Blackadder: I was under the impression that it’s common maritime practice for a ship to have a crew?

Captain Rum: Opinion is divided on the subject. Everyone else says you should-I say you shouldn’t. Blackadder. “Potato” 1986.

The Western population is becoming increasingly divided- by gender, race and region. The recent protests against Trump’s election speaks of an enormous gulf between the viewpoints on both sides. There is even a trending thread on Twitter entitled “We can’t just get along”. Now there is news of a potential recount in some states in the US, in an attempt to change the election result!

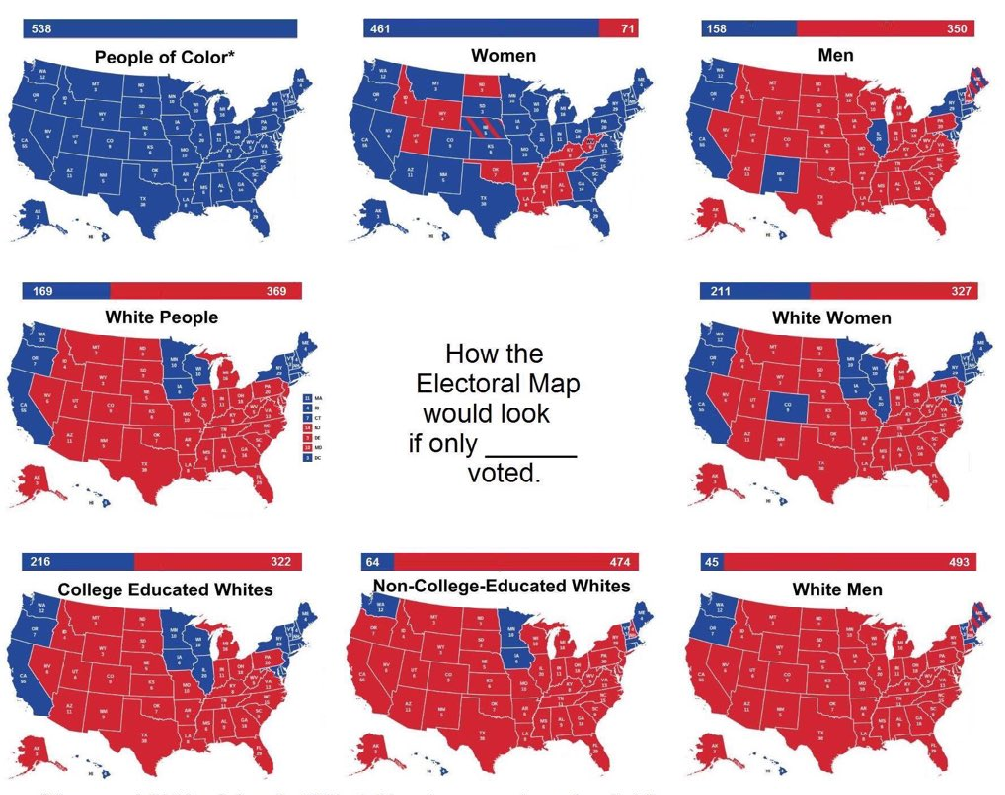

In the UK it was Townies versus Country folk, in the US it was based on both Race and Gender. The charts below demonstrate the split.

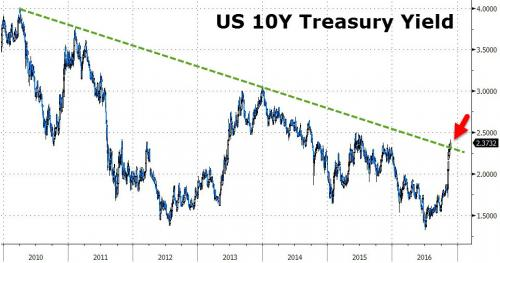

In the words of Vladimir Illyich Ulyanov, “What is to be Done ?” From a stock market perspective, nothing at all- things are going great; the Dow is up 1600 points from the 9th November low. But the map is not the terrain, and we may be looking at the emergence of “political risk” for the first time in a very long while. Maybe this is why US Bonds are falling and have now (partially) breached resistance-see below- its not just US bonds though; all bonds have been sold off aggressively post Trump.

This clearly reflects uncertainty- about the inflationary effects of an Infrastructure boom, the resultant impact on the Fed’s monetary policy (the end of QE?), and the consequences for bond investors. But it also may reflect positioning by investors; for years, bonds have been supported by the reality of huge Central bank buying, at almost any price across the globe. The withdrawal of that prop cannot but have price implications, if Central Banks were to start selling (remember the Fed currently has a balance sheet of over $4.4 trillion) there would be blood on the (Wall) streets.

The fact is, however, that the President does not come into office until early January 2017, and so this is all mere speculation. The market may be correct, but if so, it has largely priced it in already. Selling bonds at this juncture may be too late to positively benefit investors. On the other hand of course, as we discussed in last week’s blog, the global economic backdrop is not conducive to a sustained rise in bond yields. It is impossible to know in advance which is correct and there is no strategy available to allow us to profit from this situation, without taking unnecessary risk.

So what strategy does work? The main defence is diversification; provided one’s assets are un-correlated this provides an effective antidote to whatever comes next. Not only is the risk of actual loss reduced, but the portfolio volatility is lowered, which in turn reduces the odds of clients selling out at the lows. Prospect Theory tells us that we are loss averse; therefore the most important portfolio constraint is NOT to lose money (as far as that is realistic).

There other options though- depending on one’s individual traits, one can choose to look through market turbulence, (i.e. ignore it) or focus on buying Value. We do both of these here at EBI, and are expecting to be able to re-balance within regional exposures in the Vantage portfolios again in the near term (just not the ones we were expecting a month ago !).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.