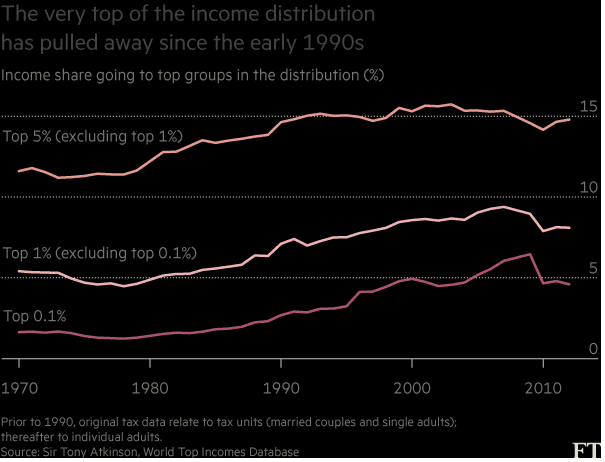

Despite oceans of liquidity, zero (or sub-zero) interest rates and all the politician’s exhortations, Companies appear unwilling to invest. Thus, despite the best efforts of Carney, Yellon, Abe and Draghi, the global economy continues to stagger along, with only stock markets showing signs of strength (and even here, it appears that Investors and Traders are fully invested – and absolutely terrified!) Uncertainty rules, with a myriad of “problems” ahead that could end the bull market in an instant (“could” is emphasized here, for good reason). But what is clear is the Reagan’s “Trickle Down economics” has not happened, with the Gini Co-efficient (a measure of income inequality) rising sharply and staying at very high levels. In fact, income inequality has not been higher since the late 1920’s (which may give us a clue as to how it will be resolved!) In any event, it may (partially) explain Brexit and Trump, as many clearly feel left behind by the march of “progress”.

But what lies behind this dearth of investment? After all, increasing income and wealth are ultimately driven by advances (technological or otherwise) and capitalism has long shown itself to be the best generator of that progress. So what has gone wrong? As I see it, there are 3 possible explanations:

1) Short-termism, both of Management AND Investors;

2) An inability to spot genuine growth opportunities and a lack of courage to invest in them when they do appear, OR

3) There are in fact no such available options and there is therefore, a huge oversupply of capital with few genuinely viable places to invest.

We shall look at these in turn.

1) This is a common refrain. Managers would prefer to maximise short-term profits, even at the expense of giving up profitable opportunities to ensure they can sell their share options at the highest possible price, and cutting costs is an easier (and quicker) way to boost the share price. Executive share options are no doubt a major contributory factor in this, which skews behaviour in this direction, and results in a misalignment in incentives (which is of course what drives most human action). The obsession with ROIC (Return in Invested Capital) targets also contributes to a focus on a short term metric of success [1],

But is it entirely their fault? “Shareholder activism”, which is a euphemism for push the share price up, is also a major worry for managers. So they will do what they must to avoid angering major institutions – in order to keep their jobs. “Activists” too, have pressure for short-term performance; any fund manager risks his career by under-performing even for short periods, and since they have no long-term necessary commitment to the company (after all, if the worst case comes, they can sell the shares), the game goes on ad infinitum.

2) A more worrying (but related) possibility is that Management is not capable of spotting good opportunities even if they appear, and are incentivised by the above factors to err on the side of caution. Thus, “hurdle rates” are set at such high levels that investments never actually get made, despite the fact that interest rates are near zero and share prices have risen sharply, which should lower the break-even point for an investment project. In the “absence” of growth opportunities, therefore, companies choose to give the money back to shareholders, to avoid controversy. (Even Takeovers are now frowned upon – British American Tobacco recently agreed a deal to buy the remaining 58% of Reynolds American it didn’t already own and the shares dropped 3.5% on the day). Unlike previous eras, Corporate animal spirits are closely watched by major Institutions, with a scepticism bordering on paranoia – though occasionally they have a point.

3) This seems to be the most plausible explanation of the 3. The economist Andrew Smithers wrote an article (in 2014) pointing out that Unquoted companies invest twice as much as Quoted ones, a fact inconsistent with claims of a lack of “confidence”, or the degree to which large companies are issuing bonds (i.e. leveraging their balance sheets). But is it not the case that in fact, most technological advances emanate from Smaller Companies anyway? (Think Facebook, and before that Netflix, Microsoft and so on) Larger, more bureaucratic firms tend to buyers of these firms ONCE they have proved themselves (if they can) – it may even be the prospect of floating on the Stock Exchange (and thus riches beyond the dreams of avarice), is what drives the “animal spirits” of these entrepreneurs. It is also possible that Management (and Investors) have noticed that innovation often accrues to consumers rather than the innovating firm, due to competition eroding profit margins. The Internet is the classic example here, but there are many others where the innovator failed to reap the “rewards” of such activity; (this would explain why Warren Buffet and other successful long-term investors tend to buy Companies that have “economic moats”, that is, barriers to entry to protect the incumbent company from competition – Coke, and GEICO, Buffets’ insurance Company are examples of his thinking).

Does it matter? In one (short-term) sense no – if Firms cannot invest the money profitably they should give it back to shareholders, which is what is happening on an enormous scale, particularly in the Western World’s stock markets. Total payouts to shareholders as a percentage of net income are at record levels – see here (as of November 2015). More payouts to shareholders can only be good news (for them) and will act to support prices over the long term, whilst share buy-backs reduce the outstanding share float, meaning that there are fewer shares available, which again will help to reduce the potential selling pressure should markets turn south.

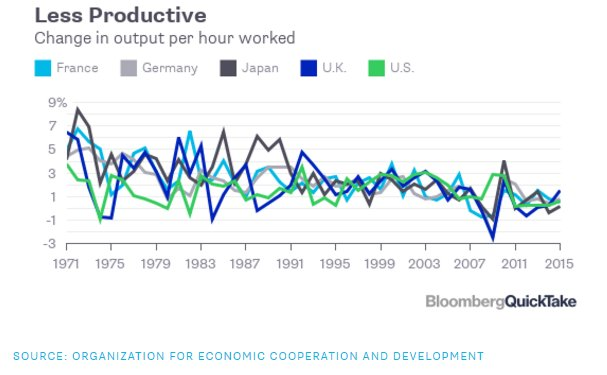

But the chart below shows the consequences of failing to invest. At root, failing productivity leads to lower growth (and wages), but with all the Dow 20,000 hype, no-one appears interested (yet). Has Capitalism lost its dynamism? We may have to wait a while to find out – but for now, Central Banks around the World stand ready to buy more stocks…

[1] ROIC = Net Income divided by Total Capital Invested. To raise the ROIC, simply do not invest in new capacity. Thus the depreciation of current assets will cause total assets to shrink, thereby reducing the denominator. Bingo – you have improved ROIC without doing anything at all! You can, of course, improve your Return On Equity (ROE) numbers too, simply by buying back shares, which is what US companies have routinely done since the 2007-09 financial crisis.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.