“Life is a series of natural and spontaneous changes. Don’t resist them; that only creates sorrow. Let reality be reality. Let things flow naturally forward in whatever way they like.” ― Lao Tzu

Last month, Vanguard announced that it is to offer UK investors a lower cost investment Platform, in a direct challenge to the incumbent behemoth Hargreaves Lansdown (HL). The immediate reaction was an 8% fall in the latter’s share price, as speculators pondered the demise of another Active-promoting financial services provider. Completely co-incidentally, the firm announced two days later a couple of executive departures and a decision to reduce financial disclosures going forward, possibly not what Investors are looking for at this time.

First, the details.

The Platform will charge 0.15% per annum (plus the underlying fund fees), with the charges being waived above £250, 000 meaning that nobody will pay more than £375 per year. One will only be able to buy Vanguard funds (initially at least), which will include Index funds, ETF’s the Life Strategy range, as well as 4 Actively managed funds, but that may change, depending on Customer demand. Importantly, there is a very low minimum lump sum/monthly savings limit, making it within the reach of ordinary investors- previously, one needed c.£100,000 to be able to use their services.

They are also not ruling out the possibility of introducing an advice option, but given the number of Advisers who use their products, that may be a little like biting the hand that feeds…

Analysts generally are skeptical- Jefferies Securities analysts, alongside those of Peel Hunt have wondered whether this move represents a new dynamic and that HL’s market dominance (its market share of the Platform business, according to Platforum, an industry consultancy was 37.8% as of September 2016, up from 35.9% a year previously) will protect it.

Interestingly, one of the other points made was that Vanguard is relatively unknown among the UK investing public, an issue I discovered to be alive when I attended a Vanguard Insight day only a fortnight ago. I was amazed to hear Advisers tell the assembled group that their clients did not know who Vanguard were. If true, then the process may be a bit slower than they (Vanguard) , might hope for, but they have deep pockets and are very (very) patient.

HL’s Chief Executive, Chris Hill was sanguine about Vanguard. “We welcome competition, that’s good for the consumer”, but to quote Mandy Rice-Davies “he would say that wouldn’t he”. AUM (Assets under Management) for the firm is currently c. £77 billion, which leaves an enormous amount for them to lose. A quick glance at recent history shows that a trickle can soon turn into a tide (as Active Managers generally are now belatedly realising), and a sizable proportion of that £77 billion could soon walk away, absent a price response from HL. They are thus faced with the choice of cutting prices now to preemptively deal with the issue (and taking the hit on profits and probably the share price), or waiting to see the reaction. It is likely that they will refrain from acting, opting instead to observe the effects; this may turn out to be a major mistake, but one that most Active Managers have made already.

Of course, there is the question of whether Investors will “buy ” it. In a country where repeated exhortations to switch Electricity providers to avoid overpaying have been ignored, whilst large numbers of mortgage holders don’t seem to want to pay less than the SVR on their mortgage, one is tempted to wonder how much difference the mooted 0.3% p.a. reduction will make. [HL’s average charge is 0.45% per annum, compared to the anticipated cost of 0.15% p.a. for the Vanguard platform]. There again, it is reasonable to assume that those who are actively choosing to save for their retirement are likely to be more motivated to switch providers, should a suitable alternative present itself. Can Advisers really justify a more expensive alternative and remain within suitability requirements? In this day and age of easy access to complaints procedures, that may be an important factor.

This is most definitely a marathon, rather than a sprint. It will take a long time for the full story to play out, but it is yet another sign of the changes afoot in financial services, once again instituted by Vanguard. The Peel Hunt analyst suggested that “it probably makes more sense to try and buy Hargreaves rather than reinvent the wheel”, (no doubt with an eye to all those M&A fees that could be earned), but this is to misunderstand the Vanguard ethos. They are not here for a quick return; Indexing took decades to become the Juggernaut that it now represents and they do not expect it to be different here in the UK. As a mutually owned organisation, they do not have the short-term pressures associated with a stock exchange listing and can thus ride out any setbacks. The excessively profitable Financial Services industry is about to be “disrupted” further, and for once, the industry’s loss will be the consumers’ gain. This “Rumble in the (City) Jungle” will be an important indicator of how (and whether) competition works in financial markets. Though they profess commitment to market forces, the big corporations of EC1 and EC2 are much less keen on change when it affects them directly. I for one, will be hoping the reckoning is nigh…

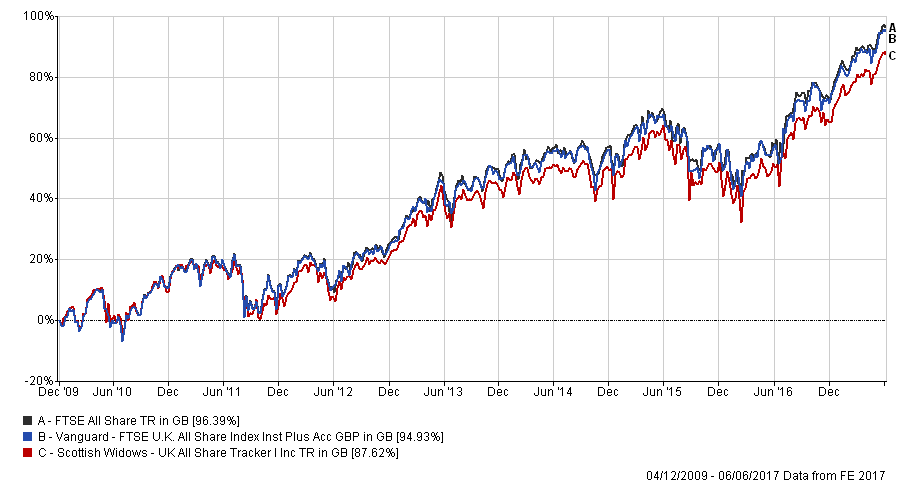

We at EBI use Vanguard funds extensively, both in our Vantage and Varius portfolios, because they do exactly what it says on the tin. If you are seeking to replicate the returns of an Index or Asset class, they are very hard to beat on both a cost and Tracking basis, as the chart below demonstrates.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.