Value Investors have had a hard time in recent years – what was cheap has remained so for what seems like an age. Does it still exist, or like the Betamax, Walkmans and the Lib Dems has it become a relic of a bygone era?

In the original research, Fama and French’s Three Factor Model used the Price/Book Ratio as the value criterion but, according to Morningstar, many “value” managers are using Price/Earnings Ratios as an alternative metric, and according to the same article, using P/E’s has performed better than P/B over the last 22 years. Still others use a blend of P/B, P/E’s and P/CF (Price to Cash Flow); all three have their uses of course, but it is necessary to understand what each ratio is actually telling us. Not all of them have equal merit, or informative value. In extremis, they can actively mislead, creating “Value Traps“

Of course, no metric is perfect or right all the time. But it is vital to know how the company is actually faring, devoid of as many distortions as possible. There is no absolute precision in any of these metrics: Price to Book relies on accurate measurements of the realisable value of the companies assets – how much machines etc. used in the business are actually worth to someone else in the event of liquidation. Price/Cashflow relies on a realistic measurement of likely capital investment needs (after all, one can improve the P/CF measure simply by not investing!), and the duration of time needed to achieve it. Price/Earnings ratios are the ones most fraught with difficulty, and so we shall primarily focus on this.

The first problem is how to assess the earnings from a quantitative perspective. For example, a share priced at £1 with earnings of £0.1 would be on a price to earnings ratio of 10 (£1/£0.1). If earnings rose to £0.2, the P/E would now be 5. But if we are at the top of the earnings cycle, then this may be misleading (and vice versa at an earnings cycle low, where the earnings may be £0.02 ). Thus, the share looks cheapest at the top of the cycle, and looks most expensive at the bottom (when earnings have been crushed). Of course, this applies primarily to cyclical businesses (commodity companies for example), but the principle holds for most (except for utility firms, who are not really affected by economic growth one way or the other). One way to do this is to use a normalised P/E:

It is an economic identity that EPS = Book Value X Return on Equity (1)

If we know what the Long Term ROE is, then we will have a good idea of what a company is capable of sustainably earning. This allows us to ignore one-off boosts (or falls) to earnings and focus on the longer term trend. It also allows us to ignore the effect of inflated profit margins, earnings add-backs, restructuring charges and other one-off “adjustments” that companies like to employ to boost quarterly earnings.

It is also the case that using a “forward” P/E is fraught with danger. Analysts’ forecasts for corporate earnings are frequently over-optimistic (to put it politely). The higher one’s E is, the lower one’s P/E becomes, so errors in estimates (almost exclusively to the upside) reduce the ratio, making the shares appear cheaper. An understanding of the behavioural influences on analyst forecasts (overconfidence, the tendency to extrapolate the past forward, and the need to sell shares to investors) can help to avoid the worst “traps”. We cannot be sure of their accuracy, and thus the true nature of the value therein. The avoidance of errors based on invalid assumptions are the key to successful value investing, as these errors will, at best, delay the realisation of profit from the factor, and at worst eliminate it.

But this only gets us so far – we still have to contend with the qualitative aspect of earnings. This is where the use of “earnings management” comes in: as this article (from as far back as 2009) points out, the grey areas of financial accounting give rise to all sorts of opportunities for earnings shenanigans. More recently, Schroder’s Value team weighted in on this subject, asking how “exceptional” are some of the items disclosed to investors in companys’ annual results.

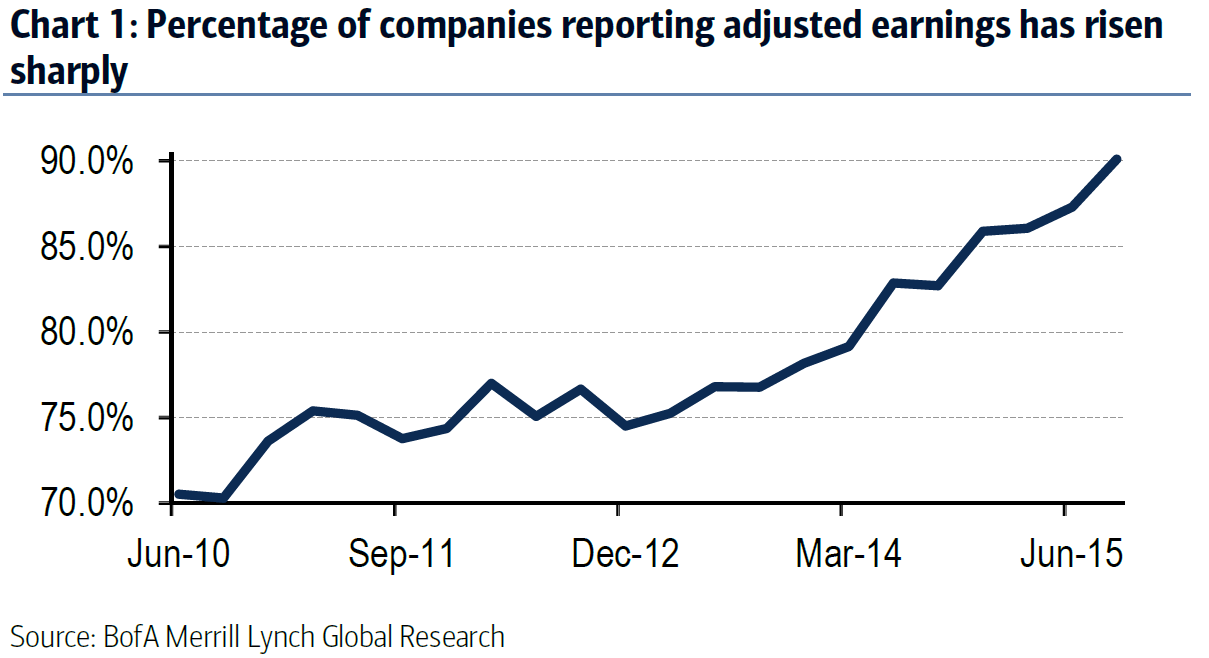

The use of “adjusted earnings”, rather than “Generally Accepted Accounting Principles” (GAAP) has risen sharply, especially in the last three years, as the chart below shows. It is an attempt to flatter earnings, boost investor confidence (and helps keep borrowing costs down, particularly for highly indebted companies).

Thus the quality of earnings are as important as the quantity. A failure to allow for this may render the valuation of a company, sector or even a market wholly inaccurate.

Why is this earnings manipulation occurring? The main reason is probably that the stakes are getting higher, and CEOs are struggling to generate meaningful growth in the current economic environment (see chart below). There is therefore a temptation to “buy time”, with a little exaggeration here, a small “tweak” there, and hope they can make it up the next quarter. Once this begins, however, it is hard to stop the habit, and can lead to outright fraud in the worst cases.

.png)

Whatever the causes, it makes it very difficult to use P/E, especially in isolation, as they can be very misleading. There is no silver bullet for this, and a blend of many indicators may be the best we can hope for. But as long as we understand the underlying rationale for “value”, we can explain why it works, and accept it when it doesn’t. Nothing works forever; we need to be able to rationalise the process, so that clients are not tempted to abandon a strategy that has proven itself time and time again. We know it works-we just have to be around long enough to benefit from it.

(1) If a company has a book value per share (the worth of all its assets) of £10 and a long term return on equity of 10% (which is the rate of profit on its assets), then normal earnings would be £10 X 10% or £1 per share

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.