On the day of Jerome Powell’s inauguration as Fed Chairman (and before he had time to find out where the cafeteria is!), markets have greeted him with a big bang. There are precedents for this “bad luck”. Alan Greenspan started his role as the Chairman in August 1987, 3 months before the Big One in October 1987 and Ben Bernanke also assumed the job in 2006, as the Financial Crisis was just unfolding. So, it is not a unique situation, but it must make him wonder whether the market gods are out to get him. I imagine, ever so quietly, Janet Yellen is having a chuckle…

It may have seemed ugly out there, but it is by no means the worst in history. It is the biggest points drop of all time, but only the 108th worst percentage fall (which as we are at all time highs -or were- is not surprising). It was the biggest fall since August 2011, (when the Dow was at 10,700), but with that, the 410 day streak of no 5% drawdowns is over; volatility is obviously much higher, boosted by the panic covering in VIX Futures, where almost literally everyone appeared to be short. Asian markets have followed suit, with Japan and Chinese shares down c.6% on Tuesday, with Europe not far behind. Only major currencies appear to have escaped the blast zone, with the Euro and Sterling seeing only minor declines as investors bought back the Dollar. Bonds have benefited, as investors seek shelter from the equity volatility. At one point, the VIX Index hit 50, having been below 9.7 at the end of November 2017.

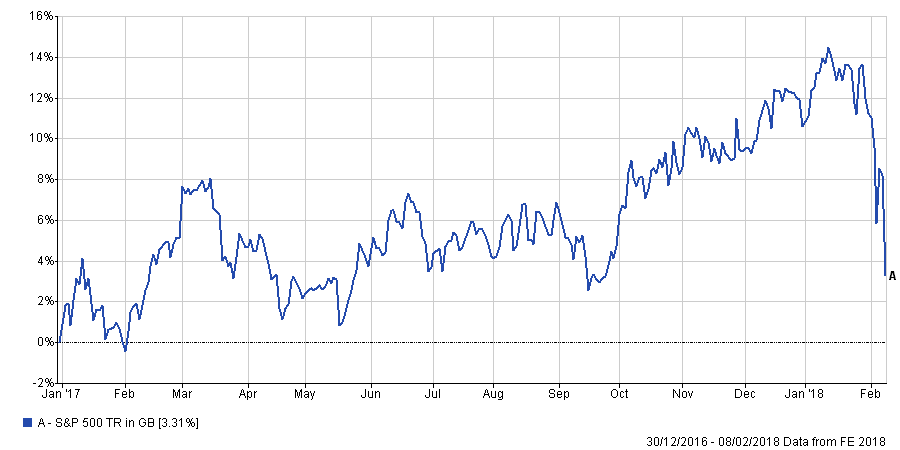

As the chart below shows, the S&P 500, up 10.6% in Sterling in the year to December 2017, has seen gains almost wiped out in a week. During that time c.$5 trillion in market capitalisation has been wiped out -if it ever truly existed of course..

So, what was the proximate trigger for this market swoon?

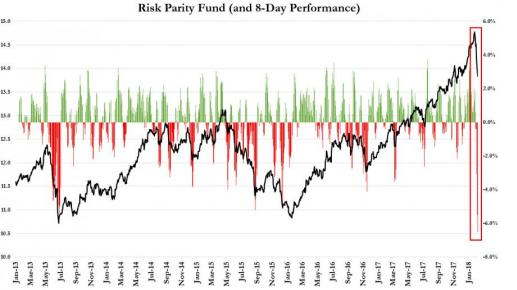

Although it is tempting to put cause and effect together to try to make sense of it (as this article does in a great pastiche of market commentary), we will never know the answer, so it is pointless to try. One thing we can be reasonably sure of is that it isn’t about “inflation”. Bond prices have been falling recently, but to anyone who buys anything real, inflation never went away! However, if one is intellectually wedded to the mantra that “low interest rates justify (permanently) high equity prices”, a rise in interest rates is disconcerting. But this in itself will not cause the mayhem that we have seen unless market positioning is incredibly one-sided. This can be most visibly seen in volatility positioning, where as of last September, net short volatility positions were at record lows, whilst the VIX itself was also at record lows. As such, even a small (upward) move would lead to “forced” buying of volatility, which of course puts more pressure on others to do the same, in a self-reinforcing cycle. Risk Parity (RP) models would also see the rise in volatility and also be sellers of equities, which pushes up the VIX index etc.etc. These “systemic” short volatility positions could not be liquidated in what rapidly became an illiquid marketplace (with nobody prepared to be on the other side of the trade), which exaggerates the moves still further, hence the 1,100 point Dow implosion (twice).

The chart below, for example, shows the effect of bond and equity price movements on Risk Parity fund’s exposures (and consequent need to de-lever; that is, sell). Monday’s S&P 500 fall was 4.1%, whilst bonds were up nowhere near enough to prevent that selling (or the fear of it doing so) leading to a big fall.

Casualties quickly became apparent; the XIV (The Short VIX ETF) fell 90% in one day, leaving its creator (Credit Suisse) to decide to terminate it, as the NAV fell from $108.36 on 2/2/18 to just $4.22 3 days later [1]. Nomura Europe has also announced the redemption of their Inverse VIX ETN (Exchange Traded Note) offering, after it too fell 80% in one day.

A Chicago-based Hedge fund, whose “strategy” involved selling Vix volatility has seen its NAV fall by over 50% (the fund had AUM of c.$366 million) is now in the process of liquidating and the in-aptly named Probabilities Fund definitely lost 8.2% on Tuesday as it got caught in double-leveraged long S&P 500 ETFs. Another Hedge fund, Option Solutions LLC, lost almost 65% (in one day!), trading in what rapidly became an illiquid traded options market. Many more losses will no doubt surface in the days and weeks to come, particularly if Risk Parity funds continue to see losses escalate (see below). If these Bloomberg articles are in any way true, then Hedge funds are about to show us that being short volatility into a storm is not the only way to lose loads of money…

Presumably, the blame game will soon begin as Trump’s rather foolish attempts to claim credit for market rises now rebounds upon him. In truth, however, this was a bubble looking for a pin, as we discussed two weeks ago. It was not necessary for an actual event to occur, merely a trigger, in the same way that loading grains of sand atop each other inevitably leads to a collapse of the pile- stability leads to instability, as Hyman Minsky observed before the Mortgage Crisis of 2008-9. All that was necessary was for nature to take its course. As we showed in another blog, the effect of a big fall can be much bigger (and more frequent) than one may imagine if one merely looks at recent returns, which have been very strong (and non-volatile) in an extended period.

Predictably, some market participants are now hoping for Fed intervention to prevent further declines, as they try to reassure frightened investors; leaving aside the role that the Fed (and other Central Banks) have played in creating this problem (which I am sure I will get to in another post!), they may well be mistaken- here is what he (Powell) said back in 2012 (p.192-3). The “Powell Put” may be a lot lower down than market participants expect…

What can we learn from all this? Markets don’t do free lunches and what looks a sure thing is never thus. Thus, these events can be seen as a lesson in complacency. It is not as if warnings weren’t sounded– they were just ignored. As long as money is being made, people don’t appear to be that inclined to ask why (or how), it was ever thus…

But will anything really change? The mind dulling effect of seemingly endless Central Bank money printing, combined with their clear refusal to allow any sort of price falls has led investors to abandon risk control almost entirely in the pursuit of what seems like “free money”. Thus, investors are all looking for the next “sure thing”- we appear to be stuck in an endless bubble, crash, bubble cycle as investors learn (next to) nothing from each successive disaster. This chart may portend the immediate future; when 10 year US Treasury yields rise above 2.85%, equity investors take fright (as they represent investment “competition” for stocks), leading to sharp falls in Indices- seeing those falls, bond prices rise (yields fall) as money moves to bonds. The decline in yields re-invigorates equity buyers, which then pushes down bond prices (as they then “worry” about inflation again), creating the conditions for another equity market swoon. The cycle recurs, until one or other asset class finally stops responding reflexively to each other. (As of mid-morning on 8/2, bond yields are now 2.83% and Dow futures are down 200 points).

The only sensible response is to ignore it all; a Yahoo finance article suggested that losing your password for your online trading account might be the best thing to do! Nothing in the immediate future suggests Armageddon is about to strike; profits are being made, dividends are being paid and tax cuts are being implemented, which in turn means that this price volatility has little connection with underlying earnings volatility (i.e. it is noise rather than signal). So there is little benefit in reacting; nobody knows what these price swings mean, let alone whether they have any long- term significance. But if it seems too easy to make money in an asset (or product), it almost certainly IS too good to be true. As we say in Yorkshire, you don’t get ‘owt for nowt…(well, I don’t, I’m from Surrey !)

[1] CS have assured investors that it will suffer no losses on this product, but as it is the (not so) proud owner of 4.79 million units, there will be blood spilled when it is redeemed (roughly equivalent to half a year’s profits at current trends).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.