“We have long felt that the only value of (stock) forecasters is to make fortune-tellers look good.” Warren Buffett.

There are lots of predictions out there already for 2017. In order to have a fighting chance of being right, I will focus on 2016 and look at the events that shaped what turned out to be an “interesting” (in the “Chinese” sense of the word) year. In no particular chronological order, the “main events” appeared to wrong foot all and sundry – It was not a good year to be a pundit.

2016 started with a bang, as Oil prices plummeted, leading to fears over Bank loan exposures amid widespread expectations of a return to $10 oil. Fast forward 11 months and an OPEC “agreement” subsequently ratified by those non-OPEC states (Russia for example), which has led to near euphoria amongst traders and a widespread expectation of $60 oil to come – a 180 degree turnaround in sentiment. Meanwhile, as we pointed out last week, evidence is emerging that individual countries are not necessarily adhering to the letter of their agreements which means that the supply/demand balance remains askew – could prices be about to turn again?

In a similar vein, equity market sentiment has turned around from the dark days of mid-January (with hindsight, RBS’s infamous warning to sell everything signalled the low), and despite warnings of impending disaster if Britain voted to leave the EU, and if Americans voted for Trump, equities have surged, getting to within touching distance of 20,000 on the Dow and prompting stories about euphoria as Investors appear to be “betting the ranch” on continued gains. Interestingly, listening to experts could cost you dearly in 2017 according to another market watch story; we agree, but note that they are not averse to quoting them (see above). We looked at consensus/contrarian investing here – it may be worth dusting the note down again.

2016 was the year that Bonds (finally) started to show signs of fatigue; after a global stampede into fixed interest, which left investors facing negative yields, Trump’s victory saw a massive volte-face, with trillions being wiped off bond values leaving those who bought 30-50 year European government bonds just 3 months ago nursing painful losses. The Fed’s decision to raise rates in December (after months of dithering), has left many calling the end of the great bond bull market. Perhaps, though as we have long argued, (most recently here), there are economic limits to high rates can go, as the extent of the debt overhang means that the world economy could not cope with the higher costs implied. This bears watching…

Higher interest rates (and widening differentials between US and other country’s bond yields), has led to a Dollar surge as Investors sentiment has also turned abruptly. As we talked about here recently, the Dollar’s demise has been greatly exaggerated; it appears now, however, that the Dollar is universally loved, which means it may be time for another turnaround…

Politics was the main agent of change in 2016. The Brexit vote, Trump’s election victory, and the on-going slow-motion car crash that is Europe, spawned a new kind of protest – one that was highly anti-establishment. As we noted in October, establishments in the Western World are struggling to comprehend what is occurring on their watch. They appear to be stuck in the denial phase of the Kubler- Ross model, but with elections due in France, Germany and Holland fast approaching in 2017, there are plenty of opportunities for stages 2-5 to occur. This of course, means that political risk – something investors have not had to deal with for a generation- is now a real possibility. This is bound to have an impact in 2017.

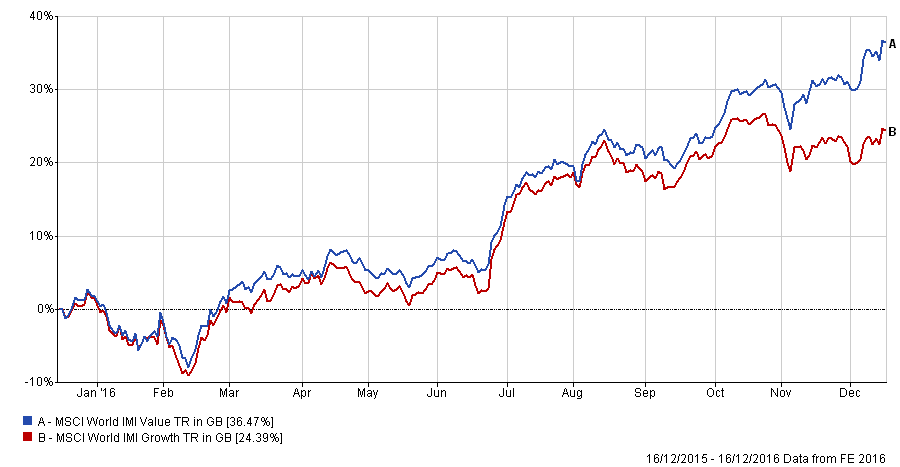

On a brighter note (for EBI clients, if not for Investors generally), 2016 finally saw Value re-emerge as a source of return. After what seemed an eternity, the MSCI World Value Index, has, in the past year started to outperform growth. Our Value tilts have not helped EBI portfolio’s performance in the last 5 years or so, but we have kept the faith, and it appears to be bearing fruit. Reassuringly, it is a Global phenomenon. The UK divergence began just after Brexit, the World’s outperformance of Value post the US election. Co-incidence?

We have long counselled patience during the barren period for Value (most recently here, but also much further back than that). The premise was that the end of QE would force fund managers to invest in a more discriminating manner, as cash infusions into asset markets slowed. This has not yet happened, (so we were wrong), but the market seems to be re-assessing its major bet against Value. If everyone is underweight Value, there are lots of potential buyers out there if sentiment improves – as it appears is happening before our eyes.

What of EBI? We have seen strong growth in almost all areas of our activity. Our Twitter following has risen by 37 to 279 in 2016, as Indexing continues its assault on the Active world – not exactly Justin Bieber admittedly, but then he knows nothing about re-balancing thresholds either. Our Vantage AUM has gone from £119 million in January 2016 to over £255 million as of this week, more than doubling after what was a slow start in January/February. It represents an average monthly average rise of over £11 million a month – which is a testament both to the strength of the investment philosophy we espouse, but also to the depth of trust our clients have in us. We are deeply grateful for this and will endeavour to continue to justify this faith in the months and years to come.

We all wish our clients a peaceful and prosperous 2017: regardless of the wrongs done in the world Max Ehrmann’s poem remains as good an antidote to pessimism as you will find…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.