A pub quiz question- what has been going on for more than 3 years, amid much frustration and bemusement to all involved, having got nowhere at all during that time and is not Brexit?

The answer is the proposed flotation of ARAMCO [1], the Saudi Arabian state oil company. Formed in 1933, it has grown as Saudi Arabia’s oil output has multiplied and is, according to documents released by Rating Agencies in April of this year ahead of a $12 billion bond issue, the world’s most profitable company. The first publicly announced intention to float was back in January 2016, but the process has been beset with difficulties: if the recent Saudi government plans come to fruition, a 5% listing of the company would be the largest IPO in history, which is why Investment bankers the world over have been very keen to be involved- tens of millions of dollars in underwriting fees, etc. are at stake…

The latest attempt to move ahead came after half year results for 2019, which revealed a profit of $46.9 billion for the period, bigger than the combined income of the world’s 6 biggest oil firms over the same time. In the first-ever investor conference call, a senior Aramco executive said they were “ready” for an IPO, subject to “optimal conditions” for existing shareholders to proceed, (the latter being the Saudi government).

But these “conditions” just haven’t come to pass on numerous occasions. The murder of Jamal Khashoggi in October 2018, seemingly at the hands of Saudi government agents and then more recently the drone attacks on Saudi oil installations set the process back, as concerns over both governance and safety began to take root. Delays of the first step, a domestic market flotation of the $2 trillion valued company, were focussed on the risk premium investors might want to justify their participation in the float, culminating in another delay, with reports in mid-October (16th), that the November launch date was now on ice. The stated reason was to allow investors to gain clarity on the effect of the oil facility attacks on quarterly earnings, but two other possible reasons were cited by commentators-

1. WeWork went from filing its public offering documents in August of this year to being taken over by its biggest shareholder, Softbank in October for a valuation of $8 billion. (The original IPO valued WeWork at $47 billion).

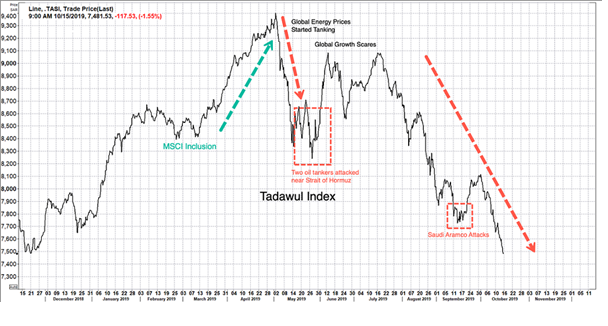

2. Partly as a consequence of oil price declines since April of this year, but also related to the perceived difficulty of a relatively small domestic market being able to absorb the Aramco listing, Saudi shares fell more than 20% from their 2019 highs at one stage in October (see below).

Given that the local listing is the prelude to a global listing in 2020 and the importance attached to it by Saudi Crown Prince bin Salman, it appears that the risk of failure was too great to bear. His personal (and potentially political) reputation would be ruined by a debacle.

But there are deeper problems for the Saudi Prince. One is political- the US Congress has overridden the Obama veto on allowing the victims of the September 11th twin towers attack to sue Saudi Arabia, (15 of the 19 hijackers were Saudi nationals), whilst the second is that the bombing campaign in Yemen and the murder of Khashoggi have made investing in Aramco potentially toxic for fund managers (even those not under pressure to reduce their fossil fuel exposures). As a member of OPEC, Saudi Arabia is also theoretically in breach of both US and UK anti-trust laws- OPEC, of which Saudi Arabia is a key member, accounts for 40% of the world’s oil output, 60% of international petroleum trading volumes and has 80% of the world’s proven oil reserves, which would appear to validate the presumption of being a cartel [2]. So, it appears that a New York listing may not be possible and the lack of transparency also makes it hard (without bending the rules on UK listings to breaking point) to see it happening in the UK either [3]. So, the two biggest, most prestigious exchanges might appear to be off-limits (absent a major concession with regard to the normal listing rules).

Finally, there is the question of who would actually buy it. The rise of climate change concerns, ESG investing, etc. makes fossil fuel producing firms a tough sell at present- Temasek, the Singaporean Sovereign Wealth fund have already ruled themselves out of investing in it. Reuters reported in late October that the underwriters were having trouble enticing “Cornerstone investors” (usually big pension funds, sovereign wealth funds, etc. whose subscriptions are intended to provide confidence to other investors), citing valuation concerns- the Saudis think Aramco is worth $2 trillion, investors believe $1.5 trillion is nearer the mark [4]. Saudi pledges to pay out a $75 billion dividend implies a yield of c.5% at the latter valuation, which is in line with the valuation of other Oil majors- Shell, Mobil, etc. In instances of disagreement between a listing organisation and the market, the latter tends to win out, but it adds to the uncertainty surrounding the floatation. The Saudi Central bank reportedly has met local banks to discuss loans to get them (and individuals) to subscribe to the IPO, so it appears nothing is being left to chance.

Given the size of the proposed floatation, the valuation will be key to its success; but there is a limit to investor appetite for Oil and related industries, so investors may sell out of other firms (BP, etc.) to make room for Aramco in their portfolios. Thus, there may be some selling pressure elsewhere in the sector, but this will not happen for a while, as the first listing (in early December) will be local (as mentioned above). The authorities will move heaven and earth to ensure it succeeds domestically, but the global listing will be much harder to control. For Crown Prince bin Salman, the stakes are very high, but the implications for the oil industry could be even bigger- a failure to get this issuance away could put the future of the oil industry as an investment destination in grave doubt. It bears much more attention than it is currently receiving…

[1] The acronym stands for its original incarnation, the Arabian American Oil Company.

[2] The Saudi’s have threatened (again) to destroy the US Shale oil industry if the “No Oil Producing and Exporting Cartels Act (NOPEC) is passed by Congress, by pushing oil prices sharply lower- but would Trump et al mind that much, even if they did so? They tried this in 2014/15 and it hurt OPECs oil producers far more than it did the US Shale oil industry, which is why it was abandoned in early 2016.

[3] According to the rules, a UK premium listing that would be included in the benchmark FTSE 100 index would mean that Aramco would need to allow potential investors full access to the company’s books, let minority investors vote on an independent board of directors and also allow them to approve transactions between the company and its controlling shareholder, the Saudi government, none of which are likely to occur. However, a standard listing would mean Aramco would not be included in the FTSE100, being relegated instead to the second-tier of companies, alongside mid-cap UK firms groups and family-controlled foreign firms. The latter would not appeal much to the Crown Prince….

[4] For an indication of the range of views on what the Company should list at, consider the following list of (informed ?) guesstimates..

Bank of America: range $1.22- $2.27 trillion

Goldman Sachs: $1.6-$2.3 trillion

HSBC: $1.589-$2.1 trillion

BNP Paribas: around $1.42 trillion

ALL of these are in the proposed underwriting syndicate, so might be expected to be “optimistic” on their valuations, but the ranges are enormous. It appears that they are covering all potential outcomes for reasons of reputational preservation. A $2 trillion valuation looks unlikely to be achieved.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.