“Blessed is he who expects nothing, for he shall never be disappointed.” ― Alexander Pope

[We have recently been asked to explain in more detail how we arrived at our Expected Rate of Return numbers used as our return assumptions. What follows is an attempt to rationalise the output numbers, in a way that can hopefully be understood as the basis for our investment philosophy].

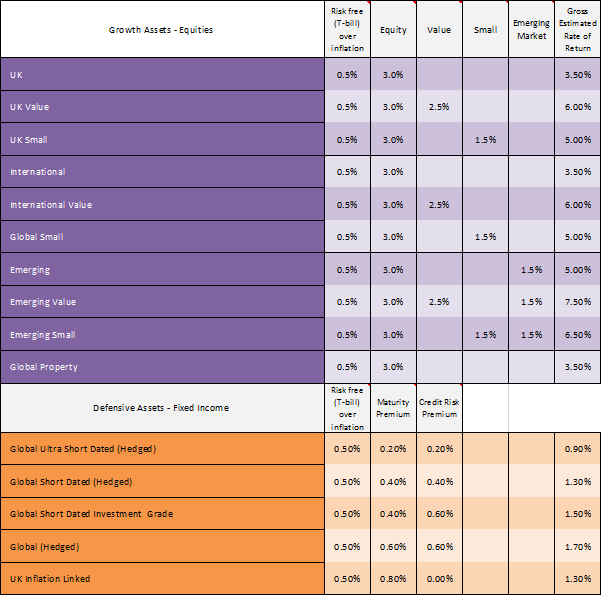

Below is a copy of the latest ERR breakdown, (from our Turnkey Workbook), showing the sources of the Equity and Bond Risk Premium (ERP) we expect to achieve over time. We shall attempt to dis-aggregate them and look at the internal logic of the results.

The Bond premium has 3 constituent parts:

1) The Risk-Free Rate (RFR) – the interest payable on a risk-free investment.

2) A Maturity Premium – as the maturity of a bond rises, so does the risks associated with that investment.

3) A Credit Risk Premium – as the credit quality declines, a greater yield is required to compensate investors for the risk of default.

The Equity Premium consists of:

1) The RFR

2) An Equity Risk Premium

3) A Value/Small Premium (in-line with the Fama/French model)

4) An Emerging Market Premium

But, are any of these assumptions valid?

The long-term default assumption for the RFR over inflation is 1-1.5% (for the US and the UK respectively) [1].But with interest rates around 0.25% and Inflation leaving real rates in negative territory, this is clearly out of line. Is this temporary? The advent of QE, Central Bank buying of bonds and sub-par economic growth has changed the game – at least for now. As we have mentioned in past blogs (here, and here for example), QE may actually be causing rather than ameliorating the problems of low growth. It may be temporary, but it may not be, as Central Banks have shown little appetite for the market volatility arising from potential interest rate rises. In addition, there is little reason to expect a premium at all, since it would seem to violate the principle that markets provide a premium to compensate for the risk taken. Thus, even the conservative 0.5% pencilled in may be over-generous. We will find out if and when we get a rise in inflation and thus interest rates.

The same Credit Suisse research revised down its Maturity Premium (MP) estimate to 0.8%; the US and UK 2-10 year yield curves are pointing in the same direction currently (with the caveat that this could also change without warning). UK spreads are (as of end-August) 0.55%, and the US equivalent is now 0.8%, and the curve itself is getting increasingly flat, implying little difference across the entire maturity spectrum [2]. This appears to be against common sense – more (bad) things can happen the longer the bond has to maturity; this does seem to be an artefact of the post-2007 crisis, as investors reach for yield (or duration). We cannot expect this to remain at these levels forever, and thus it may be sensible to assume a wider premium in the future, especially if inflation expectations start to rise: possibly the MP itself already contains an inflation premium, since it can have such a pernicious effect – a bond issued at £100 would be worth only £74.41 in real terms if inflation averaged just 3% over ten years, a substantial loss in potential purchasing power for the Investor.

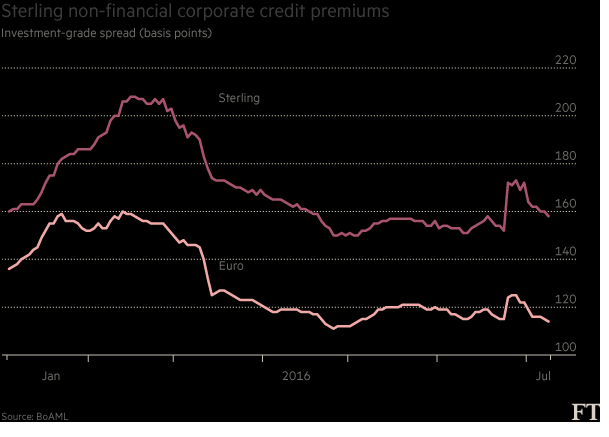

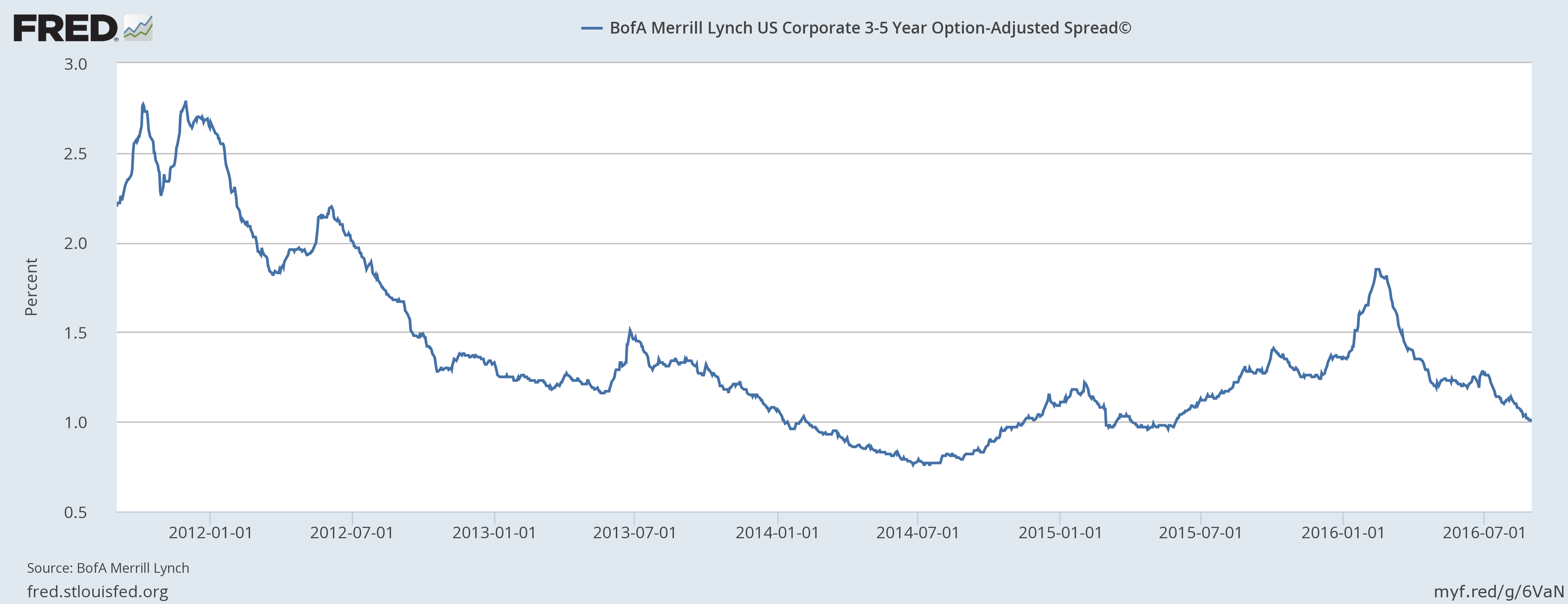

EBI Credit Risk assumptions flow from the Maturity Risk numbers. Again, the market derived numbers are pointing in a similar direction to that of EBI (as the charts below demonstrate). They are still comfortably above our own figures, giving us a margin of error, but with Nestle and Deutsche Bahn recently issuing negative yielding bonds, the line between Government and Corporate debt’s relative riskiness is becoming blurred, especially given the huge debt levels being incurred. Of course, governments could print money to cover debts (unlike Corporates), but can they really? Would Investors buy bonds in that situation? It doesn’t seem likely. There may in fact be mutually assured destruction element in this – government coffers need investors to buy their bonds as much as Investors need an investment return.

Moving to the Equity Premium, the above comments regarding the RFR apply equally to equities. The Equity Premium has been complicated in recent years by the fact QE etc. has reduced real bond yields to below zero, and that equities now yield more than comparable bonds, a reversal of the “yield gap” that has persisted since the 1950’s. The MSCI World Index (a global equity proxy) now yields 2.66%, a 1.5% premium to that of the Bond equivalent, the Barclays Global Aggregate bond Index. In a low return world, it may be that relative riskiness of equities has changed vis-a-vis bonds, but there is no way, ex-ante we can know this for sure.

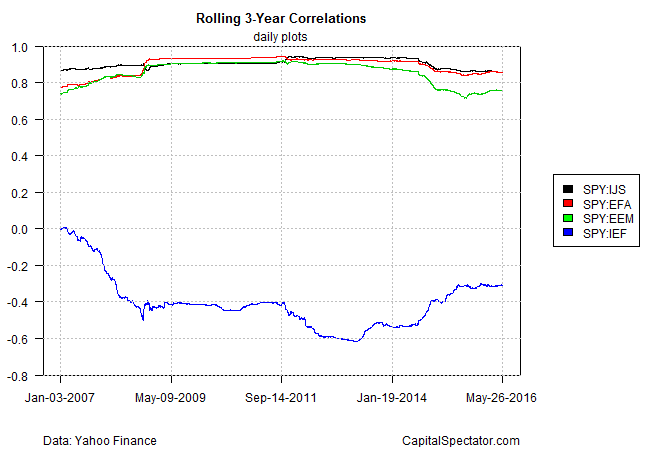

Similarly, the Emerging Market premium may no longer exist, at least to the same extent as before – the chart below shows that, since 2007, rolling US/ Developed markets/EM correlations have remained between 75-90%, which implies little diversification benefits have been obtained in the last decade or so (except that EM stocks tend to be more volatile). The EM premium may thus be a volatility rather than a risk premium [3], though this says nothing about whether the actual amount is different to the one EBI employs.

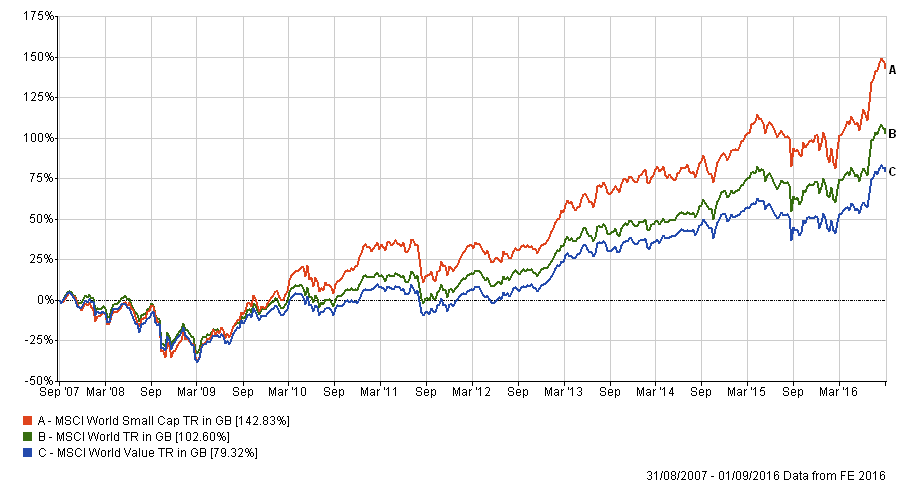

Finally, the Value/Small premiums present even more of a challenge – the chart below from FE shows that the Global Small Cap Index has returned an annualised 2% excess return over the World Index, almost exactly in line with estimates, but the Value premium has been missing in action for the entirety of the period. This does not negate the validity of the assumption, but the longevity of this phenomenon is hard to reconcile with the theoretical basis for its existence. In a world of constant Central Bank intervention in market pricing, it is hard to see this premium re-surfacing, but that itself is an assumption – that QE will continue indefinitely, which is a dangerous premise to adopt.

Notwithstanding the above, it would seem hard to justify wholesale changes to the assumptions; to amend the estimates would be tantamount to saying that “this time is different”, which are possibly the most dangerous 4 words in investment…

The future is inherently unknowable – thus risk premiums are at best guesstimates. Regulatory pressures (as well as business prudence), demand that we err on the side of caution. Investors are not well served by overstating likely returns, as this only sets them up for failure later on. Investors need a starting point, and thus Risk Premium numbers do not function as a destination, but rather as a signpost. Winston Churchill said of Democracy that “it is the worst form of government, except for all the others. So it is with expected return estimates – we have to start somewhere; it may not be perfect, but we don’t live in a perfect world.

[1] See here for the Credit Suisse research on this topic.

[2] The German and Japanese equivalents are at 0.58% and 0.13% respectively, implying that this is a global phenomenon, rather than one confined to the Anglo-Saxon world.

[3] Although ostensibly the same, we consider risk to be the permanent loss of capital rather than price volatility per se.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.