Ricky Gervais on intelligence: “Some of you are really smart. You know who you are. Some of you are really thick. Unfortunately, you don’t know who you are.”

Every week at the close of US markets on a Friday, the Chicago Commodity Futures Trading Commission releases its Commitments of Traders Report, where it details the Open Interest in Futures and Options in various assets and commodities markets. This data, current to the previous Tuesday, details where and to what extent traders, investors (and individual investors) are positioned and is keenly watched by many to try to ascertain what other investors are doing with their capital.

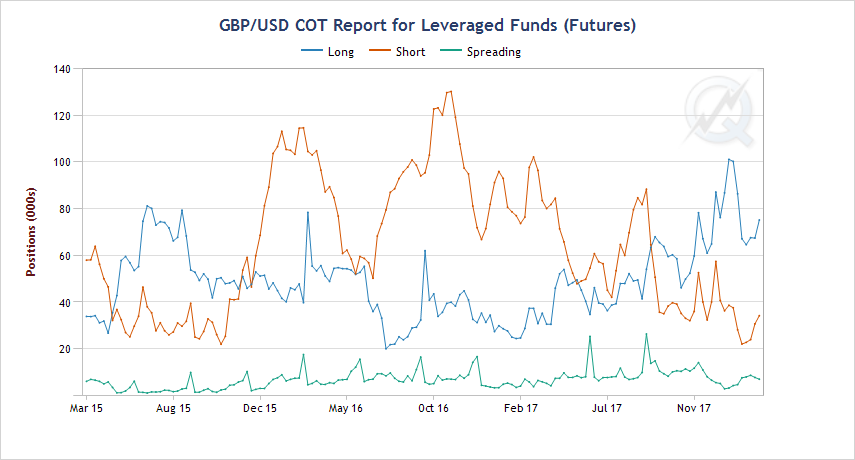

If you go to the CFTC website and go to the Financial Futures Report you will see all the details of holdings in a wide variety of currencies and Indices traded on the Chicago Mercantile Exchange. We shall use the GBP (Sterling) contract to see what can be gleaned by investors.

There are three categories of investor represented in the table, the Dealer/Intermediary, the Asset Manager and the Leveraged Funds groups. The first group are the big trading houses (e.g. Goldman Sachs or Citibank for example) who do this sort of thing for a living and are thus considered to be “smart money” (obviously, if they were not “smart”, they would not be in business long – ignoring bailouts for a second). The second group is Fund Managers of various types, who will often deal in currencies to either buy assets (shares or bonds) denominated in those currencies or use the futures market to hedge their currency exposure in those assets. For example, in the last 3 years or so, it was commonplace for fund managers to buy Japanese shares (which potentially required them to buy Yen to pay for the shares), but at the same time, hedge their currency exposure, as they were expecting the Yen to fall against the Dollar, which required them to sell Yen futures. Thirdly, there are the Leveraged Fund investors (generally Hedge Funds etc.), who are generally seen as trend followers (which means that they tend to be most bullish at market tops and bearish at lows) [1].

So, what does the latest report reveal about investor positioning?

The chart below shows that Leveraged funds are as long Sterling as they have been in the last 3 years (blue line). The chart below that shows what happened 3 years ago. A 24% decline, which was accelerated (but not caused by) Brexit. Having been long at the highs, speculators reached their maximum bearishness at the subsequent lows. This is not a new phenomenon – it repeatedly recurs, as “popular” strategies become crowded, leaving progressively fewer investors left to buy them. Indeed, it MUST occur, as those who are “early” look to sell to the latecomers.

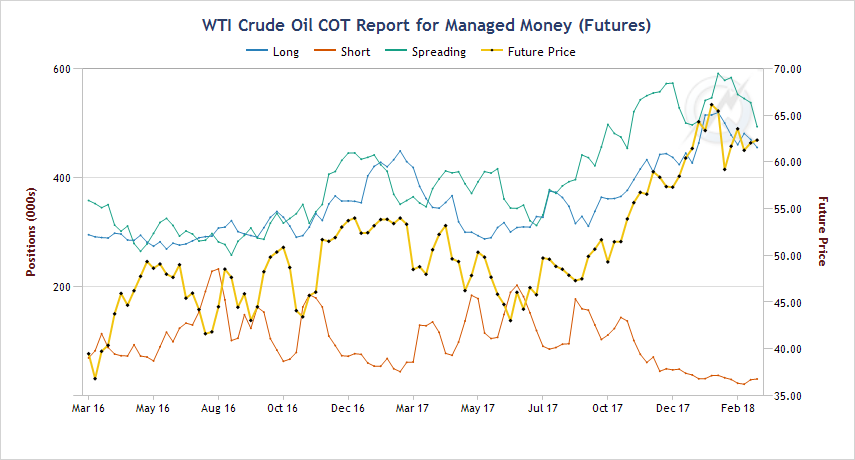

After a sustained bull market in oil (no doubt helped by US Dollar weakness), Managed Money (speculators) are also at 2-year highs; meanwhile, Producers (the Oil Companies for example) are much less long (and thus much less bullish). Who will be right? History favours the latter and as of this week, they remain skeptical.

More topically, the spike in Volatility during February can be traced back only a few weeks; at the end of 2017, net speculative shorts on the VIX Index reached all-time highs; what followed was a historic VIX rally that wiped out one hedge fund and lost some investors 80-90% (in one day!). Familiarity breeds contempt it is said, but over-popularity just as certainly breeds losses – the more popular the bigger the scope for loss.

This is NOT a timing tool, but it does warn us when markets are getting too carried away by sentiment (or simply price action) and helps us to avoid trading on the basis of popularity alone. For example, the current data shows that Hedge Funds are short Dollars against nearly every major currency at present; it may not be an opportune moment to invest in something that requires US Dollar weakness to profit (e.g. commodities). That is NOT to say they won’t rise, just that they may not rise immediately.

5 years or so ago, investors were extremely keen on “Income Investing”, buying high yielding shares as an alternative to the low interest rates prevailing at the time, but as an idea gains traction, it sows the seeds of its own downfall, as too many investors are on board. In the last two years (according to FE below), the UK Equity Income sector has underperformed the FTSE All Share Index by 3.2% per annum and by even more on a Global basis – once everyone has bought, there is nobody new left to buy and thus prices can fall under their own “weight” simply through a lack of further buying impetus.

Of course, nothing is certain in markets: more information does not always lead to better decisions. Indeed, the opposite can be the case, especially if it leads to overconfidence (i.e. over-trading, or bigger exposures to Active funds for example), or that it tempts us to “over-think” things – one might have imagined that knowing in advance the result of the Brexit vote, or the US election would have lead to big profits from market falls – quite the opposite. The rule of thumb that states that markets generally rise and that market timing is futile might have been ignored in these instances, to the investor’s huge detriment.

We at EBI can never be accused of being trendy; but we can’t be charged with doing too much either. Compositional changes to our portfolios have to pass such a high bar that more often than not the precautionary principle (“first, do no harm”) applies, leading us to do nothing. It is important, however not to confuse no action with indecision. It’s just that the dangers highlighted in the previous paragraph outweigh any potential benefits of changing funds, strategy etc without extremely careful consideration. Given that what we think we know is almost always less than what we do know, it is by far the most prudent option. As any football goalkeeper will agree, one’s mistakes are often remembered far more clearly than one’s saves…

[1] The final category is that of Other Reportables, who are generally small traders, who are often trend followers too but are not considered to be large enough to influence market dynamics to a significant extent and so are often removed from the overall market picture.

We have covered this issue before, see here and here for more detail on the theory of Contrary Opinion and how and why it works in practice.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.