“Live everyday as if it were your last because someday you’re going to be right.” – Muhammed Ali

There appears to be trouble ahead – the Brexit Vote, the US Presidential election, and the tensions arising therein, have created a dangerously entrenched set of opposing sides. It is happening across the globe, with potentially de-stabilising effects on markets. There are a number of flash-points which bear close attention.

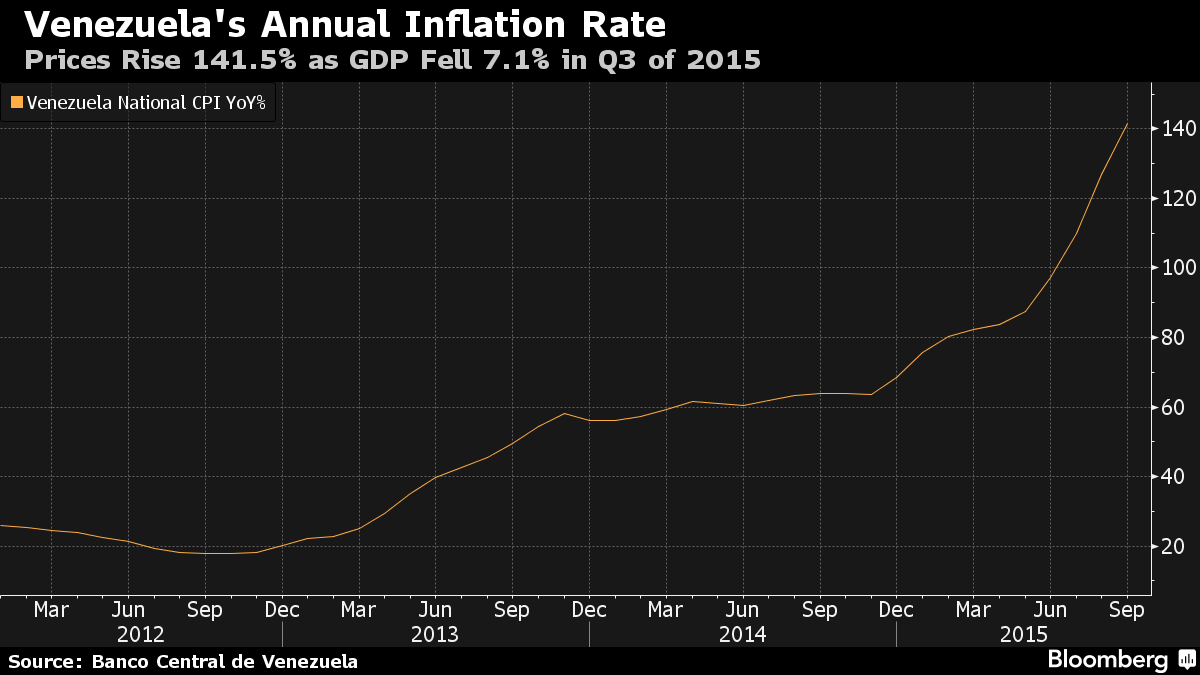

First stop on our global tour of malady, is Venezuela: in a country with the largest proven oil reserves in the world, people are looting shops, eating domestic animals and watching those few items on the shelves rising exponentially in price as hyperinflation takes hold. Meanwhile President Maduro blames US Foreign Policy rather than his own socialist policies. He has announced a state of emergency to foil “subversive plots”, whilst his population literally starves.

[Jeremy Corbyn, a previously vocal Maduro supporter, has been quieter than usual on this situation recently. Is this what a Corbyn socialist Britain would look like?]

The Venezuelan inflation rate has rocketed as money is rapidly becoming worthless.

Next stop on our odyssey is France, where according to the evil Capitalist-promoting lap-dog The Guardian, France is on a collision course with economic reality, as they blockade roads, burn tyres and march angrily through Paris, all the while demonstrating the absolute necessity for enacting the pitifully small labour law changes that Francois Hollande, the Socialist President, wants to introduce. It’s always tempting to take an instant dislike to the French – it saves time – but recent events have started to get more serious. Ahead of the European Championship football tournament which starts this week, there is widespread disruption, not to mention fears concerning ISIS terror threats aimed at the games themselves. It has been the case that the Left (the CGT Union is staunchly Socialist, some say Communist), is leading the charge, organising the blockades etc, but with Holland’s approval rating at a rock-bottom 14%, it is clear that most people would like to be rid of him. Like a lot of electorates, the French appear tired of the establishment and their failure to re-establish “growth”. The labour legislation seems to be the spark for, rather than the cause of, the unrest. Meanwhile France appears to be shutting down.

Going East, the drop in oil prices have led to increased pressure on the Saudi currency, the Riyal, which has been made worse by the Authorities’ decision to ban future sales of products designed to benefit from the Riyal’s fall. Promises of austerity, higher taxes and subsidy cuts are not likely to endear the regime to the locals in a region that have already had an Arab Spring in the recent past. That we haven’t heard about unrest recently (the last suggestion of trouble was in January), may be a function of the Kingdom’s news management prowess rather than popular acquiescence to Government policies, and as we saw in 2010, events can move rapidly out of control once they begin.

Alighting in the US, we find that Trump supporters were subjected to violent assaults as they emerged from a rally in San Jose, California, as students in particular vent their anger at his candidacy. That it may help to legitimise him in many eyes has clearly escaped them, but it clearly demonstrates that for some, this is a life or death issue. As Scott Adams writes, Clinton has compared President Trump to Hitler, nuclear conflict and implied that a race war is imminent (which is scaremongering of an almost Cameronesque nature). The danger, as he says is that once one compares Trump to a genocidal manic, you are implicitly giving moral permission to kill him (which is clear incitement to violence). A political scientist, Wallace Sayre once proffered the theory that academics’ disputes are bitter because the stakes are so low – the stakes are rising rapidly as we approach November, with no sign that this bitterness will recede either before OR after the result is known.

Socio-economics has long posited a link between economic trends and societal changes (for example, revolutions tend to occur during or at the end of economic downturns), leading to a connection being drawn between the Stock Market and social mood. Normally however, the top in markets precedes the obvious change in social mood, rather than the other way round, which makes things a bit tricky to unravel. Regardless of whether this is correct, it behoves us to watch events closely, as they may signify something important ahead. Thus far, most of the insurrection has taken place at the ballot box (see here too), but the degree of animosity between the competing sides suggests that there may be trouble ahead, precisely because in a close election result, nearly 50% of the populace will be unhappy with the result: then what?

Up-date: a Poll out today (Wednesday), shows that the British are not alone in Euroscepticism: the migrant crisis, the economy and “ever closer union” appear to be losing support (except from the young). As the article concludes ” We have not yet reached a flash point, but it’s coming”.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.