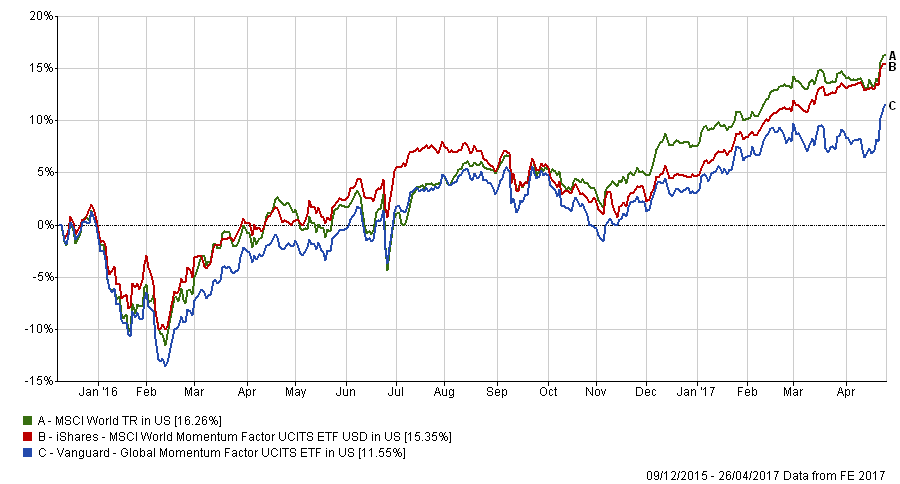

Ever since the “discovery of Fama and French’s 3 Factor Model to explain asset price returns, Investors have been seeking to modify and refine this methodology (as apparently 90% explanatory power was not enough!) In 2014, they added Profitability and Investment return but strangely remained silent about the phenomenon of Low Risk (i.e. Volatility) shares outperforming and the documented (since 1993, Jegadeesh and Titman) evidence supporting the inclusion of Momentum as an investment “Factor” [1]. Some Hedge Funds have a whole raft of Momentum funds available, and it is now possible to buy these in ETF form, as both Ishares and Vanguard have launched products in this area. It is rather early to tell much about the performance of these funds [2], but evidence of the success of Momentum investing goes back as much as 200 years, according to some studies.

So, how does it work?

The strategy is predicated on the idea that stocks (or any asset really) that have done well will continue to do so (in my day, this was called “Trend Following”, but it probably needed a sexier name even then) for much longer than Investors often assume. [This incidentally is why Bubbles peak a long time after most expect them to- in Behavioral Finance terms, Investors are under-reacting to positive news]. Conversely, those assets that have done badly will also continue in that vein. This flies in the face of the “Buy and Hold” philosophy (as personified by Warren Buffett for example) and is a direct challenge to the Contrarian approach adopted by “Value” investors. Some investors use it as part of a screening system to select stocks, but more recently, some have argued that it merits attention in its own right. The main problem heretofore was that it involves quite a bit of portfolio turnover (which can get expensive), but as it is now possible to trade (via Platforms for example) for free -or nearly so- this objection has been blunted somewhat.

Most Momentum investors/funds use a 6 month and/or a 12-month screen to identify potential buy/sell candidates [3]. That is, they calculate the price changes over those periods and formulate a “score” against which they compare all stocks etc. Those exhibiting the highest Momentum score will be bought, and the lowest will be sold (note that UCITs funds cannot short stocks, so they can only be buyers, unlike Hedge Funds, who can do so). As these scores change, the fund buys or sells as appropriate.

Does it work?

Researchers using up to 200 years of data, in both the UK and the US have confirmed its persistence and consistency across both markets AND time. It appears to have beaten (on a risk-adjusted basis) the returns to Value or Small Cap styles. In addition, the returns are negatively correlated with both of these, which serve to improve overall Portfolio efficiency, when Investing across Styles. A highly volatile market serves the strategy best, and though market volatility (as measured, for example by the VIX index ) realised volatility (i.e. that actually experienced in real time by Investors) has been much higher, helping the strategy over the last 6 months or so.

Of course, NOTHING works all the time- in the wrong hands, nearly anything is dangerous after all. The strategy can be high turnover (and for some, tax-inefficient) and is subject to potentially large draw-downs, (the so-called Momentum Crashes ) particularly at market inflection points. It seeks to take advantage of Investor errors, fear, greed, overconfidence, and herding etc. which are highly unlikely to disappear anytime soon, so it may be that the phenomenon can prosper beyond the QE-driven investment environment we are now in.

We have incorporated Momentum into our Varius equity fund holdings, which currently have a c.13% portfolio exposure. It acts as a portfolio diversifier, as the strategy is negatively correlated with Value, and positively correlated with Growth, potentially leading to improved risk-adjusted returns. In so doing, EBI is effectively using it as an overlay onto the Value/Small Cap tilt that we employ within the Portfolio (as with Vantage).

[1] A recent Blackrock study (link here), updates the thinking and data behind this strategy.

[2 I have put the returns in US Dollars, as it is the Global Currency, but the Sterling returns are very similar in relative terms.

[3] This pdf describes Vanguard’s investment process. Most Momentum funds use a variation on this method, with only the time period differing.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.