“At the end of the day, it’s not a normal condition to have interest rates at zero”- Lloyd Blankfein (Goldman Sachs CEO). Quoted in June 2014.

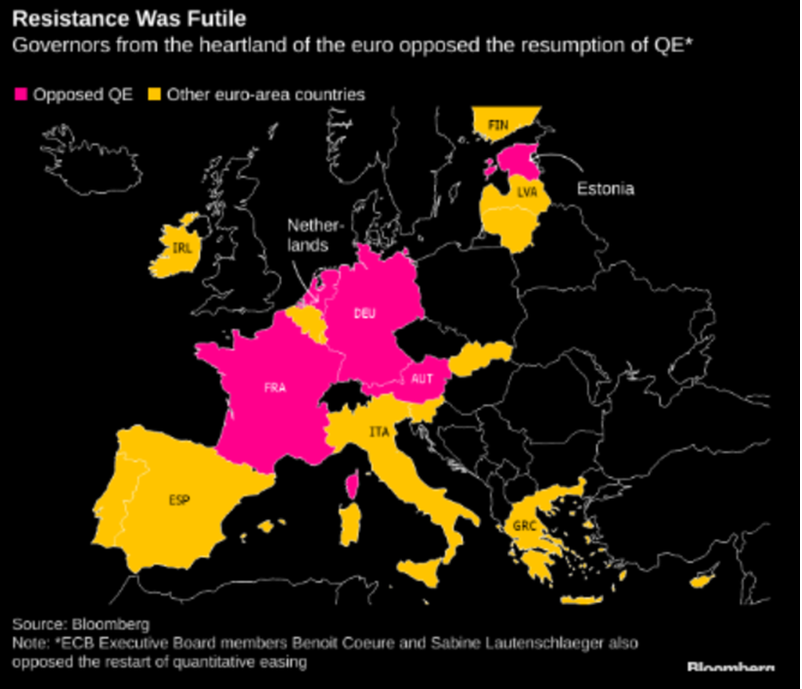

The above quote is now 5 years old and things have moved further on, with negative interest rates now becoming almost “normal”. One wonders what Mr. Blankfein thinks now. The notional value of Globally tradable negatively yielding bonds now totals $17 trillion, as yields go subterranean. Claudio Borio, the Head of the BIS (Bank of International Settlements, the Central Bankers’ Central Bank) describes the situation as “vaguely troubling”, which seems like a massive understatement. The ECB (European Central Bank) has cut rates again in recent weeks to -0.5%, and has re-started their bond-buying programme, but in a sign that Mario Draghi sees little further scope for cuts, he called on fiscal policy (i.e. government spending) to take over; he stated that “it’s high time for the fiscal policy to take charge.” Indeed, there is now opposition to his policy from within the ECB Board itself, coming mainly from the Core Eurozone members, (one of whom, a German member of the ECB board, has just announced her resignation).

The real-world consequences are starting to be felt by individuals too; Denmark’s Jyske Bank announced in August that they will offer negative rate mortgages and they have more recently decided to follow the lead of Swiss Bank UBS in charging their wealthier clients (and Corporations) 0.75% to hold large deposits with them; at present, the trigger point is quite high (2 million Swiss Francs in the latter case), but Jyske is levying the fee on just $111,000 in deposits. Many are watching closely, and if there are no signs of capital flight (sales of safe deposit boxes in Japan soared in 2016 when they moved to negative interest rates), other banks will surely follow this path, and the trigger point will surely fall below $111,000 over the months ahead. Needless to say, this will not be popular, but European banks are suffering badly, (which is why the ECB “tiered” the negative interest rates – the full pain is only felt once total bank deposits rise to six times their mandated reserve levels). The chart below highlights how bank shares have performed since 2009 – it is by no means pretty…

The question is what comes next? The Euro Interest Rate Swaps market is currently priced to reflect the view that interest rates in the Eurozone will fall further and then stay there for a decade! The ECB itself is unsure if widespread negative interest rates will lead to individuals pulling their money out of banks. It certainly makes little sense to leave money in the banking system [1], especially if there is a perceived ” counterparty risk” in doing so (i.e. a bank closure and a subsequent “bail-in” of depositors). IF interest rates remain negative for any length of time, the alure for individuals of the mattress may become irresistible and lead to other unintended consequences;

1) There may be a shortage of liquidity – as the banking system sees assets leaving the demand for cash will increase, leading to higher rates for those banks wishing to obtain short-term funding. Ironically, the first signs of stress have been in the US, where the Fed has tried to ease the shortage of cash via the Repo Market, but the next stage of the squeeze may occur in Europe.

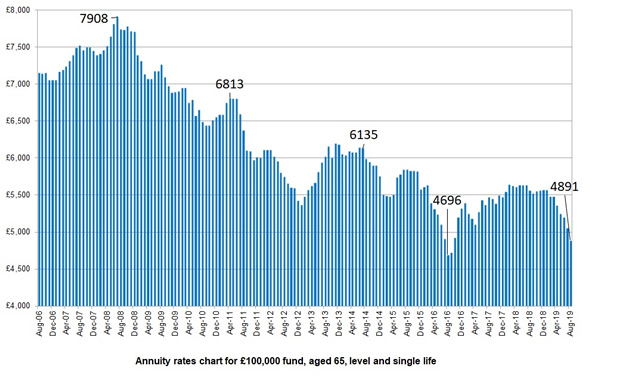

2) Continued economic stagnation; counterintuitively, as the interest rate drops for savers, the propensity for savings rises – the very opposite of what Central Banks are hoping for. Cutting rates are supposed to spur spending, but as the Western World’s population ages, they have seemed to increase their savings levels to offset the loss of annuity income. The chart below shows how UK annuity rates have fallen since the 2008 peak; according to Irish Life, an equivalent annuity in Ireland would pay €4,500 (£4,000 at current exchange rates) per year. As the need to raise savings still further to offset the near 40% drop in UK annuity income (and a similar fall in Euro annuity rates), spending will inevitably fall further in Europe. So, the low growth, low inflation economic scenario will likely continue – this should be good for asset prices.

On the other hand, an alternative possibility arises from the US experience of late. The US Dollar is extremely strong at present, possibly as a result of the higher money market rates now pertaining, as financial firms struggle to obtain funds, especially as the Quarter-end approaches. IF Euro rates start to rise for the same reason, it is possible that so too will the Euro, as rate expectations may need to be revised upwards, the exact opposite of what the ECB both aimed for and intended. Such is often the result of attempting to intervene in complex systems such as markets, especially in novel ways.

For investors, there is little that can (or should) be done. But one thing that needs to be maintained is investment discipline. Investors may feel “forced” to buy assets by the lack of viable low-risk alternatives, but buying those assets that have done well in the recent past is simply performance chasing and will not end well. The link between risk and return has not been broken and so taking more risk, especially if that risk is undiversified, will not necessarily increase returns, but WILL increase the volatility of those returns. This is true of both equities AND bonds, for the reasons enumerated in our other blog ‘All the same things’ . As we have also warned, things are in a constant state of flux, such that today’s “hot” stock/sector/asset class can go cold very quickly. It is impossible to know when this could happen, so it’s not worth trying to anticipate the changes.

The asset allocation that was suitable for a client last month (or even several months ago), is still suitable, regardless of market movements. A well-diversified portfolio will not always match the very best performing alternatives, but it will deliver on the required retirement objectives over time. Trying to squeeze out a few extra percentage points of return will inevitably end up costing the investor far more at some point, so this temptation should be avoided. As with all things, the current period of negative interest rates too will pass.

[1] In theory, a “risk-free” deposit implies a zero return, so investors should not necessarily be surprised by zero bank deposit rates; but when one is paying to leave money in the bank, tempers can get a little frayed. Politically, given the banking sector bailout of 2009, negative returns on savings may be hard to explain to voters as well as customers, which explains the banks’ reticence thus far. But if there is no capital flight from the banking system, sooner or later banks will impose negative rates.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.