There is nothing permanent except change

In the early 1990’s Fama and French demonstrated that Company Size and Price-to-Book (Value) explained the majority of investment returns, in what was dubbed the Three Factor model. This was the addition of two factors to the market risk (Beta), that the CAPM stated was the cause of stock returns. These have since expanded to 5 (operating profitability and investment policy), and more recently to 6, as investors have judged Momentum to be a “factor”. It is the last of these that has had the most influence on market behaviour over the past few years, in both directions.

The sharp falls of January and early February already seem a distant memory. Since bottoming around 15,450 on the 11th of February, the Dow has rocketed nearly 1600 points (10%) in a matter of 14 trading days, leading some to declare the market falls over. That may be premature, but there is no gainsaying the strength of the move: someone is buying, and doing so aggressively, and with little concern for value. Naturally, the bears (those with short positions), have been hit hard. Short-covering may have a lot to do with it, but they cannot be the only buyers, otherwise it would have petered out by now. No, someone else is buying.. who?

One of the candidates would be Hedge Funds, whose Investment strategies revolve closely around “Momentum”. This aims to take advantage of the phenomenon whereby a rise (or fall) in the price of an asset will be followed by a continuation of that trend. A more detailed description of the theoretical underpinnings of the strategy can be read here. There is no doubt that it has worked; there is no doubt that it works in different markets and in differently sized and capitalised shares.

So, given that we accept the validity of the general principles of momentum, maybe we at EBI should pile in, buying stuff that has gone up and selling that which has fallen…

Not so fast.

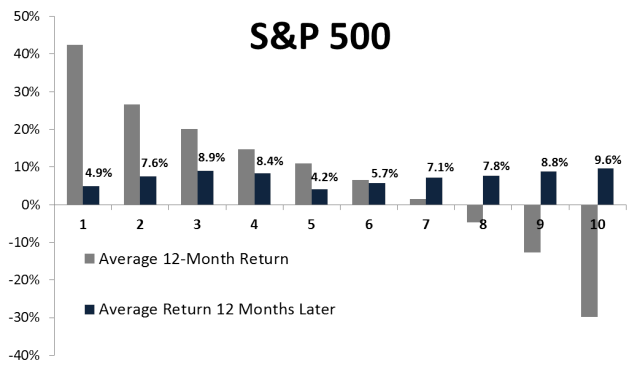

The chart below highlights the almost inverse correlation between the past returns of the S&P 500 and those of the following year. There is no significant pattern between one years’ return and the next. Thus momentum does not seem to be present on a long term perspective, which is of course our preferred time horizon.

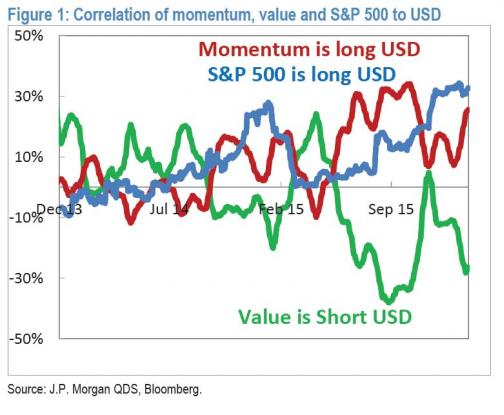

There is another problem with using Momentum as a factor; according to the chart below (from JP Morgan); it’s returns vary widely. In the recent past, it appears to be implicitly long US Dollar (in the S&P, it presently has a 30% correlation with the Dollar as the Index has a large domestic, e.g Technology-related share bias). On the other hand, Value shares appear to be negatively correlated to Dollar strength (via energy in particular). Not only does this imply that the S&P may go nowhere for a while, as it is trapped between a strong Dollar (which favours momentum) and a weak one (which favours value), but that combining the two factors (as the article above suggests is desirable), will yield near zero return on a net, risk-adjusted basis. After all the better the offset between the two, the lower the risk and thus the lower the expected returns on the strategy should be. But our portfolios are tilted towards value, small etc, precisely to capture that premium: there is no benefit to offsetting that return by combining it with momentum – it will reduce overall volatility, but that is why we invest in bonds!

One of the tests of a truly “scientific” theory is that it should be testable, reproducible, consistent with known facts and observations, and that it should be intuitively reasonable, (either via Inductive or Deductive Reasoning). The problem with Momentum investing, is that it makes no real sense to us and contradicts our edict that one should pay as little as possible for assets.

As prices rise, the long term value of the stream of cash flows that the asset throws off necessarily falls, (via the time value of money effect). Thus, the higher the price that the asset rises, the lower the future returns will be. It thus cuts across the principle of Value Investing, where one buys cheap assets (and buys more if they fall further) – Momentum investors do just the opposite. Further, the implementation creates another layer of complexity: what level of momentum constitutes a justification for initiating a new position, and at what threshold would it be liquidated ? We simple folk at EBI advocate a “fire-and-forget” solution- the easier it is to understand a concept, the easier it is to articulate it. It is not clear that the increased costs (via elevated turnover levels etc), justify the incremental benefits of using momentum in our portfolios [It is noteworthy that the AQR article above touches on the costs, but does not quantify how much it costs: (“real world trading costs for all the factors have been far lower than many believe, and this very much includes, perhaps even highlights, the momentum factor. In particular, even rudimentary “smart trading” reduced the trading costs dramatically — perhaps most dramatically for momentum, where the high turnover Professor Fama cites gives more latitude for the “smart” part of smart trading”)]

The history of the 2000’s (and to a lesser extent August 2015, and the first 6 weeks of 2016) show that a pattern of bubble and crash has been a prevalent theme, as investors have all adopted this same strategy at the same time, (helped by the largesse of Central Banks of course), leading to disaster. It has been noticeable that the euphoria/panic /euphoria cycle has been evident again recently as markets see sharp declines followed by equally vertical rallies. To blame momentum investors for all of this may be unfair, but it clearly has a major influence on market movements.

Can we see why investors adopt it ? Absolutely. Will we be monitoring its performance ? Yes. Will we be using it as a part of our investment strategy going forward? Probably not-it just doesn’t fit with our philosophy: we can see no way of efficiently capturing the returns without incurring (different) risks which we cannot justify, either to ourselves, or to our clients.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.