“Victory has a thousand fathers, but defeat is an orphan”. – John F. Kennedy

As ESG/SRI goes mainstream, with more providers offering ethical options for investors, the spotlight has fallen on those shares that do not fulfill the criteria required for inclusion in “Responsible” portfolios. As a result of the potential tracking error risk for Investors arising from wholesale deletions of a large number of firms from the mainstream indices, Fund Management firms have been cautious in what they omit from their Index funds, mostly restricting themselves to 3 main sectors; controversial weapons, Coal producers and those firms that fail to comply with the UN Global Compact on Corporate sustainability.

None of these exclusions are particularly “controversial” – does any investor really want to be investing in manufacturers of biological weapons (depleted uranium shells etc.?) or those that routinely engage in child labour, slave labour, corruption or deliberately pollutive activities. But as the number of shares that definitively fall into these categories is small – according to an iShares study, “Build a Sustainable Core” (available on request), only 4 firms globally are omitted due to Controversial Weapons criteria, 14 via the UN Global Compact, 15 through the Tobacco exposure and 18 due to their involvement in Nuclear Weapons. The potential (Global Index) Tracking Error from these exclusions is thus extremely limited. But there are 51 omissions via the exposure to Coal, equal to all the others combined, so there is likely to be a much greater effect in this sector. One measure of the increased adoption of ESG criteria might be seen in the relative performance of Coal – related shares, so we shall have a look at one of these, namely Drax, which is based in North Yorkshire (Selby to be precise). It is by far the largest emitter of CO2 in the UK, as a result of the coal-burning process used to generate 6% of the UK’s electricity supply. If we are to see evidence of the effect of ESG’s impact, it could be here that we see it most clearly. How has the most high profile investment “orphan” fared in the recent past?

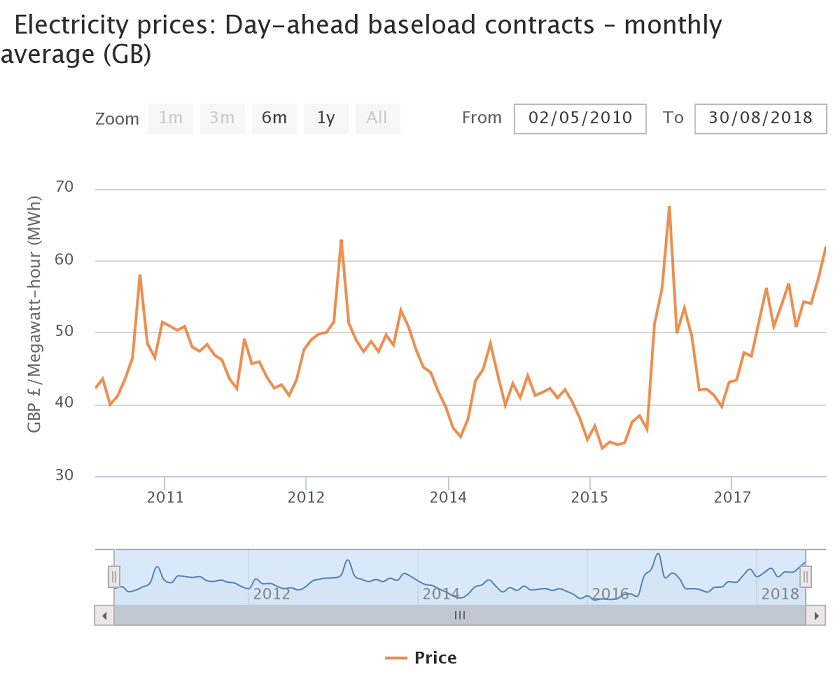

So far, the evidence is mixed. As the charts below show, it has massively underperformed the FTSE 250 Index (of which it is a member), over 5 years but has trounced the Index year-to-date. According to the ONS, coal prices (a cost input) have risen by just 2.03% per annum since the start of 2014, but output prices have not kept pace, resulting in a margin squeeze which has hit profits. But prices have since rebounded (and helped by the Industry’s proclivity for circumventing competition by raising prices simultaneously) and the share price of Drax has recovered sharply this year. So we can reasonably infer that cost input/output prices have been a, (if not the), major driver of the share over both of these periods.

.png)

But what about valuation? We should expect that even if the share price rises, the valuation multiple that the firm commands should drop if there was evidence of an ebbing in Institutional demand for the company’s shares. As the firm lost money last year, the P/E ratio is uninformative (as there is no E), but the Price/Book has seen a steady downtrend in the last 4-5 years, from a peak of 2.11x in July 2014 to a low point at the end of 2017 of just 0.6x. At the current share price (386p), the P/B is trading at a 7.2% discount to the firm’s Book Value per Share of 416p.

Digging deeper into this, we know that, as a result of both EU and UK Government-mandated increases in pollution standards, the last coal-fired power station will be forced to close by October 2025, so we can use that date as a form of “expiry” for the company. We can calculate the present value of the expected future dividends and add to that a residual value of the remaining assets to arrive at an approximate “fair” price for the shares now [1] for the full calculations.

Adding the discounted dividends expected until 2025 (£0.82) to the value of the assets at that time gives us a present value of £3.64 per share, which is extremely close to the current price (£3.65).

All this suggests that the markets ARE pricing the future value of the shares pretty accurately (subject to the caveats re: my calculations below). In turn, it implies that markets have taken the specific circumstances of Drax plc into account already, with the share price moving according to earnings estimations whilst taking into consideration the longer-term effects of “de-carbonisation” on board. This does not necessarily generalise, as, for example, the fate of BP/Shell etc. is as yet unknown with regards to SRI investing trends – if oil use became verboten, then their share prices would suffer, but this is as of now not on the table, either for Governments or investors.

It is hard to say definitively that ESG/SRI has had a major impact on share prices thus far; whilst valuations have trended lower, the shares are more or less where we might expect them to be in this (particular) situation. The jury is still out – we await a verdict.

[1] Using the Dividend Discount Model, we can calculate the present value of future expected dividends; assuming a constant 12p payout over the next 7 years (which may be optimistic, as dividends have fallen over the last 5 years ) the seven payments, discounted by the current Gilt interest rate for the period sum to a present value of 81.98p (as rates are very low, it has only a marginal effect on nominal pay-outs).

We then need to add to this an estimate of the liquidation value of the firm’s assets in 2025, the best estimate for which is Book Value per share today, minus depreciation over that period. According to this article, as of September 2018, two-thirds of its’ power output comes from biomass, (i.e. the burning of wood pellets to generate power). At the current shares outstanding of c.394 million and total productive assets (net of previous depreciation charges) of £1.662 billion, this implies a book value per share of £4.20 – if 66% of those are producing electricity via Biomass (i.e. it will continue to do so post 2025), around £550 million will need to be written down to zero by 2025 (to reflect the fact that coal-producing assets will no longer be usable). This gives us a total asset value of £1.11 billion, or (1.11/0.394)= £2.82 per share.

The liquidation value of the firms assets involve a number of assumptions (percentage amount that needs to be written off, the value of the remaining assets etc. ) which may not be completely accurate (I am not an accountant!), but they give us a reasonable indication of the expected future value of Drax plc by 2025 (in so far as this is possible).