emerging market equity prior to closing stands at around c.-4%

Increased volatility, not diversification

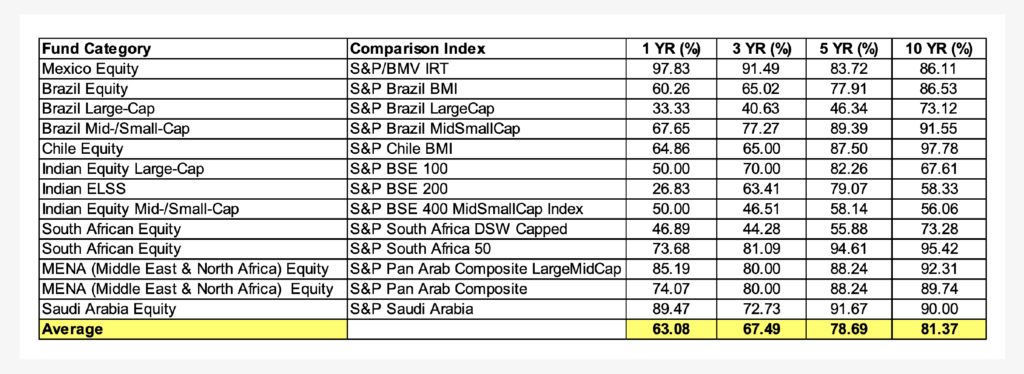

Figure 4 shows that over one year, on average 63.08% of these actively managed emerging markets funds underperformed their respective benchmarks. This rises to 81.37% over 10 years. It is important to stress that emerging market equity makes up around 12% of global market coverage and of this 12%, around 35% is attributed to China. Taiwan (14.5%) and India (12.7%) make up other significant constituents, [3].

Given the country exposures listed above, investing in an active emerging markets fund will not look too different than an emerging markets index tracker as a large proportion of the exposure will be in Chinese and Asian companies. The MSCI Emerging Markets Index, as of 30/06/2022, allocates 6.05% to Taiwan Semiconductor MFG, 4.33% to Tencent Holdings LI, 3.32% to Alibaba GRP Holdings, and 3.22% to Samsung Electronics Co. Many actively managed funds have the same companies in their top holdings but adopt tactical weighting tilts in an attempt to generate alpha. Smaller weightings will be attributed to companies with more of an unknown nature that have been handpicked using in-depth research and analysis. There is an increased cost to undergo this research which is ultimately passed on to the retail investor. Additionally, making active decisions and incorporating tactical tilts can increase the volatility of the fund – with the handpicked stocks not always producing their expected returns. Ultimately actively managed emerging market funds provide portfolios with additional stock-specific risk with no greater diversification than a passively managed fund.

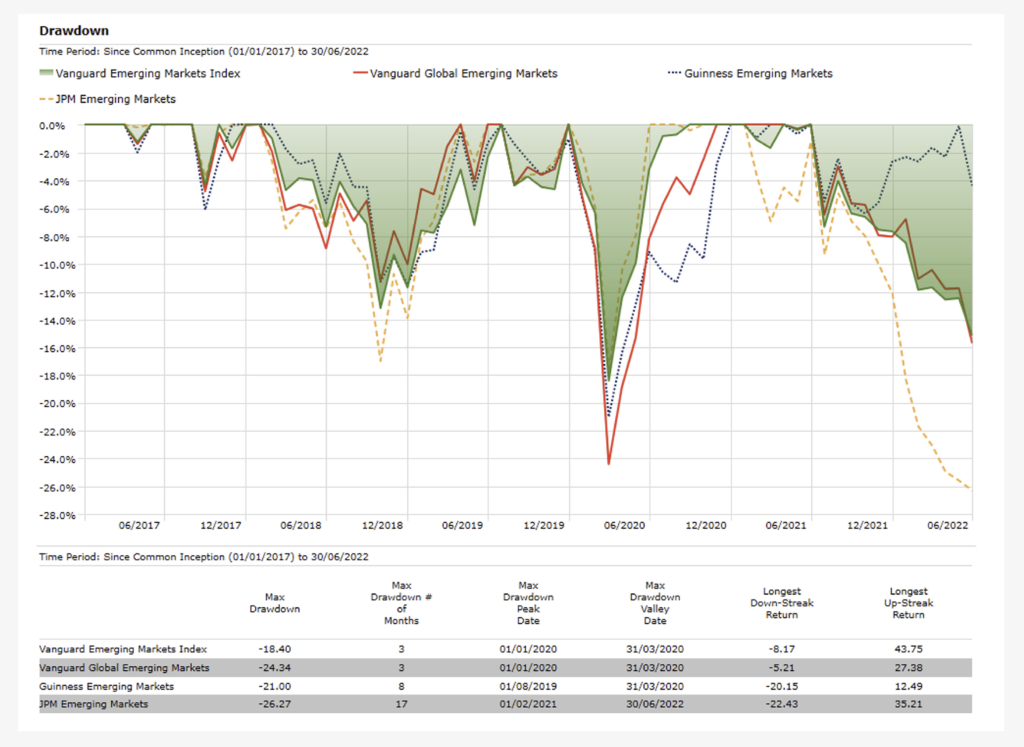

Figure 5 compares the Vanguard Emerging Markets Index fund (passively managed) to 3 actively managed emerging market funds. The passively managed fund produces a smaller ‘max drawdown’ since common inception whilst also producing the ‘longest up-streak return’. The passively managed fund has produced lower downside volatility and higher upside.

EBI’s Stance

EBI incorporate a passively managed emerging market ESG equity fund within their equity portfolios for the primary aim of global diversification. A broad-based emerging markets index offers exposure to countries that are outside of the developed world and therefore provides exposure to the global market. The low correlation with developed markets provides portfolios with a risk-reducing advantage against those portfolios that do not include emerging market equity as one of their asset classes. Dispersion across all emerging market countries can help lower the volatility of a portfolio and portfolios can gain access to sectors and securities that are undervalued and/or have growth potential. We believe that passively managed emerging market equity funds have proven their worth and offer a lower-cost and better-diversified alternative as well as a return premium to actively managed emerging market funds.

References

[1] Rowley, Jr., CFA, J. and Plagge, J., 2022. The case for low-cost index fund investing. Available here [Accessed 22 July 2022]

[2] Liu, B., and Sinha, G., 2022. SPIVA® U.S. Scorecard. [ebook]. Available here [Accessed 20 July 2022]

[3] Msci.com. 2022. MSCI Emerging Markets Index (USD). Available here [Accessed 25 July 2022]

Blog Post by Amar Ghai

Investment Analyst at ebi Portfolios.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025

- Ruffled Feathers: Exploring Black Swan Events

- Q1 Market Review 2025