“The secret of success is sincerity. Once you can fake that you’ve got it made.” Jean Giraudoux

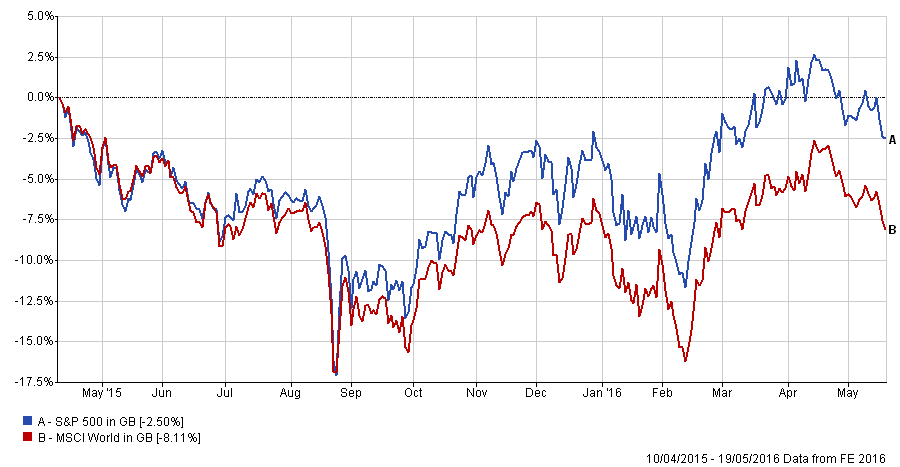

We have seen a series of big rises and scary falls in the last year. Since the April 2015 highs, the market has gone nowhere, but very fast.

As the market continues its most recent ascent, participants are getting increasingly nervous. As the chart below shows, Fund Managers have been hoarding cash, and according to Bank of America’s regular client survey, so-called “smart money” have been net sellers for 17 consecutive weeks ! [1] [Up Date: According to Lipper Fund Flow data, the selling continues, especially of equities:

“Equities continued to experience outflows and lost $3.32bn (-0.1%) last week, their 4th consecutive decline. Year-to-date, equity funds have lost $58.6bn (-0.6%), the largest ever dollar outflow in any 22 week period for the asset class” Bank Of America’s Michael Contopoulos ]

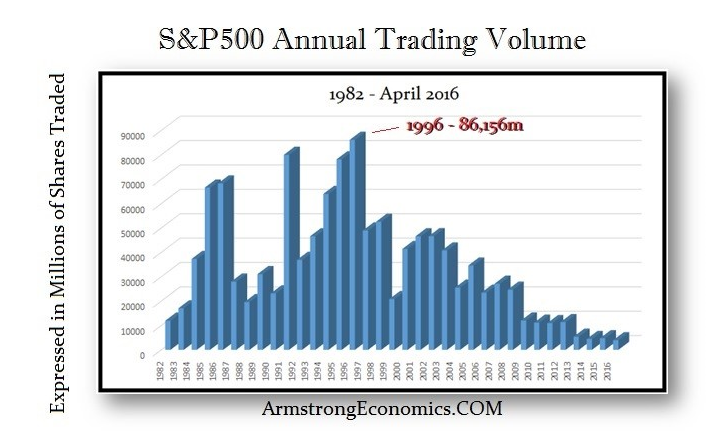

Meanwhile the long term trend of falling volume (and thus liquidity) continues, as Investors pull back from activity and by extension, risk.

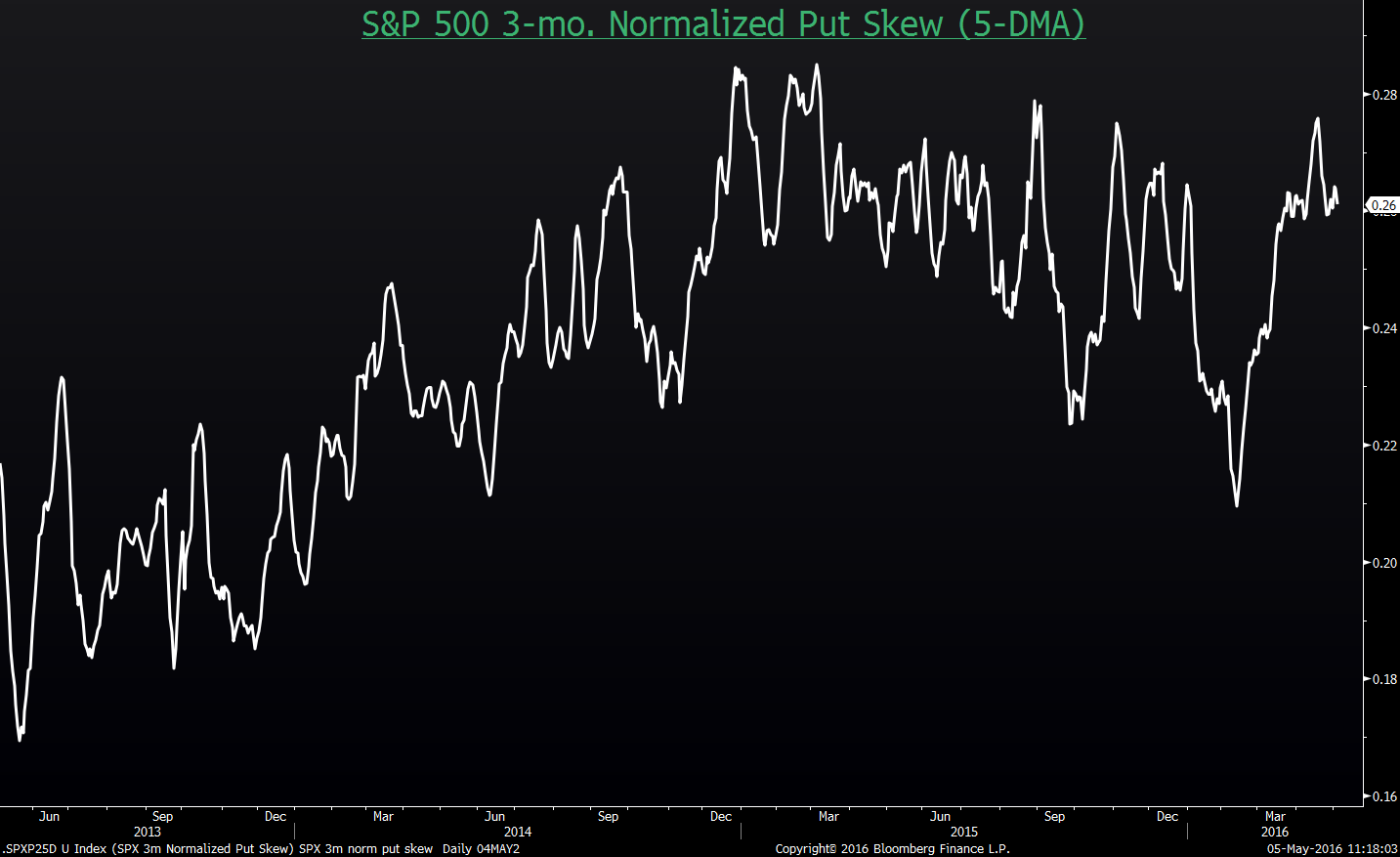

Meanwhile, Put Skew sits close to record highs, as traders worry about “tail risk” [2]. Indeed, yesterday (Wednesday) saw the ISE (International Securities Exchange) figures for the Put/Call ratio , which measures investor sentiment, showing the 10th most bearish reading in the exchange’s 10 year history. Normally, the ratio gets bearish only after the market drops, which makes these readings very atypical. Despite the markets relative strength, traders and investors remain inordinately cautious.

It appears everyone is selling, but to whom? Corporate buy-backs have been a potent force for the last few years, as they try to boost earnings per share by reducing the divisor-the number of shares outstanding [see here for more on this], though this appears to be flattening out at present; those traders that are short of the market are also under immense pressure to buy back shares, which accounts for the rally since February (possibly), but this week it has re-surfaced , with the “most shorted” stocks leading the rise. It has been a rough time for hedge funds in the last few years, and it looks set to continue, as the market appears to be like a Duracell Bunny that will not stop rising, no matter how the professionals wish it otherwise.

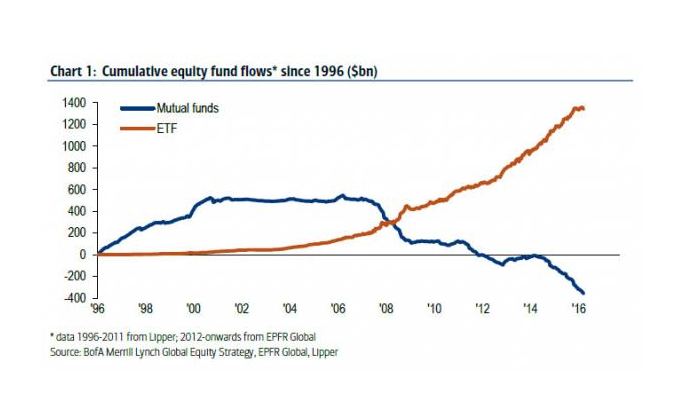

But there is a more interesting (possible) explanation: the chart below shows the long term trend with regards to investor’s changing attitudes to their assets. One would not be going too far out on a limb to suggest that Investors are abandoning fund investments (which are mostly Actively managed) in favour of ETF’s (a large majority of which are Index/Factor-related, and are therefore more Passive in nature). The debate between the two appears to be largely over, with even the CFA Institute (not known for their pro-passive stance), conceding the reality. As Larry Swedroe has maintained (here), the Active Management industry has peddled excuses for their failure for years, but it appears investors have stopped listening.

Markets exist to maximise trade- if there is an imbalance, prices will move to exploit this fact, ensuring that the majority of investors are “wrong” at any given point. Given the large degree of scepticism (some might say outright pessimism), about the economy, markets etc, this will manifest itself in periodic sharp rallies as bearish investors are forced to buy back their shares (at a loss). This could go on for a while- although Index/Passive AUM (Assets under Management) continue to rise, it still represents only around one third of all equity fund assets in the US, and according to this FT Advisor article , about 13% of all UK investment funds. This might explain the seemingly perverse- that institutions are bearish but markets continue to rise, because they have failed to spot the emerging trend: City/Wall Street investors refer to retail investors as “dumb money”, but it was not individuals who bought Russian bonds, took out leveraged mortgage bond positions, and they (generally) dont pay insane fees for lousy hedge fund returns. It was RBS economists who, in mid January , told us to “sell everything”, panicking in a very “dumb money” sort of fashion. That advice has now lost anyone foolish enough to listen to economists 7% in missed returns (basis the MSCI World Index), and 8% in S&P performance.

So, are we on the right side of history at EBI ? Who knows, but we can be sure that the Active Management industry (and particularly Hedge Funds) have a lot more pain to go through before we find out. The “smart money” appears dumber by the day…

[1] Of course, the market has been rising for most of that time, so it is debatable how “smart” this money actually is..

[2] This refers to the possibility of a major market fall. It measures the difference between the prices of S&P 500 put options at the current market level (2090 presently) and those around 1950 (6.6% below the current market level). The latter options reflect the perceived risk of a major market decline. The higher the skew number is, the more investors and traders are expecting a large market fall (as reflected in a rising price differential between the two options). In statistical jargon, this reflects “tail risk” , namely the possibility of a major market move (in this case to the downside).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.