A new phenomenon of the 2000s and beyond has been the rise of Financial Television. As the markets have soared, so has interest in them, to the point where even Channel 4 news (not an outlet known for its pro-capitalist views), now feel compelled to announce how stock markets have done that day. Meanwhile, at Bloomberg TV, CNBC, Fox Business News etc, they maintain a hectic pace, often spending as long as 3 minutes covering in depth the latest news stories of the day (hour?), and discussing economic issues with all the gravitas they can muster. One of the first casualties in all this is thought, which they replace with cliches of varying vacuity. Below are some of the best (or worst, depending on your view).

1): “China will have a Hard/Soft landing”.

It is by no means clear how a country can get airborne in the first place.

Also, Europe NEVER has a landing of any sort (it is usually just a run-of the-mill crisis). Similarly with the UK and the US. The desire to imbue inanimate concepts with the gift of movement (in this case), is universal, but adds nothing to collective understanding of the potential likelihood of this occurrence, nor to the linkages that make it germane to other markets.

2): “It’s a Stock Pickers market”, or it’s close cousin, “I am cautiously optimistic”.

This is the active managers’ mantra- you just need my skill/acumen/ability on your side and the world is your oyster. We shall leave aside the impossibility of consistently choosing the right stocks, and ask when is it the right time to go all in, all guns blazing, into ETFs, Derivatives etc ? We never hear; similarly, we never hear analysts proclaiming their “reckless optimism” about a stock, or a market. That being the case, we can only suppose that those markets never exist or that they would not spot them even if they occurred. There is ample evidence to suggest that share price correlations rise in times of market stress, (on the 24th August for example, you had less than a 5% chance of “picking” (see here) a share that went up that day). So we have to assume they are merely referring to a bull market.

3): “Markets hate uncertainty”.

When were markets ever “certain” ? If they were, prices would not be where they are now !! Analysts (and investors) often mistake certainty for a trend (in either direction). In bull markets, investors are geniuses; in bear markets, they are chumps.

4): “It is a potential Black Swan event”.

One look at the definition demonstrates the oxymoron here. It is logically impossible for an unpredictable event to be predicted in advance. Even if the pundit got the event right, it would thus not qualify as a Black Swan, as they had predicted it ! By extension of course, the more people predict a Black Swan type event, the less likely it is to occur, because people will take evasive action, to prevent damage. So in both cases, it is meaningless from an investment standpoint…. but it sounds informed (or should that be half-formed ?)

5): “Money is on the sidelines, which is the “fuel ” which will push share prices up”. This is normally uttered in an attempt to get clients to buy during market downturns.

To see the crass illogicality of this statement, let us try a thought experiment:

Imagine a 3 person investment world, where Tom owns all the stocks, Dick owns all the Bonds, and Harry has all the cash (on the sidelines !). If Harry decides to buy stocks, he uses the cash to pay for Tom’s shares. Thus, Harry owns the shares, Dick still owns the bonds and now Tom has the cash: the money does not go “into” the market, it goes through it. It is merely the ownership of the cash that has changed. To the extent that Harry pays higher prices to buy the stock, there is now in fact even MORE money on the sidelines !

6): “The market fell because there were more buyers than sellers”.

Au contraire- every purchase of shares is matched with a seller. Market prices move to reflect the relative eagerness with which buyers and sellers co-relate. If buyers are more eager to buy, prices rise and vice versa. Exchanges are where these two forces meet, to exchange money for assets. Markets are not like a balloon that expand and contract with money flows.

7): “Don’t fight the Fed”.

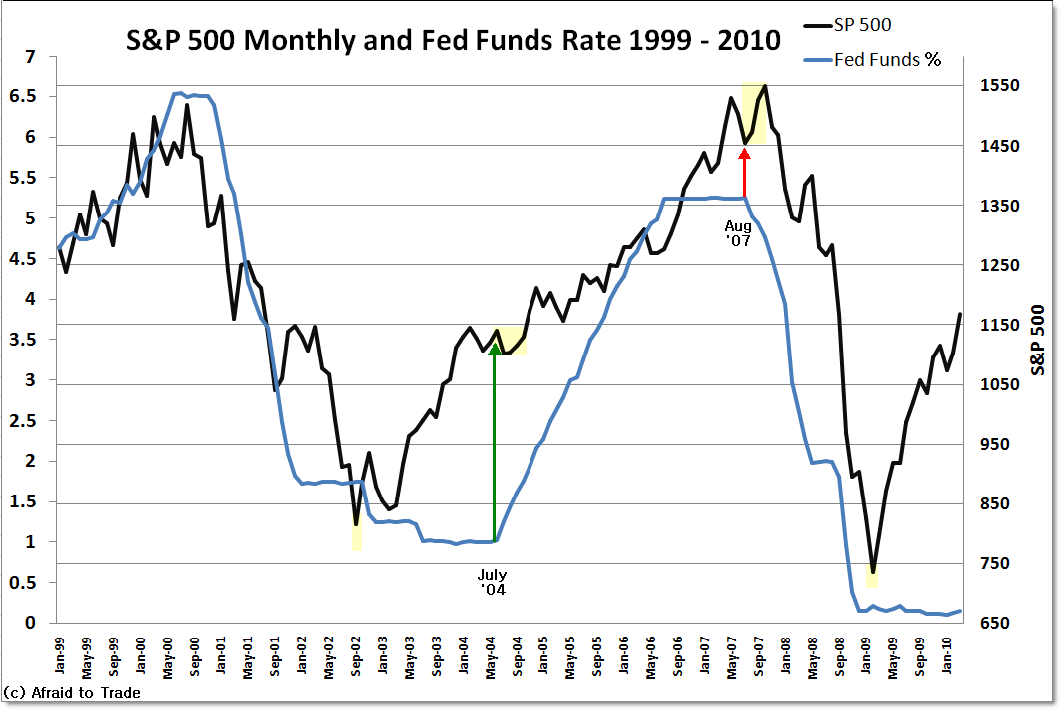

This has been the mantra for twenty years or so. But, as the chart below demonstrates, it doesn’t work. In fact, the Fed was cutting rates ALL the way through both downturns, to no avail. Markets fell 50% from their previous highs on both occasions. [It was the suspension of Mark-to Market rules in April 2009, NOT rate cuts that stopped the rout, as it allowed Banks to pretend that they were solvent].

The reasoning is simple- while investors believe that prices will go up, low interest rates cause cash to be viewed as a “hot potato”, which investors are keen to pass on, to avoid earning no return on their assets. Once investors see losses occurring, (and are expected in the future), low , or even zero interest bearing money becomes an attractive asset, and no amount of rate cuts will change this attitude. Only when risk appetite returns will investors be enticed back into markets- low rates only become a factor AFTER this occurrence, not before.

Central Bankers are not immune from these deluded thought processes. Although their words are parsed for hidden meaning as if passed down from the Oracles of Delphi, the following examples suggest they are just as clueless as the rest of us.

The Bernanke legacy:

“We’ve never had a decline in house prices on a nationwide basis. So, what I think what is more likely is that house prices will slow, maybe stabilize, might slow consumption spending a bit. I don’t think it’s gonna drive the economy too far from its full employment path, though.” July 2005

“I believe the effect of the troubles in the sub-prime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the sub-prime market to the rest of the economy or to the financial system. The vast majority of mortgages, including even sub-prime mortgages, continue to perform well. May 17 2007

“The Federal Reserve is not currently forecasting a recession.” Jan 10 2008

In a speech to the National Association of House builders International Show in Florida in February 2012, he opined that “housing may no longer be viewed as the secure investment it once was thought to be”. Gee, thanks Ben.

8) “This time is different”. Possibly the four most dangerous words in Investment !!

You may not be entirely surprised to know that I was somewhat sceptical of both the Internet bubble AND the US housing bubble during the 2000’s. I was constantly told however, that “I didn’t get it” (true enough), and that the world had changed as a result of t’interweb, Collatoralised Debt Obligations, Value-at-Risk models’ increasing sophistication.. or whatever was the latest fad.

There is always a “new paradigm”, but it is human nature, not paradigms that get people into pets.com, Cisco (-86% peak to trough), eBay and Amazon, whose shares both fell over 90% each. Be extremely wary of pundits bearing investment gifts- they will likely turn out to be very expensive, and justify the old adage that free advice is worth what you pay for it !

The purpose of using these phrases, from an Industry already groaning under the weight of mindless “truisms” is of course to obscure, not to enlighten. The above comments indicate the fact pundits don’t actually know what is going on, an affliction we at EBI readily confess to. By using them, City types think they sound wise, considered and prudent and are thus trustworthy guardians of your money. Unfortunately, the converse is often the case.

So next time you hear someone on the TV, or on the news uttering these lines think about what they are really saying- in most cases, it is a variant on “I don’t know what’s happening, or why”. It may help clients to avoid the next pot-hole in the investment road ahead. Brokers need us to trade (to keep the commission flowing in). Once we understand what they really mean, it is easier to avoid the temptation to react to news or events – it rarely works out well.

Finally, one cliché that IS true.

It is said that there is one sure way to make a million in the Stock Market… start with 2 million. We have seen no evidence to dispute this, and don’t expect to any time soon.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.