“Stocks have reached what looks like a permanently high plateau.” – Irving Fisher, (economist), 3 days before the 1929 market crash.

We have covered this subject before (here, and in our Quarterly Review of Q2 2015), but it is always worth returning to, as Investors appear unable to shake off the conviction that they can “beat” the market. Passive inflows (and Active outflows) suggest the tide is turning, but as all politicians feel obliged to say nowadays, there is still much to do. It is gratifying to know that the ranks of Index investors are rising (through EBI, but others too), and that we are no longer the geeks at the party that no-one wants to talk to.

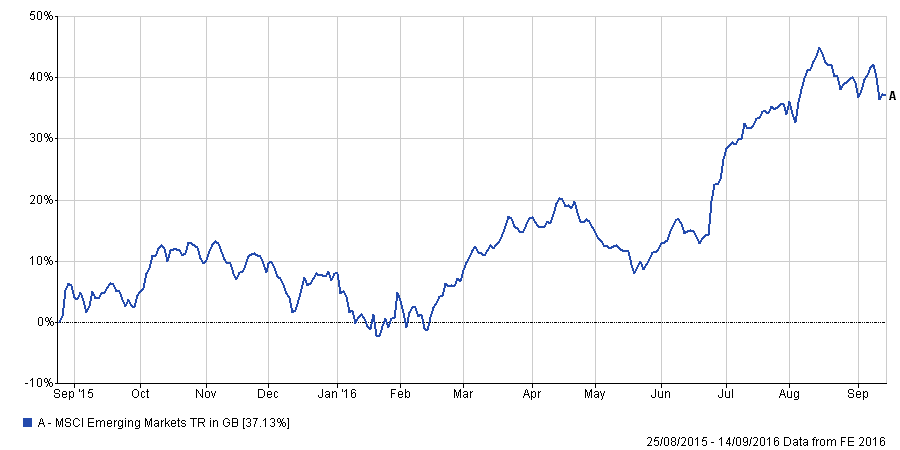

Experts are having a tough time – the public’s refusal to follow their advice vis-a-vis Brexit has led to much wailing and gnashing of teeth, as fund managers who bet on “Remain” have been left looking (more) foolish. But it’s not just in the UK that views have been (belatedly ) revised. This time last year, we at EBI performed a portfolio re-balance (due to tolerance breaching), which involved buying Emerging Market equities, at a time when Forbes were liberally quoting analysts from Schroders, Nomura and others to the effect that EMs were going to suffer from continued weak commodity prices, Dollar strength etc. Fast forward just 1 year, (and a 40%+ gain from the low in February 2016), and EBI are now contemplating a reversal of this re-balance, whilst such investment luminaries as Lazard’s are now bullish on EM assets, citing “fundamental underpinnings” for a continued rally, following on from Bank of America, who turned bullish in April, (near a peak, we should note), and AFTER 20% price gains in both Brazil and Russia had already occurred; with recommendations like this, investors may not need to worry too much about capital gains taxes – there probably won’t be any!

We all (or should) know by now the folly of market timing – the real issue is not so much why investors do it, but why it fails so often (and in some cases spectacularly so).

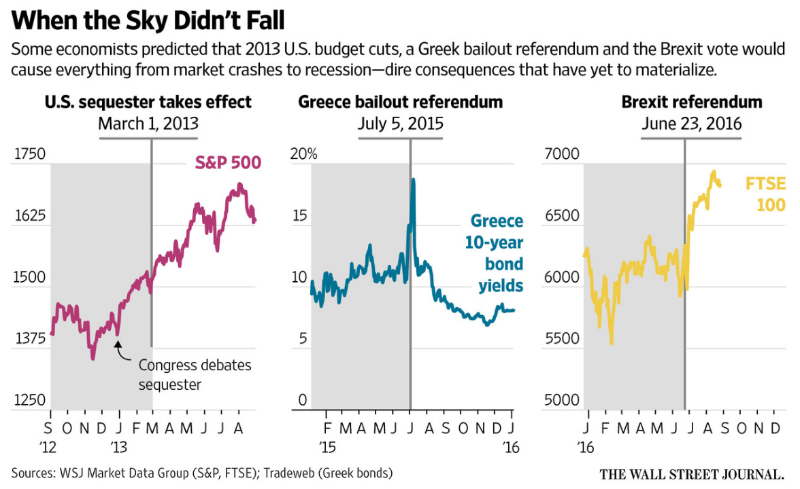

Recent predictions have largely failed to materialise; the charts below show 3 recent examples. In all three life went on, pretty much for the better.

There are many other famous examples of false prophecies – including Barron’s Facebook cover of September 2014. The share is up 500%+ since then and is now the 5th largest US firm. They are not alone though – this chart (and this one) show the calamitous failure to understand context – these cover stories came about through consensus – an editor would never run a story that he thought he couldn’t get past his proprietor/owner/committee etc., and so they will only occur at the end of a trend, rather than the beginning. Even some journalists are starting to accept that the track record is less than stellar, but they still dutifully report on and quote experts, as without them, they would have precious little to say, other than resorting to cliches.

In truth, we only have ourselves to blame; this article demonstrates that we allow ourselves to be bamboozled by easily disprovable statistics that purport to demonstrate that Active management “works” when in fact it is in reality locking in failure.

There seem to be a few possible explanations for this state of affairs, all of which are to some extent psychological:

1) Experts have a tendency to herd: at market peaks they are resoundingly bullish, and at lows, extremely bearish; it is lonely being the only one bullish at the lows, and even worse being bearish at the highs – [I know this from personal experience: I was foolish enough, in 2007, to tell my friends I was selling my Leeds property because I was expecting the UK property bubble to burst; I was met with responses ranging from bemusement to outright hostility, as if I was attacking them personally. Next time I shall keep my mouth shut – for a change]. Of course, trying to sell a contrarian viewpoint to clients is extremely hard, and the longer the trend, the more entrenched views become (via “recency bias“). In investment, success = sales, and being right appears to be less important than getting the sale. It may be good for you, but no-one actually orders kale salad at a restaurant, and the Chef putting it on the menu is unlikely to be busy!

2) They also extrapolate trends endlessly into the future. Our ancestors learnt to duck when a rock is aiming for their head, and we use the same thinking to assign probabilities to future events. Thus, once a trend in prices is established, it will continue as far as the eye can see. It is no accident that the two magazine covers referenced above came out when they did; one at the top of a major trend, the other at the bottom of one. It was safe to make that sort of announcement – if you were wrong, at least you were not alone, which Keynes judged to be the worst error. Thus, both experts and fund managers shy away from “career risk”, which is the risk of being the only one underperforming a benchmark (and thus being fired). Buying US Banks in March 2009 would have been a sackable offence, yet, basis the Dow Jones banking Index, one would have tripled one’s money by now: the number who did so, however, probably equals zero.

3) Perhaps the biggest contributor to forecast failure is the inability to correctly ascertain cause and effect. This can be seen in the Passive/Active debate, where Active managers are blaming Index funds for increasing cross-asset correlations, whereas in fact, the latter is the breeding ground for the former.

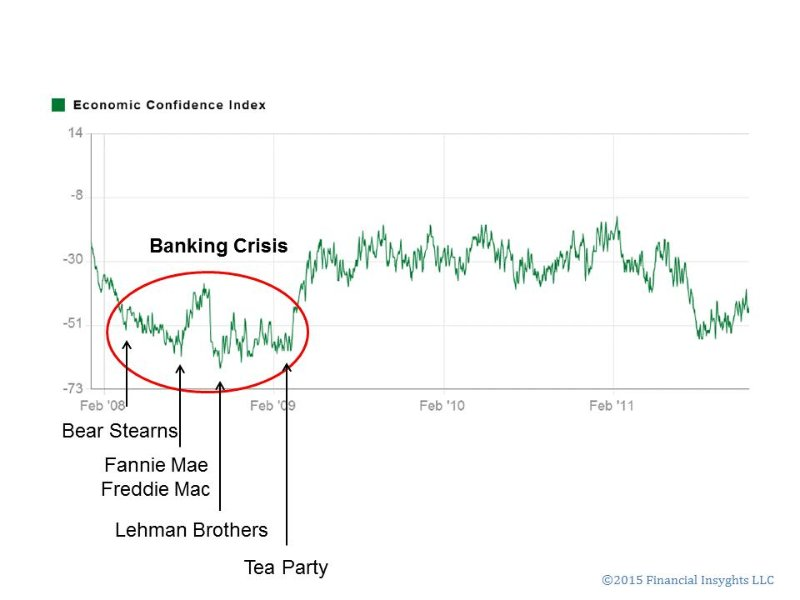

Similarly, as the chart below shows, the US banking collapse occurred at the bottom of the Index cycle, indicating that the bankruptcies of Bear Stearns, Lehman’s et al were a consequence of confidence falling NOT a cause of it, an exact reversal of the conventional relationship. The Great Depression of the 1930’s was not caused by the Crash – it was a consequence of a fall in confidence which manifested itself in the crash. Socionomics posits that social mood drives events and the stock market, being the most easily monitored indicator thereof gives us early warnings of changes in trends. Market prices are thus merely an expression of the prevailing mood; an angry, confused and resentful social mood will very often (the end of the 1930’s, Vietnam, even Gulf War 1) climax at the end of bearish phases, and NOT at market tops (where everything is all rosy).

This is not to say that you shouldn’t listen to market experts, commentators etc. On the contrary, pay close attention, just don’t follow their advice [1]. A consensus of doom amongst experts is a sign that a low is close, whilst a belief that “this time is different”, and aggressively optimistic forecasts tell you the opposite. Once you understand this phenomenon, it is much easier to resist the siren call of bulls and bears alike, both urging you to take action. Ask what the forecast is really telling you about the future; day-trading amateur investors (as per 1999-2000), more likely indicate the end of a trend not the beginning. Investors may not get rich following this method, but they will massively increase their chances of not getting poor.

[1] When I worked in the City, one of my early clients was the most valuable asset there is – a man who is always wrong. He was thus an excellent indicator that your ideas were on the right track (provided that he disagreed with you!!).

P.S

The recent rise in volatility has caught many investors out, but as this article points out, the increasingly widespread use of “Risk Parity” strategies has led to a reversal in the generational meme that Stock prices and Bond yields move in the same direction; that this may be changing will doubtless catch analysts (and fund managers) unawares again. But you won’t hear about it from newspapers etc. until the process has already occurred (and probably completed).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.