“I remember the ….. period as if it were yesterday (unlike yesterday itself)” – Albert Edwards, Soc Gen Strategist.

It has been said that all one needs for bull market success is a long position and a short memory. It appears that despite the evidence of the sometimes disastrous attempts at merging two companies Corporate Executives still engage in pointless, expensive and economically dangerous acquisitions which seem to be motivated as much by ego as logic. So we come to the latest- Standard Life and Aberdeen announced this week that they will “merge” [1] to form a new company (called “Staberdeen” by some wags).

Mergers and Acquisitions are often defended (by the executives concerned) as being about “size” (or scale as they call it). You need to be BIG to succeed in Market A, Sector B, or Industry C. This merger will create a firm with c.£660 billion in Assets under Management (AUM), so it certainly qualifies on that score. Or at least it would, were it not for the presence of Blackrock ($5 trillion) and Vanguard ($4 trillion) in the industry, making them still seem rather puny. The announcement of the merger was accompanied by the usual assurances of “synergies”, and cost reductions (a.k.a. job cuts- possibly as many as 1,000) leading to improved cash flow etc.etc. Even some Brokers are warning of the risks involved in what looks like a desperate attempt to forestall the inevitable.

But how useful is “size” in the fund management industry anyway?

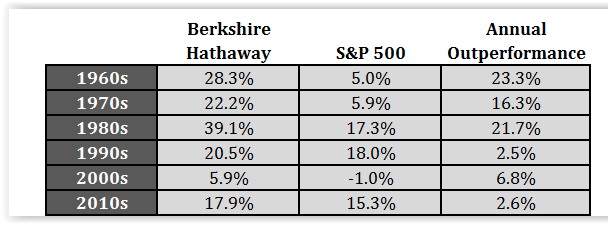

Ben Carlson (Ritholtz Wealth Management in the US) recently showed this rather revealing chart on the world’s most successful investment operation. As the size of Warren Buffet’s Berkshire Hathaway firm rose, the performance dipped relative to the market, demonstrating once again the almost perfect negative correlation between fund size and relative returns- something that should give investors pause for thought. (See our blog on GARS for another example). The fact is that as the firm gets larger, the opportunity set of profitable investments fall, and one has the ever-present danger of other traders “front-running” your ideas, both on the buy side AND the sell side. Positions have to be ever larger to make a difference, which magnifies the negative consequences of investment errors- and if you don’t believe me ask Bill Ackman.

The industry has come under increasing threat from the stellar rise of Index/Passive investing; according to Market Mogul, “Passive funds received inflows of $505 billion last year, now accounting for 29% of assets in the US and 15% in the European markets. At the same time, actively managed funds saw withdrawals of up to $340 billion. Vanguard, the industry leader with over $4 trillion of assets under management, announced net inflows greater than the rest of the asset management industry combined”. Add this with the poor performance of Active Managers, the possible introduction of more transparency in fund pricing to investors and an increase in risk capital requirements to reduce “systemic risk” from a possible repeat of 2007-09, and you have a recipe for trouble, of a possibly terminal nature.

Last year I wrote a blog asking if the Hedge Fund industry was about to face its final curtain, (which hasn’t quite happened); yet, the same may be occurring in the Active world generally. This looks like a defensive merger, from two companies worried about survival, rather than growth. Even if the mooted cost savings (c.£200 million) actually materialize [2], the share price rises on the day (+9% for SL, +8% for Aberdeen) more than take that into account, leaving the market positioning exactly the same after the merger as before. The “Value” thus created still relies on the ability of the two firms to overcome their respective problems, which are outflows, caused by both high fees and poor performance, (from GARS for SL), and Emerging Markets for Aberdeen), neither of which are likely to stop in the short run. Indeed, if clients are not happy with this deal, they could even accelerate.

This will not be the last of this type of Corporate action; as more firms start to struggle, the long-awaited consolidation of the Active Management industry will proceed apace. Whether it will save this increasingly anachronistic relic is another question entirely…

[1] I put it in quotes because the terms don’t suggest a merger of equals. Contrary to the optimistic noises coming from Senior Management on both sides, it appears a completely defensive move, too.

[2] These “cost savings” seem to be entirely for the benefit of the Company’s involved- if so, it will make no difference to the Investor’s fees. If they do cut charges, the net gains for shareholders are correspondingly muted, leaving the share prices up for no obvious reason. Thus, the existential problem for the firms remains unresolved.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.