“Price is what you pay. Value is what you get.” – Warren Buffet.

[All returns are quoted in US Dollars, to avoid the currency effects of Brexit on Sterling returns. The basic premise, however, is not changed by the base currency choice as currencies tend to be correlated with the economic cycle, whereas the Value (and Size) premium is understood to be independent thereof. I have used the MSCI World Index, as a global equity proxy. Essentially the same situation pertains throughout the regions of the world and especially so in the UK].

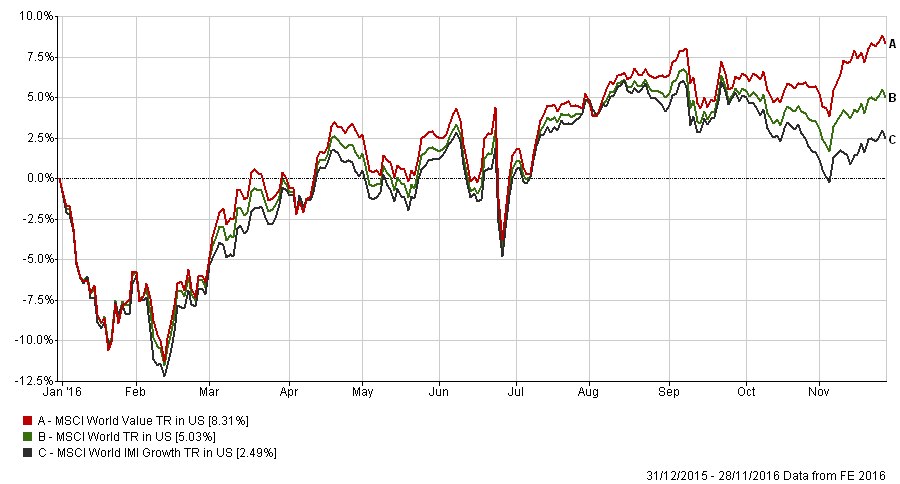

Value investing has become less popular than the Zimbabwean dollar in recent years. Relentless underperformance has been the order of the day (and week and month etc.) leading some to ponder its demise. The chart below shows the pain Investors (along with EBI) have experienced in the past 10 years and so it is understandable that scepticism is rising – after all, the Fama-French 3 factor model predicted Value stocks’ outperformance as far back as the early 1990’s; maybe now, “this time is different” [1].

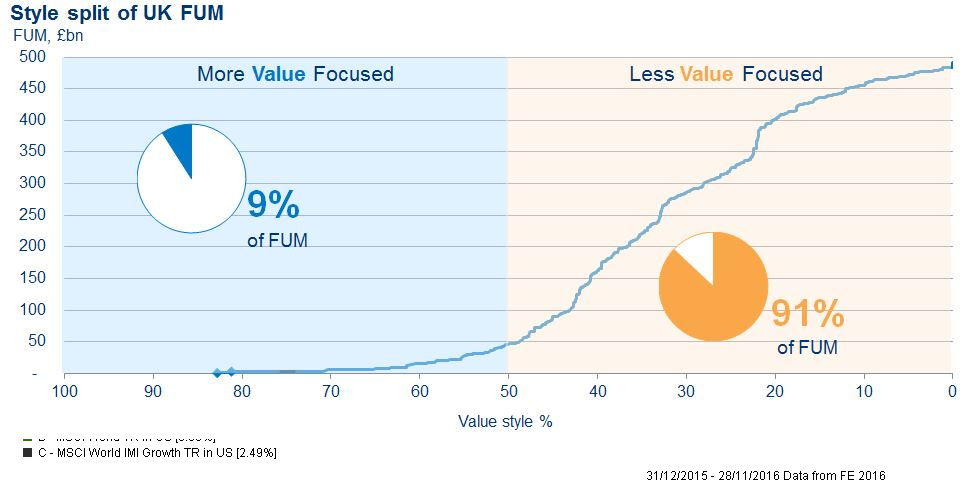

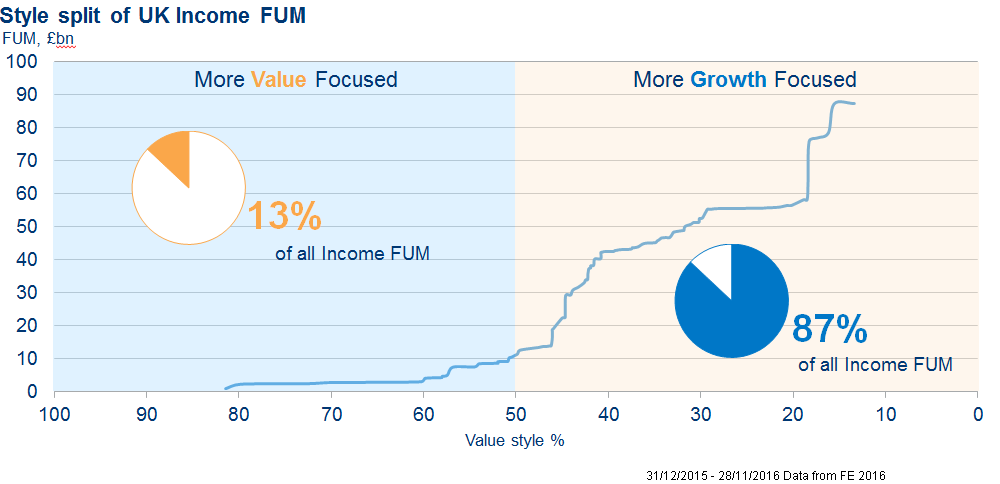

Investors attitude to Value can be summarised in the next two charts based on Morningstar data as of 2016. As can be seen, Investors have shifted dramatically away from Value as a strategy; they are more or less “all in” on growth, even in the Income sector, one where traditionally one might expect a clearer focus on elements of the value style.

The challenge is to provide a plausible explanation: two spring to mind, but they are related.

1) QE/Low-interest rates: successive cuts in interest rates and seemingly endless cash dumps into the financial system have left investors effectively anaesthetised. The absence of a positive yielding risk-free asset has pushed investors into the “reach for yield”, as they search for income to replace the interest rates previously available in bank deposits. Hence the popularity of Income funds, who buy high yielding shares as an alternative. Furthermore, when the Bank of England for example, is creating £10 billion or more each month and advertising its’ willingness to do more at the drop of a hat at the first sign of market turbulence, fund managers have an invidious choice. Buy now, (almost any asset) or risk underperformance (and ultimately the sack). It is not necessary to scrutinise the assets chosen so much as it is to invest now; thus indiscriminate buying occurs (as intended by the Central Banks when they launched the policy!).

2) Share prices tend to fluctuate much more than the metrics used to value them. This provides an opportunity for momentum traders to push prices a long way from equilibrium. Book Value per share, dividends etc. move relatively slowly, giving ample time for retrospective justification for any given move. This allows a trend to develop, which in the absence of growth shocks (and lack of market volatility to the downside), creates a sense of confidence, which in turn ultimately leads to excess. So, we have investors shunning value because others are doing so. The longer this situation goes on, the more confident investors become that it will continue (a form of Recency Bias).

Is the situation hopeless? Far from it. As the chart below shows, Year-to-Date, Value has outperformed the World Index, and more so the Growth Index. Why might this be and could it continue?

The victory for Trump and his much publicised plans for Infrastructure expenditure may well change the game. Bond markets have already responded vigorously, with yields sharply higher, implying an expected increase in future inflation expectations. While one could quibble with that view (as indeed I have done), the market has spoken, and pretty clearly. If the bond market is even half right, the major beneficiaries will be Basic Materials, Oil and even Bank shares (the latter due to the positive effect of rising rates on their interest margins). These are all major components of the Value sector (and together represent nearly 44% of the All Share Index). Should value rebound, it would be difficult to see this strategy (and UK markets too) not doing well. Of course, if markets were to enter into a downturn (triggered by higher interest rates), fund managers would have to do a lot more research work. A focus on valuation metrics would become important again, as growth stocks would struggle to command the same lofty valuations at 3.5% bond yields as they did at 1%.

“History doesn’t repeat itself but it often rhymes,” a phrase often attributed to Mark Twain, is applicable here. Markets move from one extreme to the other in a self-reinforcing process, which leads to a reversal as market positioning becomes “crowded”[2]. If the above Morningstar charts indicate sentiment towards value, the recent outperformance by value has a LONG way to go. Investors are woefully under-prepared for the sectors’ resurgence – they may have a lot of buying to do even if they do not wish to overweight the factor – though investor history suggests they will almost inevitably do so, as optimistic sentiment reaches an excess similar but opposite to the negativity that preceded it. There are many investors out there who have no interest in, or even outright hostility to, the concept of value investing. Once they have been “converted”, the trend will no doubt change again. That could be many years away, but it would be the time to reduce exposure if so desired.

If only we knew when that was…

[1] The Professors emphasised repeatedly that they were referring to the long term; anything is possible in the short run, and the Premium cannot be counted on to deliver on time and at all times – in order to harvest the Value premium one needs to sell (to someone else) who, having paid that premium to the first investor, has no premium to extract unless the premium expands still further.

[2] See a previous blog for a fuller explanation of how trends change when a consensus has occurred.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.