The Venezuelan economy is in freefall. In the last 5 years, their economy has shrunk by 50%, amidst shortages in medicines, food, and other material basics, inflation is over 500,000%, (and the IMF projects it to be 1 million percent by year-end). According to U.N. estimates, nearly 2.3 million Venezuelans have left the country over the last 2-3 years (about 7% of the population). The currency has collapsed too, as confidence implodes, with some wags now suggesting that the State TV broadcaster drops their version of “Who wants to be a millionaire” as even the jackpot is now worthless – 1 million Bolivars is currently worth about £3.09. In mid-August, President Maduro announced a 95% devaluation of the currency, turning it into a form of Cryptocurrency, linked to Oil prices. It doesn’t appear to have done much, aside from raising prices for almost everything. All this is happening in a country with the largest proven oil reserves in the World.

A brief history may be in order – the malaise began under the presidency of Hugo Chavez, elected President in 1998, who began an “economic war” against capitalism (and particularly the US), as he tried to export his socialist model to other countries in the region. Predictably, this led to shortages, unemployment and rises in crime levels. According to the Venezuelan Observatory of Violence, an Independent watchdog, the murder rate in the country is 89 per 100,000 residents in 2017, (the equivalent is 5 per 100, 000 in the US). Since the “election” of new President Maduro, in 2013, the situation appears to have deteriorated further, as he adopts an increasingly authoritarian stance, as opponents are imprisoned and the media and National Assembly are taken under the control of his allies. Those that can leave appear to have done so, leaving those left behind in an increasingly desperate situation. It already looks as if Venezuela has become a “failed state”, with the last election (in May this year), being seen by nearly all foreign observers as rigged.

Assorted (extremely wealthy) socialists have gone very quiet these days, as the chaos unfolds and many previously staunch political allies have also distanced themselves from the potential fallout of the current unfolding economic disaster. Of course, this is not “real socialism”, [1] they intone, though they seemed much less certain of this when high oil prices masked the problems that their policies created. Ironically, just as the crisis becomes a news topic, a 28-year-old “Democratic Socialist” has won a New York primary election, ousting a 10-term incumbent Congressman to the consternation of party officials. The self-styled “girl from the Bronx” spent most of her childhood in Westchester County New York state, in a suburb whose average income contrasts sharply with that of her constituents. But it was ever thus – the cartoon above highlights the absurdity of the political proposition advanced.

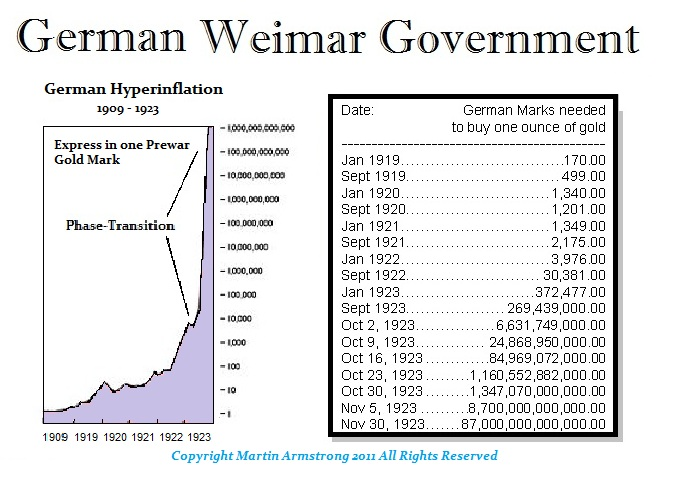

The arguments against socialism should be well known by now, (see here for example), but the big surprise is that people are surprised by the turn of events in Venezuela or anywhere else that these experiments are tried – hyperinflation is the result of a destruction in confidence in government caused by their OWN policies (not those of “outside forces”, US imperialists/CIA Agents, or anyone else). South Africa may be about to repeat the stupidities of Zimbabwe (in expropriating farmers’ land), which means nobody in their right mind would invest there, whilst any spare capital is hoarded (normally using US Dollars), to protect themselves from further currency depreciation. As in Zimbabwe (and before that Weimar Germany in the 1920’s – see below), local currency thus has no value – so too has it come to pass in Venezuela. But the increasingly dictatorial methods being used are inherent in socialism – freedom cannot be allowed to get in the way of the “socialist paradise”. If (some) people choose to reject socialism (in favour of a more individualistic, free market society for example), then (state) violence is used to prevent that from happening. In effect, the populace are to be forced to have socialism, whether they want it or not, leading to an increasingly repressive tyranny to maintain that situation – until the whole economy implodes of course.

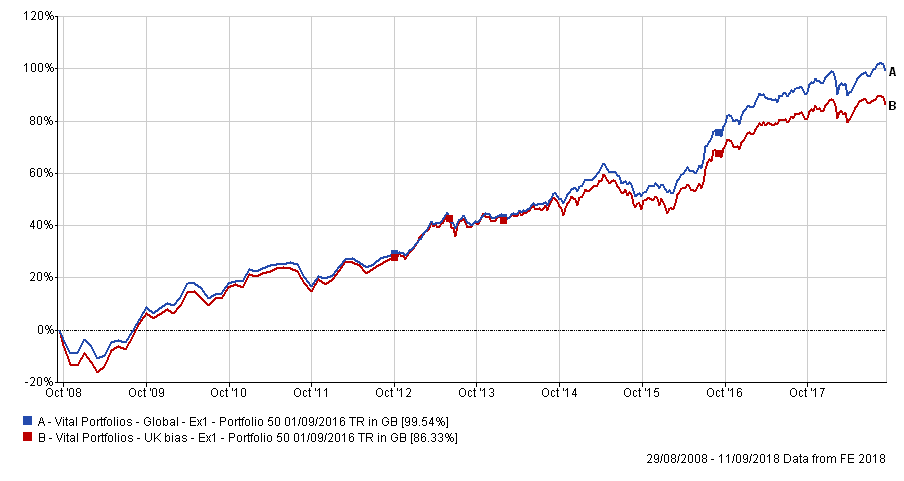

All of this strengthens further the argument for Global portfolios; we cannot know the future, but we can prepare – buying a global portfolio would not lead to owning anything above a minute fraction of Venezuela, but sticking with UK Bias portfolios WILL lead to significant ownership of UK assets – EBI 100 has a 31.8% exposure to UK equities, while EBI Bond has 29.5% of its assets in UK bonds. It is not necessary for a Venezuelan style collapse to occur to inflict heavy damage to a portfolio that is over-concentrated in UK assets under a (potential) Corbyn government, in relative if not absolute terms. As the chart below shows, the returns of a Global portfolio have been persistently better than a UK biased version, with Brexit merely accelerating what is an already established trend.

The first rule of diversification is to own as many different assets/regional exposures as is practical – the Global portfolio does this in an efficient, low-cost manner and is likely to see better returns (with lower overall volatility) as a consequence. There are no guarantees, but the investing road is uncertain – in the long run, the world will (somewhere) deliver the growth (and thus investment returns) investors seek. The potholes in the UK road could deliver a bumpy ride for UK-focussed investors in almost any scenario that we can see at present.

[1] This series of photos seem to sum up how socialism actually works in practice. Some family members of the previous regime, appear to have done pretty well out of the last 10 years it seems…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.