With the S&P 500 Index having just touched all-time highs and Donald Trump deciding that now is a good time to demand a cut in interest rates by 1% and to re-start QE, contrasting their timidity with that of the Chinese Central Bank, averring that the US economy would go up “like a rocket” if they followed his advice [1]. This would appear to be akin to fighting a fire with gasoline, but that doesn’t mean the Fed won’t do it anyway, (though not this week it seems!)

Outside of US markets, however, things are not quite so rosy, as indicated by the fact that the MSCI World Index ex-US Index is nearly 11% below its highs (reached in January 2018), and nearly 20% below its 2007 highs, indicating that, once again, the US is leading the charge higher.

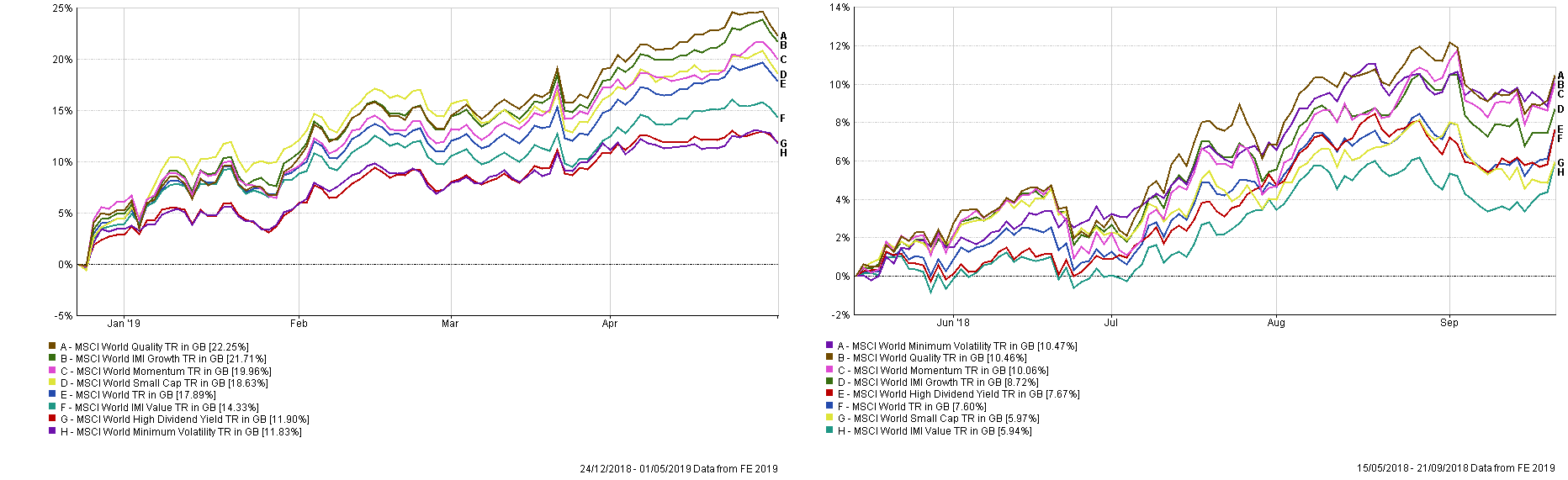

But if we look more closely, we can see that a fair bit has changed under the surface since the September 2018 highs, most clearly in the performance of global factors [2]. Although some things are similar (Value’s underperformance and the outperformance of Momentum for example), some things are rather different – in the lead up to the September highs, Minimum Volatility and Quality led the way, with Growth beating Value by 2.78 percentage points over the period. In the last 4 months or so, Quality, Growth, and Momentum have been joined by Small Cap shares at the top of the leader board, whilst Min Vol and High Dividend Yield (known as “Carry”) have fallen back sharply; both beat the World Index in the run-up to the September peak, but have underperformed in the last 4 month rally.

What can we take from this? Markets have become even more enamored with risk – Momentum and Growth (which have a high correlation between them), in addition to Small Cap shares, thrive in growing, “risk-on” markets, whilst Value, Carry and Min Vol do not (as they are more defensive in nature). This change in strategy has been rewarded handsomely, with absolute returns double that of the May-September 2018 gains (so far).

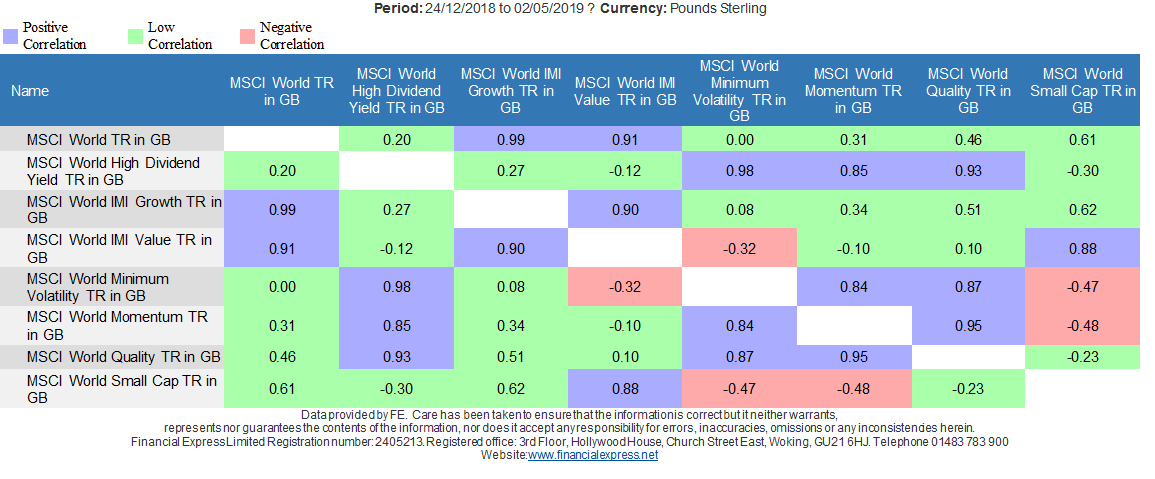

So, we can see that, just as sector flows (and thus prices), fluctuate seemingly randomly, so do those of Factors, with the same implications for investors – Factor “timing” is no easier to achieve than market timing and tends to lead to the same result – underperformance (partly as a result of increased costs). The solution (for both markets and Factor investing) is to be as diversified as possible – the correlation table below shows how this can be achieved. Admittedly, this is a short time horizon [3]. but it shows a negative correlation between Value and Small Cap vis-a-vis Momentum, which provides a large diversification benefit and a high (positive) correlation between Min Vol and High Dividend Yield, which does not. Not coincidentally, EBI has exposure to the former 3 Factors and eschews investing in the latter two.

Despite the dire economic warnings about the recent bond yield curve inversion, US-China trade war fears and the widespread bearish sentiment expressed by both Institutional fund flows and allocations to global shares, the markets don’t seem to be concerned (at all) and have risen relentlessly in recent months. But the serene market progress over the last 4 months obscures the changes in investor preferences that have occurred. Days like this, (4/3/19), where Value and Growth/Momentum go in markedly different directions to those that have pertained for most of Q1 have become more frequent, leading to some significant pain to both Long/Short funds and Hedge Funds; but this is not visible when one just glances at the Indices…

[1] He doesn’t seem to comprehend that rockets go down as well – for every Apollo 11, there was a Soyuz 1.

[2] I have taken the Factor returns since the low point in December 2018 to the present and then the same returns for a similar period prior to the last high in September 2018, such that they have an equal time horizon.

[3] If one charts the correlations over a longer time span, (e.g. a decade) the resulting numbers are +0.65 or above for ALL Factors in the above table; this may be QE-related, in that the torrent of money being injected into the financial system has tended to increase stock correlations post-2009. Note how they have been above the 30-year average (30%) for most of the period post-2009. If individual stock correlations have been high it is reasonable to conclude that this filters into Factor correlations too, though this is difficult to demonstrate empirically, due to a lack of data.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.