As the increasingly farcical Greek debt saga staggers on, away from the spotlight a potentially bigger crisis is brewing in the US. The Island of Puerto Rico, led by Democrat Governor Alejandro Padilla has declared their $72 billion debt “un-payable” and is looking to “re-structure” (aka reduce) the debts.

The problems experienced in Puerto Rico are not unprecedented – New York and Cleveland in the 1970’s, and Orange County in the 1990’s faced similar problems, but subsequently recovered. The problem for the local authorities is that they cannot just declare bankruptcy-under US Law, neither Puerto Rico nor its “sub-state entities” (public corporations, judicial districts etc.) can do so, unlike in US cities such as New York or California. Public Corporations, such as the PR Electric Power company owe between $20-25 billion. For comparison, New York, the most indebted US State, owes $29 billion in total, despite having a population five times that of Puerto Rico. [1]

The background is summarised by Bloomberg: “Since 2006, Puerto Rico’s economy has contracted every year but one. Its unemployment rate of 13.7 percent is double that of the U.S. mainland; its poverty rate is twice that of Mississippi. Meanwhile, Puerto Rico’s population and tax base have aged and shrunk. Since 2000, public debt has risen from 60 percent of gross domestic product to more than 100 percent. Much of that has been racked up by the island’s inefficient public-sector corporations”. [2]

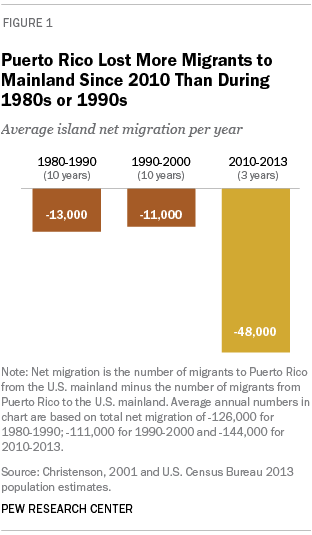

The ending of tax breaks for business’s investing in Puerto Rico which ended in 2006 [3], was compounded by the Financial Crisis of 2007-09, and led to a deep recession, as the economy was uncompetitive relative to the US mainland, but was saddled with the same minimum wage level as the rest of the US [4] (this has a familiar ring to it..). The chart below highlights the extent of the emigration crisis the island has experienced.

The government runs chronic budget deficits and has a weak track record for collecting everything from Sales and corporate income taxes to power and water bills (this also sounds familiar). To plug the gap, the government and its agencies have turned repeatedly to the $3.7 trillion U.S. municipal bond market, eventually amassing a collective debt of $72.6 billion [5]. One might have imagined that Investors would be wary of this sort of investment, but the “triple tax exemption”, whereby investors pay no federal, state or local taxes, regardless of the Investor’s residence status, ensured that they did not look too closely at the unfolding situation. According to Vox.com [6], Hedge Funds hold c. $15 billion in PR debt, Mutual Funds own another $11 billion and Individual Investors own the rest. So Americans (and not Foreigners) are owed the money, even as the bonds were downgraded to Junk status, by both S&P and Moody’s.

Needless to say, Wall Street profited extensively from selling Puerto Rican debt to investors who were attracted by the tax free status of the Island’s Municipal bonds. According to the Wall Street Journal, “In the process of selling $61 billion worth of bonds from 2006 to 2013 on behalf of the territory, financial firms and lawyers were paid approximately $1.4 billion in fees” [7].

The problem for the local authorities is that they cannot just declare bankruptcy-under US Law, neither Puerto Rico nor its “sub-state entities” (public corporations, judicial districts etc.) can do so, unlike US cities such as New York or California. Puerto Rican Public Corporations, such as the PR Electric Power company owe between $20-25 billion, and currently have no way of alleviating the situation.

Puerto Rico has lobbied Congress to allow the same Bankruptcy procedure to be applicable in their case as to Detroit, not (they say), to walk away from the debt but to be allowed to negotiate with Creditors to allow some breathing space. In all likelihood, however, Investors would have to settle for less back than they invested- a haircut. One plan involves an additional $2.3 billion in loans from Bondholders, which may provide a blueprint for restructuring other debts. A $400 million Bond payment due in July means that the issue is now quite pressing.

Political opinion appears divided on the subject. Democrats are (broadly) in favour of amending the statute, but (some) Republicans are fiercely opposed, arguing that the Bonds were sold as essentially default-free, and this should be honoured, especially as many Americans hold these Bonds in their 401K’s. They also see the problem of “moral hazard”-decades of fiscal mismanagement by Puerto Rican politicians would be rewarded if the debts are reduced at the expense of Investors.

Whatever the rights and wrongs of the situation, by the end of July the Island will start missing debt repayments, which could trigger cross default clauses allowing Investors to start the process of suing Puerto Rico to get their money back (known as a “credit event”), which would mean the local officials would have to start allocating funds to creditors rather than paying employees’ salaries (or pensions). This happened to Argentina in June 2014 (see here) , but this would be a Court enforcing payments to Americans BY Americans, which is a different matter to trying to collect money from a foreign Government on behalf of a Hedge Fund.

The cards are not wholly stacked against the Puerto Ricans-according to a Pew Research Centre study [8], 4.7 million people of Puerto Rican descent reside in the US, an estimated 744.000 of whom live in Florida, which is a key swing state for the 2016 presidential election. This may explain why both Jeb Bush and Hilary Clinton have expressed support for the Puerto Rican authorities…

Update (16/07/2015)

According to this article, Puerto Rico has failed to make a Bond payment as of yesterday.It is currently unclear as to whether this constitutes a credit event,but it shows that pressures are mounting…

Greek Update

Yesterday (Wednesday), the Greek Government made the $94.5 million payment on a Yen-denominated Samurai note which matured on the 14 July. If they had not made the payment, it would have triggered “cross default” clauses within other loans that would have entitled creditors to sue the Greek government for immediate re-payments, which would have led to severe consequences. It was therefore vital that the payment was made on time to avoid a “credit event” (which would trigger payouts to Credit Default Swap buyers). With a few hours to go, the Bonds were trading at 58.5-thus any (brave) buyers made nearly 71% in less than one day… [they have missed another IMF tranche re-payment though-clearly the Greeks are prioritising their payments]. This bears watching, as a default on Private Sector bonds (approximately 19% of total debt) will be sign of the further deterioration in the Greek liquidity situation.

- [1] According to Bloomberg View 25/02/2015

- [2] Bloomberg View 25/02/2015

- [3] According to Bloomberg, many of the Companies that benefited from this break moved to the Cayman Islands

- [4] Vox.com 10/07/2015

- [5] Reuters Article 23/07/2014

- [6] Vox.com 10/07/2015

- [7] Wall Street Journal 22/10/2013

- [8] Pew Research Study 27/06/2012 (pewhispanic.org)

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.