The hypocrisy of some is that we like to think of ourselves as sophisticated and evolved, but we’re still also driven by primal urges like greed and power- Michael Leunig (Australian Cartoonist and Poet).

[This posting serves as an adjunct to the latest Wendy Cook article, posted on Tuesday, regarding Structured CD’s in the US. What follows is a more UK-centric version of same].

—

Last week an adviser asked me about a new Structured Product a client had shown him. My first reaction was to rubbish it. However, I felt duty-bound to delve deeper into it. What I found made me wonder whether I had under-reacted! What I want to show today is not only how bad these sorts of things are for Investors, but how these firms make money on them (at the investor’s expense). Indeed, given access to these markets, investors could actually construct these products for themselves.

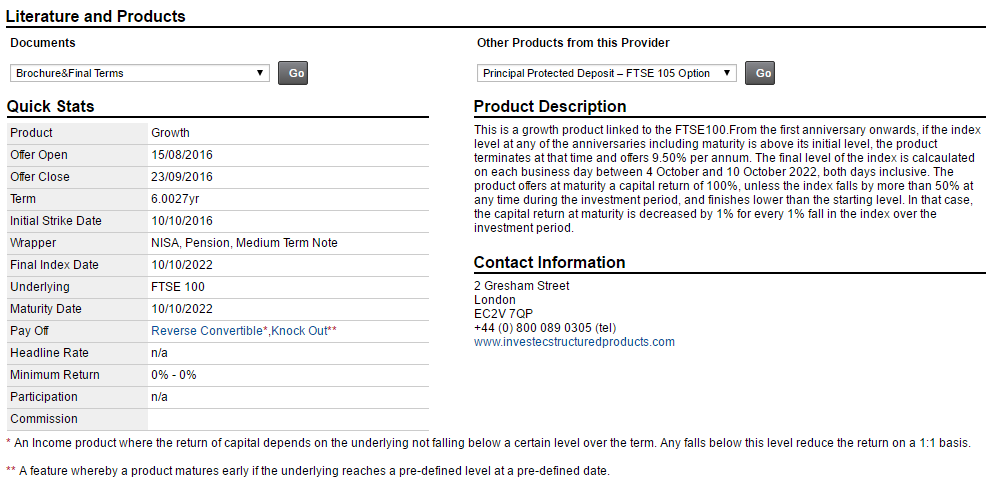

The plan itself, which I shall highlight is via Investec; is by no means unique, except in the sense that it does not include the word “Guaranteed” or “Protected” in the name, but it still possesses all the essential features of a structured product, namely the implied separation of risk and reward, with the promise of better returns than are available elsewhere with little or no risk. Unfortunately, in a world of zero-yielding bank accounts and what appears to be highly volatile equity markets, this has a powerful resonance with investors. The Factsheet is presented below.

There are a number of problems with this Information (aside from its brevity).

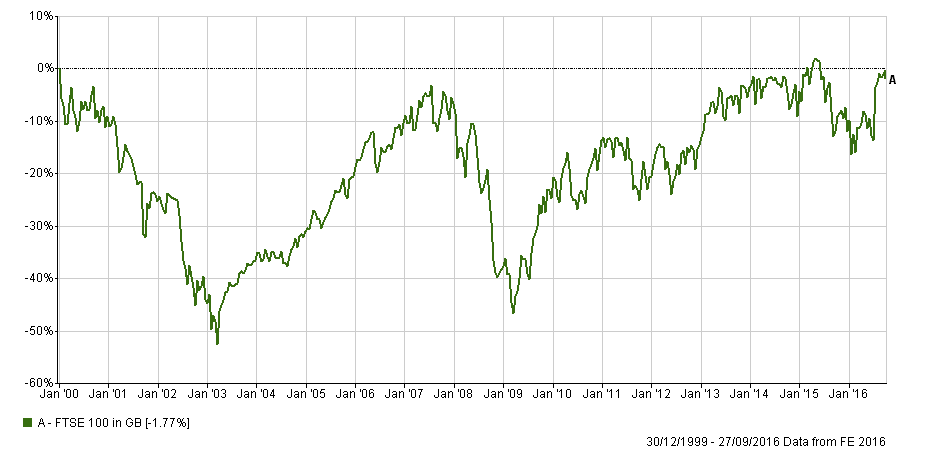

1) Prominent under the Quick Stats is the Minimum Return figure of 0%, implying a risk-free investment. Yet, the product description indicates (at the end), that in fact, the investors are exposed (one for one!), to the downside should the FTSE 100 fall by 50% or more at any time during the investment term – and, if it is lower than the starting level at the maturity of the product. The chart below shows that from 2000, and from 2007, these criteria would have been triggered; a close 10% below the original level would have led to a 10% loss for the Investor. (See chart below). This product is by no means risk-less!

2) The Pay off is described as that of a “Reverse Convertible” with a “Knock Out”. These are terms derived from the exotic options market, an especially complicated market unavailable to Private Investors, whose features are not likely to be well understood. I am familiar with the nomenclature (as I ought to be; I traded options whilst working in the City), but are non-City types?

3) 9.5% sounds like a tempting return, but it is not compounded. Thus, if it takes 3 years for the market to rise above its initial level the compound annual return is 8.7% per annum, NOT 9.5%. After 6 years, the annualised return falls to 7.8%. Not bad, but not the 9.5% implied return.

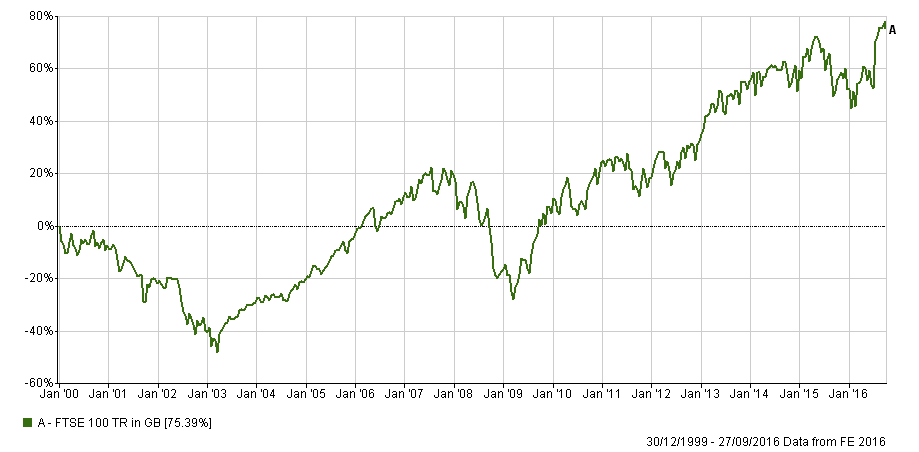

The complexity of the product means that Investors are unlikely to appreciate what risks they are taking. The chart below is from exactly the same period as above, only on a Total Return Basis (the first is price only, as one would not receive the dividends from the Index via this investment). As the graph demonstrates, one would have been much better off just investing directly!

How do firms like Investec do this? It’s actually quite simple (and extremely profitable).

Starting with the 9.5% “yield”, the firm sells a long dated FTSE 100 put option. As of now, the June 2017 3500 Put is trading at 3.6p. Assuming the same Implied Volatility for a one year option (as per the Black Scholes option pricing model) yields a price of 12.9p. So, for a £10,000 client investment, they would need to sell 8 contracts [1].

If the market rises, the client receives their 9.5% return. If not, the process is repeated the following year, and so on until year 6. If the markets fall by 50% at any time, the firm will need to hedge the open option position, but there would be plenty of time to take evasive action from their perspective. Of course, if a 50% fall does occur the investor is now effectively invested in a FTSE 100 Futures contract, with a 1:1 participation in any declines (but capped at a 9.5% rise above the Index start point !).

From the company’s viewpoint, the real beauty of this is access to capital. A mythical £100,000 investment would be essentially a loan to the firm, to do with as they wish. This is a very valuable resource for Investec, but potentially makes the Investor an un-secured creditor of the firm, as it will not be covered by the FSCS; thus, counter party risk is high. Investec has a BBB+ credit rating at present. As this article points out, Lehman Brothers were assigned an A rating by all three of the major credit rating agencies right up until its bankruptcy. It may not be wise to rely on them for an early warning signal.

If something looks too good to be true, it probably is. At best this is a sub-optimal strategy, and at worst a potentially disastrous investment. The product relies on opacity; the more complex it is, the more tempting it becomes (a sort of vicarious kudos). Don’t believe the hype.

[1] The realised sale amount would be 12.9 x £10 (the face value of the option) x 8 = £1032. This covers the £950 liability to the Investor. (There would be a small amount of “margin” or collateral to post too, but nothing significant).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.