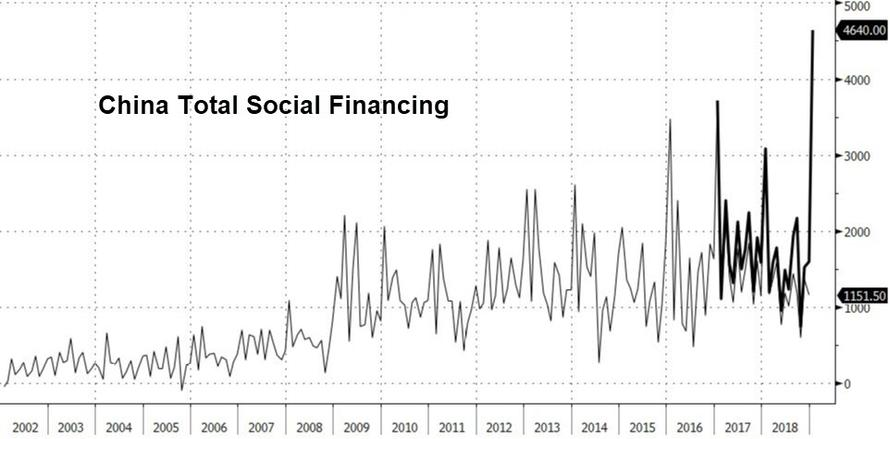

China has become an increasingly important player in the Global economy in recent years. As the economy has grown, its effect on world liquidity has also expanded. In the middle of February, the Bank of China announced that “Total Social Financing” (a metric that includes Renminbi loans to the real economy as well as Shadow Banking credit growth), exploded by a factor of three, to 4.64 trillion Yuan ($685 billion) [1]. The amount of outstanding loans in the Chinese financial system is now $30 trillion, more than double the GDP of that country. This has more than offset the declines seen in 2018, suggesting that the Government has once more opened the credit spigot, possibly in response to the economic slowdown caused by the on-going US/China trade dispute.

As of the end of 2018, total Chinese debt (both public and private), was higher than that of the US and has risen to 317% of total Chinese GDP, fuelled by a surge in both Corporate and Consumer debt as seen below, which dwarfs international comparators.

![D40p0euxoaawpyw[1]](https://ebip.co.uk/uploads/blog_post_content/t1556095832/D40P0EUXoAAWpYW%5B1%5D.png)

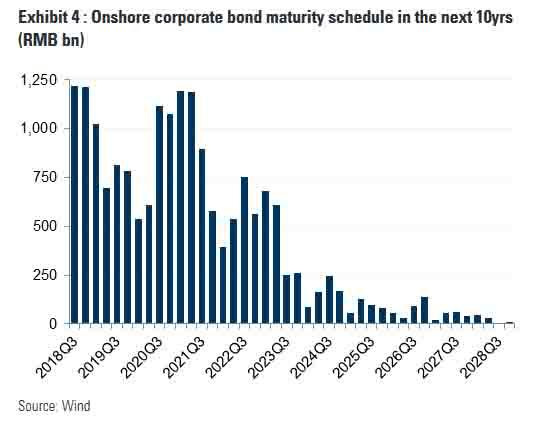

But could this be reaching a tipping point? Since 2016, the Chinese government has allowed private Chinese firms (and even some state-owned enterprises) to file for bankruptcy to facilitate debt restructuring, leading to a record number of bond defaults in 2018. For the most part, those defaults were not “systemic” in nature, but at the beginning of April, CWT International, (a subsidiary of the HNA Group conglomerate, which itself is in the process of restructuring), defaulted on a loan it took out only seven months ago. At the end of last week, China Minsheng Investment Group – dubbed China’s JP Morgan – admitted that cross-default clauses had been triggered on $800 million of its Dollar bonds; this can have a cascading effect on its affiliates, making their debts immediately repayable (and so on). The total debts of CMIG are around 310 billion yuan, against assets of only 310 billion yuan, making liquidity (and ultimately solvency) a very real concern. Bloomberg has recently reported that 44 Chinese firms have a total of $43.7 billion in bonds coming due “imminently”. As the chart below shows, Q3 2020 shows another large maturity schedule to come. It is made worse by the rise in the US Dollar, (up nearly 11% since the lows of February 2018), which has helped to turn a surplus of Dollar assets held by Chinese banks into a deficit in the last 2 years.

All this comes at a time when China is seeing a large rise in its Emerging Markets Index weightings, with the country now representing 33% of the MSCI EM Index and similar exposures in the S&P Dow Jones Indices and FTSE Russell. The increased availability of China’s A shares has increased investor interest in what was previously an uninvestable universe. According to Morningstar, once all the amendments have been completed (scheduled for March 2020), Chinese A shares will be 5.5% of the FTSE Emerging Index and 0.4% of the MSCI All Countries World Index – so how this plays out will matter a great deal to global investors, though at present, foreign participation in both equities and bonds is still quite low.

As I am fond of pointing out, all this may look concerning, but a bearish view requires an assumption that the Chinese Government allows the de-leveraging process to play out without any response, and that Corporate and Consumer defaults accelerate, something that neither the Chinese (or any other) Central Bank has tolerated hitherto. It may well be that some defaults will occur, but the Bank of China will definitely step in to prevent systemically dangerous bankruptcies. That being the case, the market will increasingly “price in” a differentiation in credit quality between the various entities, such that default may, in the words of one analyst, “become more frequent, yet more idiosyncratic” [2].

Patience is always a virtue and it may well be needed at this point. Massive fund flows into Chinese assets as a result of the re-weighting of China in EM Indices may not, in the short term, be enough to offset the negative effects of the cash flow crunch caused by an economic slowdown. The long term growth story for China is still intact, but it would be unwise to assume that asset price gains will be smooth and consistent, at least for now. Markets rarely work that way, the more so when one is faced with the inscrutability of Central Banks. Investors and other economies alike have a keen interest in the outcome though if the problems outlined with regard to Chinese debt DO materialise, it is likely that Western markets, which suffer from the same issues, will experience the same effects.

[1] To put this in context, this is more than the entire GDP of Saudi Arabia.

[2] Anne Zhang, Fixed Income analyst at JP Morgan Private Bank.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.