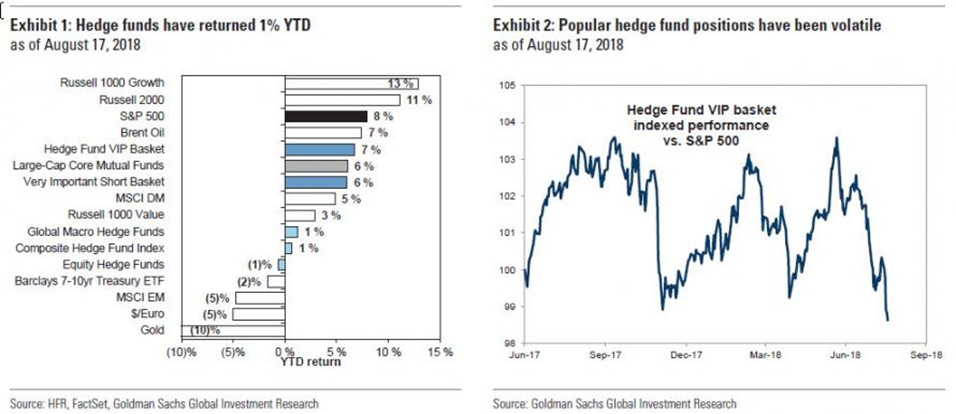

Around 2 years ago we talked about the performance (or lack thereof) of Hedge funds and wondered whether they would survive – they clearly have done so, but the self-styled “smartest guys in the room” are now resembling the dumbest creatures on the planet. After 2017’s volatility-free rise, the masters of the universe unanimously agreed that when Volatility picked up they would be on hand to benefit. A fall in February did indeed allow them to (briefly) shine, such that by the end of April they were up 0.4% year-to-date versus a 0.4% fall for the S&P 500 over the same time frame [1]. It did not last though – as the major indices saw a succession of new all-time highs going into August, the (equity) hedge fund returns fell to -1%, whilst the S&P 500 rose 8% as of mid-August. What went wrong (this time)?

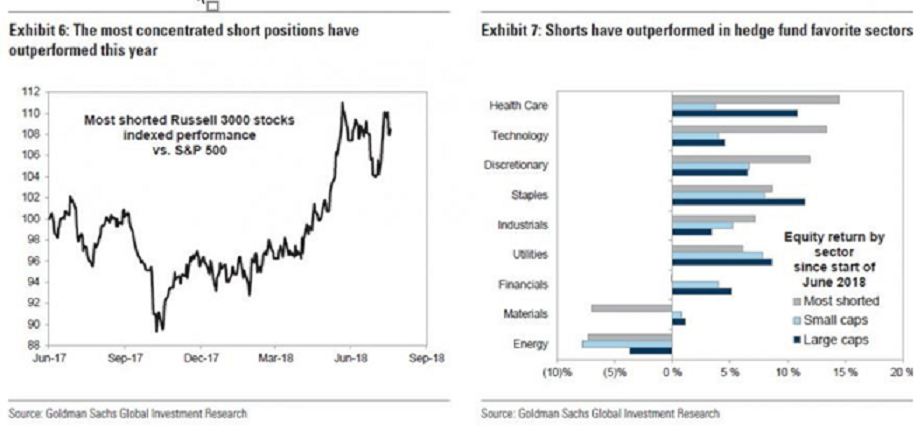

The chart above (right), shows that the shares mostly owned by Hedge funds (a pseudo-Index created by Goldman Sachs) have fallen sharply in the last 2 months or so, the most notable of which is Facebook – it was the most widely held HF stock as of the 30th June, just before the 20% plunge as a result of an earnings “miss”, from which it is yet to fully recover. But the REAL damage has been done to their short positions. A relentless “short squeeze” [2] has decimated their portfolios, such that the Most Shorted stocks (another Goldman Sachs Index construction), have risen 21% year-to-date, beating the S&P 500 by 14 percentage points. Greenlight Capital admitted that it was down 18.3% as of the beginning of August, mainly as a result of selling Tech shares short, though with a bit of “help” from selling Healthcare companies too. One might imagine that this would have given them pause for thought, but apparently not – according to this article, short selling of FAANGs shares has risen by 40% in the last year as Hedge Funds continue to bet against the longest (and some might argue) the strongest sector in the strongest bull market for a long time, if not ever. At present, Technology shares represent half of the worlds most shorted shares.

It is normally at this point that I fulminate against market timing in all its forms, but it may not be the whole story here; there may be an element of ego involved – (the greater the rise, the greater the fall, they suppose – if I do it for long enough, I am bound to right eventually). There is also an enormous amount of “group think” here. All my contemporaries are selling short so I cannot afford to miss out, they “think” – there is said to be enormous pressure to “perform” within the Hedge fund industry, but in reality, it is the fear of being wrong alone that is the overriding concern of most [3]. Of course, should markets actually collapse, the fund manager will be a hero…

This is said to be the most hated bull market ever – by that, commentators mean that major institutions (including but not exclusively Hedge funds) have been warning of, and acting as if, a major crash in shares is imminent. The repeated short-selling has led to one rally after another as short positions had to be bought back, further fueling the rise. Although Corporate share buy-backs have clearly been a positive catalyst for this refusal of the market to follow the expert’s script, another factor has been (much more quietly) just as effective. Over the same period, the S&P 500 has risen 13.2% in Euros, more than the 8% US Dollar gain and more than the decline of the Euro/Dollar exchange rate over the period, suggesting that foreign investors (mainly Europeans?) have absorbed the selling. Given the political and financial fragmentation of the Eurozone in 2018, this may be an understandable reaction. Whilst every analyst and trader expect each new high to be the last, we can be reasonably confident that the high is a long way off still. Maybe the time to be concerned is when they get bullish…

Meanwhile, the market continues to defy conventional “wisdom” once again this year.

[1] Noteworthy, however, is the fact that the Hedge Fund industry saw a 0.38% gain in April alone, so all of the Y-T-D gains occurred in one month.

[2] A short squeeze occurs when the price of a heavily shorted asset starts to rise, forcing HFs to buy them back to avoid further losses, which in turn causes prices to rise still faster, forcing others to do the same, and so on, in a vicious circle (for the shorts).

[3] Also known as career risk – if you lose a lot alongside many others you have little to fear. But if you lose even a small amount alone, you may be out of a job tout suite.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.