“The strength of the dollar has historically been tied to the strength of the U.S. economy and the faith that investors have in doing business in America” – Steve Mnuchin (US Secretary of the Treasury).

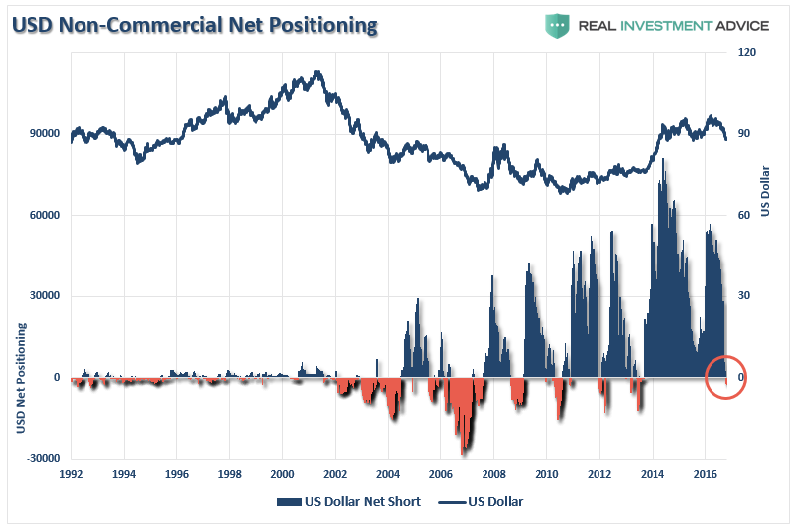

The Dollar is currently about as popular as a rattlesnake in a lucky dip; earlier this week the US Dollar Index hit lows not seen since December 2014, and is down nearly 12% since the start of the year. Speculative positioning in the US Dollar has also reversed sharply, with Hedge funds etc. now net short for the first time since 2013 (note the confluence of short positions with major market lows!). Since the Dollar is the world’s reserve currency, it is an important indicator of risk appetite across the globe. We wrote about Dollar negativity in October last year and it seems to have returned.

What has caused this seismic turnaround? A number of factors have conspired against the Dollar, since the apparent Dollar euphoria in the wake of Trump’s election as US President.

There has been a significant reduction in the (largely unrealistic) hopes placed on his victory; in recent weeks, the increasing political chaos, resignations and sackings from the administration has thrown into doubt the prospect of many of the key planks of Trump’s election platform. Deregulation, and tax cuts, (which Wall Street cares about most, since they expect to be major beneficiaries), are now on the back burner, which in turn has implications for growth, thus invalidating -at least for now- the rationale behind the “Trump trade”, (Small Cap stocks are now down on the year).

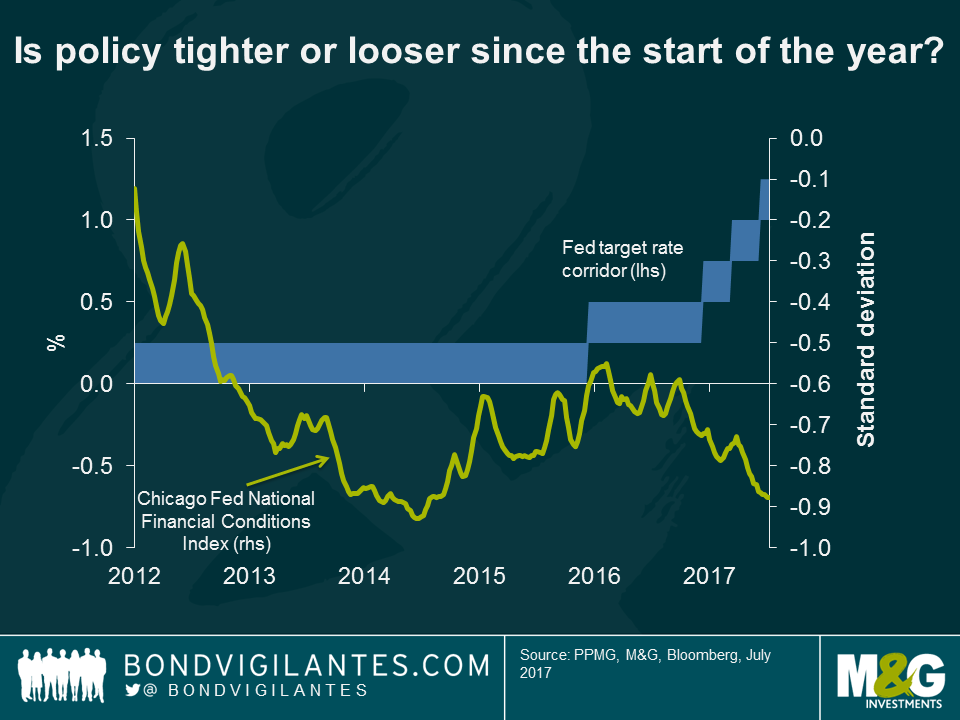

As this has played out, US Bond yields have fallen sharply, which further reduces the (relative) appeal of the Dollar, helped by a string of lower than expected Inflation numbers. As the chart below suggests, the recent Interest rate rises have not tightened financial conditions; rather they have loosened, again implying a lower US Dollar (which may explain the strength of stock markets despite the Fed funds rising to 1.25% this year).

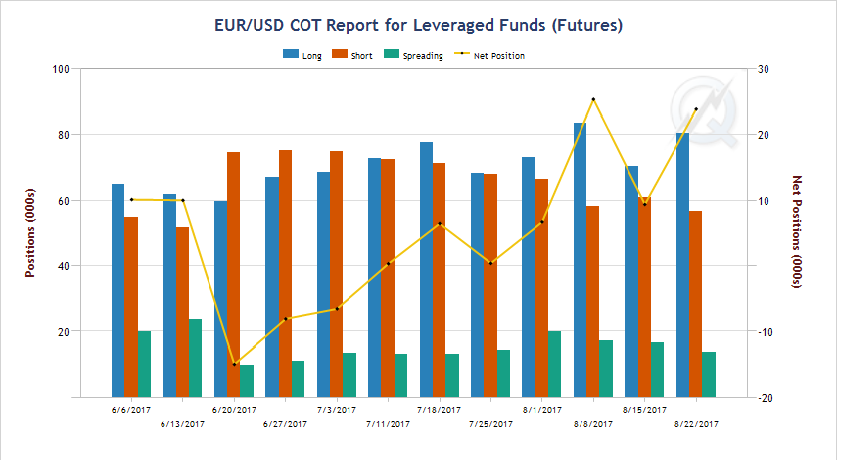

At the same time Mario Draghi, the head of the ECB, hinted at the start of “tapering” their purchases of Euro zone bonds, (quickly reversed when markets-who really control monetary policy nowadays)- reacted negatively. This implies higher than otherwise Euro interest rates, leading to a strengthening Euro. As is usual in currency markets, this momentum feeds upon itself, as investors follow the trend, leading to the Euro recently hitting €1.2 to the US Dollar. This has led some (unidentified) ECB sources to try and “talk” the Euro down again, by hinting at a delay in their tapering plans. It seems Speculative traders are heavily bullish the Euro (which is heavily weighted in the US Dollar Index ) once again (see below). These positions will need to be unwound (either to take profits or cut losses), which will likely cause a strong Dollar rally, taking us back once again towards where we were at the start of 2017.

Better than expected US GDP growth for Q2 has further muddied the waters, giving some “fundamental” justification for Dollar strength to come (?). We shall have to see how long that lasts.

There is plenty of academic support for the notion that FX moves are mean-reverting, that is, they oscillate around Purchasing power Parity (or “fair value”). Thus, there is little that long term investors can do (or should do) to mitigate it, at least in equity markets. But it bears watching as many of the world’s biggest investors do so on a currency basis ( i.e. their investments are predicated first on a suitable currency and only then on a chosen asset class). The currency can act as a magnifier of gains (or losses of course) [1]. Thus, a strong currency can sometimes (though not always) be an indicator of cross border investment flows, as one needs to buy the currency of the investment target in order to own the assets. When a market is rising in both local and foreign currency terms, (the latter on a net basis), it is often a sign of significant foreign investment in that market, a situation that developed in Japan in the 1980’s and the US in the late 1990’s , (though in both cases it did not end well!).

Thus, all investors should pay attention to developments in foreign exchange markets, as they can often be a precursor to major changes in the way markets behave. We may be about to witness another twist in the tale…

[1] A European investor buying the FTSE All Share Index this year has lost money (-0.74% in Euro terms) compared to their UK counterpart who has seen a gain of 7.23%. Conversely, the UK investor in the MSCI Europe ex -UK Index has returned 15.78%, more than double the return of the European investor, as a result of the Euro’s rise. The Dollar returns are better still (+21% for Europe, +12% for the All Share). This highlights the benefit of being in the right currency as well as the right asset class. (How one does this consistently is hard to see however).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.