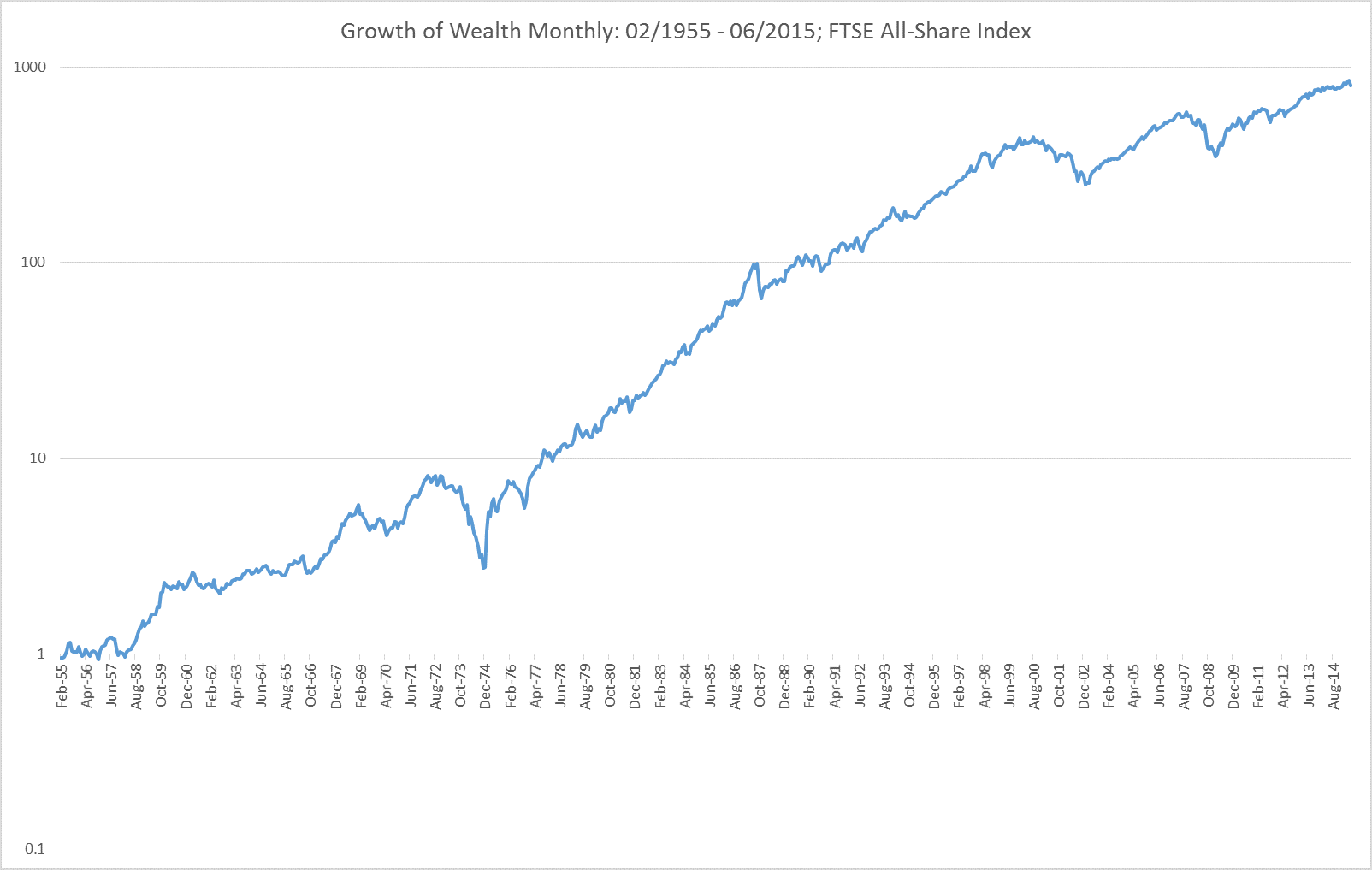

The media frenzy is in full swing today as markets see sharp falls, especially in China (and today Hong Kong). But what will this all look like in 10 (or even 20) years? The chart below shows the FTSE All Share Index on a log basis. Without knowing when it occurred, it may be difficult to see the “crash”, when shares fell 21% in one day(!). This underscores the crucial importance of not over-reacting (or over-analysing) market movements. There is a distinction between the map and the terrain – volatility is the norm, not the exception, and those who can ignore the news, the hype, the scaremongering of the financial media will survive and prosper.

An awful lot of things have happened since 1962, but none of it was terminal. Life (and capitalism) went on, and the long term progress of growth, profits and dividends continues regardless. Remember – there is only one top but plenty of lows in any given time period. The odds are that this is shaping up to be another one…

(CityWire.co.uk 10/04/2012)

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.