A teacher asks a class a question: There are ten sheep in a pen. One jumps out, how many are left? Everyone but one boy said nine are left. That one boy said none are left. The teacher said you don’t understand arithmetic and he said: “You don’t understand sheep.”- Charlie Munger

Last week’s 2.2% gain in US markets is a distant memory; a combination of concerns over Global Growth, trade wars and the effect on corporate earnings (most of which have been with us for a while now), has led (or helped to spur) a wave of selling in the formerly high-flying US equity markets. Hedge funds, who have been reducing their net exposure to US equities this year consistently, may now be about to have their day in the sun, having endured an extremely painful 2018 (not to mention the previous 5 years).

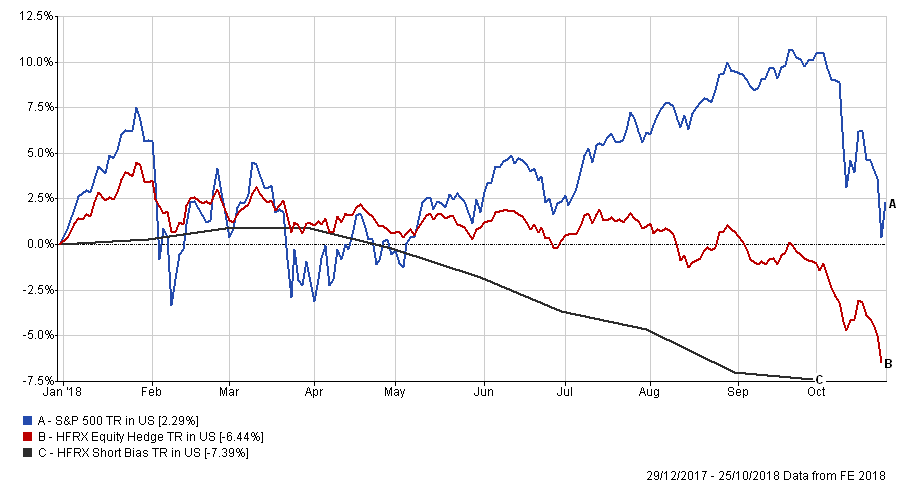

on tthe very early to start celebrating- after all, they have a LONG way to go to get back to even vis-a-vis Indices; the great selling point of a hedge fund in the past has been the idea of uncorrelated returns, which act as a portfolio stabiliser, such that hedge fund investors will prosper when times are bad in asset markets generally. But has it been true? Not in either the recent or the distant past.

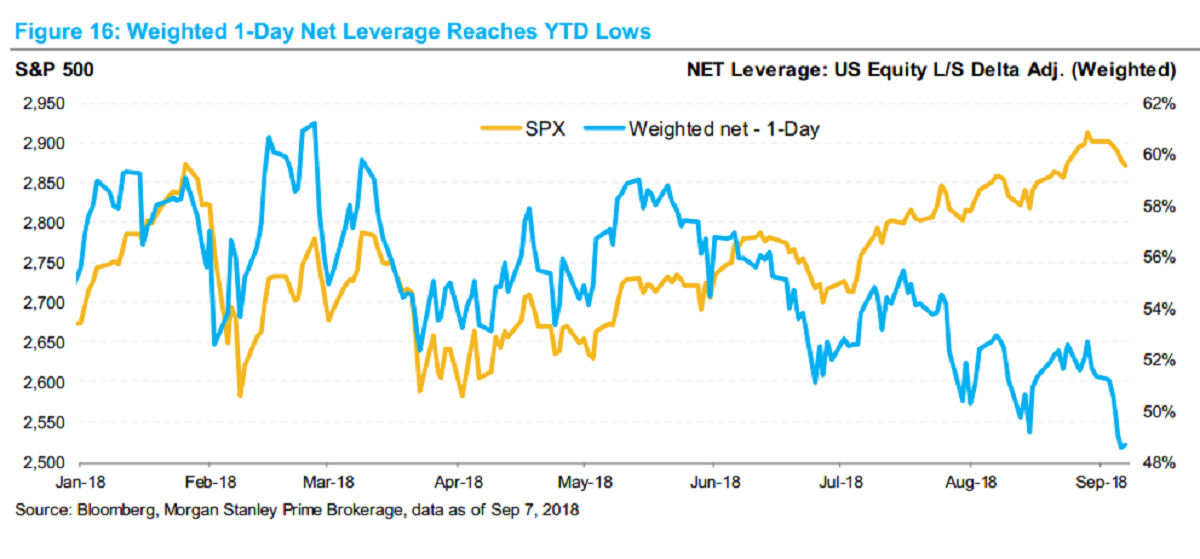

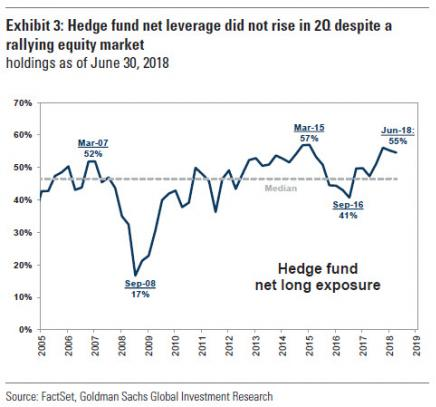

Using the chart above as a template, along with the link above that, we can estimate what they should have returned, given their market exposure over this time [1]. As they are supposed to be hedging (with a few exceptions who take outright views on markets or assets), we cannot reasonably expect them to match the S&P 500 as they are rarely (if ever) wholly long, but we should expect them to match the Index on a market (Delta) adjusted basis if they are doing their job properly. The evidence strongly points to the fact that they have not- they have lagged the (implied) return on the S&P by a long way.

Things get much tougher in a down phase- for one thing, every asset becomes correlated with every other asset, both on a sector and on a regional basis. Banks, for example, have gone the same way in both the US and in Europe making hedging extremely difficult. Another is the tendency for Hedge Fund Managers to “herd” into the same stocks- a Goldman Sachs-created Index of the most popular Hedge Fund long positions (Tech at present), is down 2.1% this year and around 10% in the last month; its decline began pre the recent crisis with the Facebook earnings debacle of the end of July (which was far and away the most popular holding in the basket, owned as it was by 230 different HFs), and has hurt them badly. Meanwhile, their most hated (i.e short ) stock holdings have rocketed north at a rate of knots; the year-to-date figures are shown below; it’s pretty grisly.

The other problem they have to deal with is redemptions [2]- after another poor year in Hedge Fund world, investors inevitably want their money back (and about time too one is tempted to say); according to eVestment‘s latest HF flows report, another $14.7 billion has been redeemed in September, leaving year-to-date flows now flat. Over the last 3 years, $300 billion has been withdrawn from the industry and 8 of the last 12 Quarters have seen net redemptions [3]. Growth in AUM has thus been entirely due to market gains, and there hasn’t been much of that either! The problem is, as mentioned above, that concentration in specific sectors (e.g. Techn) means that forced selling by one Hedge fund leads to price (and thus performance) “issues” for other Hedge funds, leading to redemptions there, forced selling and so on in what could become a vicious circle for the industry, as selling begets more selling.

What will they do now? Clearly, confidence (as reflected in their net market exposure) is extremely low- it has been a rotten year and there is no light at the end of the tunnel (except possibly an on-coming train). The self-styled “master of the universe” are in severe danger of becoming obsolete.

Even Larry Swedroe, a fervent critic of Active Management agrees that Hedge Fund managers do have stock-picking ability (see here), the problem being that ALL the benefits of their activity accrue to themselves rather than to their investors. And THIS is the essential problem (which applies equally to Active Managers)- unless and until they can demonstrate that their charges are in any way commensurate with the risks investors are facing, investors would be better off in a balanced portfolio. We don’t see that logic changing any time soon.

[1] A portfolio Delta is similar to a Beta, in that it measures the sensitivity of the portfolio’s price movement to that of the market- so a Delta of 0.3 would imply a move that is 0.3 times that of the market, a Delta of 0.6 would imply a move 0.6 x that of the market etc, etc. If we divide the return over the last 5 years of the Hedge Fund Composite Index (+32.81%) by the return of the S&P 500 over that time (+110.21%) we get 0.2977 or an implied Delta of just below 0.3 over that period.

But as the Net Leverage Chart above shows, in the last year at least, it has only now reached lows around 0.5. If we divide 110.21% by 0.5 we get an implied return of 110.21/0.5 = +55.11%, far ahead of what was actually achieved in that time. So, either the net Delta has been substantially lower for the first two years of this period, or Hedge Funds have massively underperformed- according to the chart below, (from Goldman Sachs), the net Delta has not gone below 41% since 2011.

(It is also worth noting that even if you add back the 2% traditional Hedge fund fee to the Index return over that period, you STILL only get an implied portfolio Delta of 45.8, again below what has prevailed over the last 5 years).

[2] hf-implode.com tracks the closure, re-structuring etc. of major Hedge Funds across the investment universe. It is not a pretty picture for the business.

[3] The next date to watch is 15th November, the date by which Year-end redemptions must be made.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.