“We have low levels of arrears, strong credit risk management and a low risk balance sheet”- Adam Applegarth, Chairman of Northern Rock (2006).

Since the Financial crisis of 2007-09, High Yield bonds (previously known as Junk, but that name reduces their sale ability), have become as popular as a foreign exchange client at Wells Fargo. Credit risk has become less “risky” as Investors have piled into some bonds of dubious quality allowing company’s, who would otherwise struggle to refinance to do so on extremely generous terms. Prices have duly responded, with returns over five times that of Investment Grade and Government equivalents (see below).

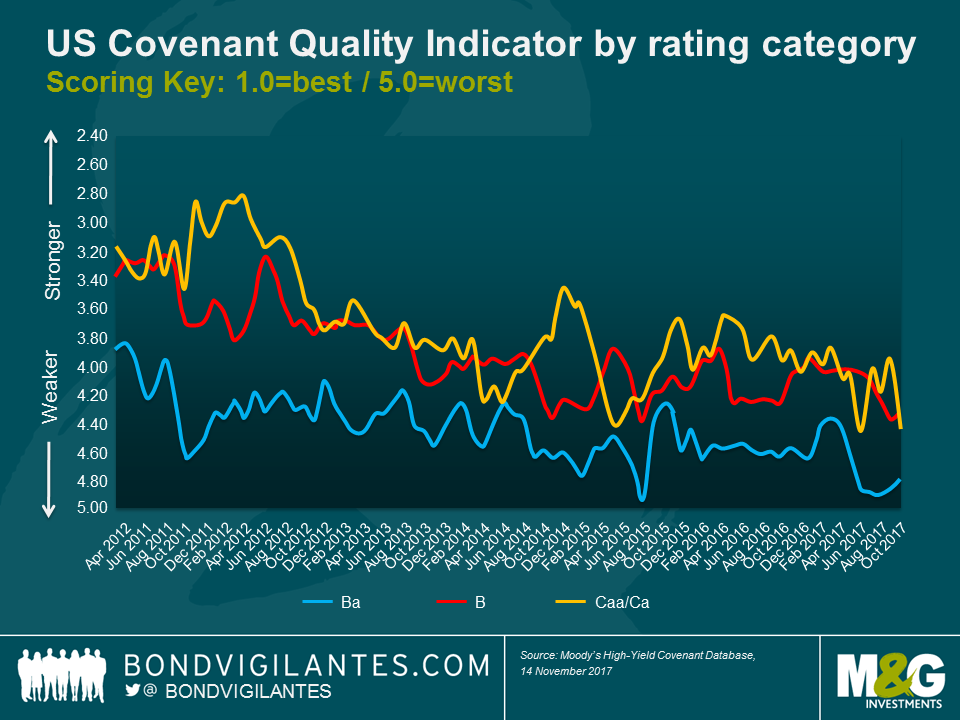

Thus, in addition to some rather “aggressive” Corporate accounting policies, the torrent of Central Bank liquidity injections ($1 trillion this year alone-and counting), has created a perfect backdrop for issuers, as Investors bought heavily, worried about “missing out” on these higher yields which their clients are demanding. One of the features of bond issuance post-2009 is the prevalence of “Covenant Lite” bonds [1], namely that the restrictions placed on Issuers have been steadily eroded, to the point that the interests of bondholders are subordinate to those of others (mostly shareholders). As the chart below suggests, the “quality” of protection offered to bondholders has been in near-constant decline since 2011, thereby increasing risks for bond investors.

In order to assess value in bonds, Investors must make some assumptions about future default rates; will the economy continue to grow (low potential defaults) or will it go into recession (leading to higher defaults)? But the rate of default is not the whole story- the recovery rate (i.e. how much of their money do investors get back after a credit event) is as, if not more important. According to Moody’s, the Global Corporate recovery rate was 31.3% in 2016, whereas in 2014 US High Yield bonds had a recovery rate of 61%. This is almost as important as the default rate in determining the risk (or otherwise), of an investment [2], as one is taking bigger risks (i.e. of not getting large parts of the investment back), whist having to accept lower yields for those bonds that DO reach maturity. Reducing protections for Bond investors can only lead to a greater risk of mistreatment at the hands of Corporate boardrooms, something that is beyond Investor’s control.

Bonds are often seen as dull investments; they certainly lack the fireworks often associated with equities. The mathematics of bonds are such that a bubble is nearly impossible, as one can easily calculate long term cash flows with a large degree of precision (unlike, for example, those of Tesla – what is that company worth now, let alone on a 5 year view ? The range of potential financial outcomes for the firm are enormous).

At EBI, we do not invest in “High Yield” at all – Bonds are not a source of return for us, but act as a portfolio stabiliser, to dampen the inherent volatility of equities. High Yield bonds have equity-like characteristics (since the return of capital depends on the company’s growth – or survival). As the chart below shows, they have even beaten Stock Indices at times, (though note that the out-performance has been almost exclusively since the 2009 post mortgage bubble lows, when Central Banks started to print money to support asset prices). There is no certainty as to that continuing, so it makes more sense to own equities outright, rather than take on credit risk to get this exposure. In addition, the spreads between High Yield and Investment Grade bond yields (a measure of the former’s relative risk) have narrowed substantially over the last decade, but there are signs of them widening again, as Investors get more concerned about credit risk.

If the Central Banks step away from market support, then a lot of things may change rather quickly in this area, likely with little warning – this seems an extra risk that is not worth taking, particularly as we have expertise in credit risk assessment. As the 2007-09 Mortgage crisis showed, we are not alone in this regard.

[1] A bond covenant is a legally binding promise by the issuing Company that it will (or will not) do certain things that may undermine the position of existing bondholders, for example by increasing their debt levels, or restricting the payment of dividends and forcing the firm to maintain Interest Coverage ratios. This compels the company to act prudently and generally not put shareholders interests above those of bondholders. All the details are contained in the documentation accompanying the bond issue process itself, but as they are extremely dull, often investors do not read them. This they can come to regret…

[2] Lets see if we can calculate the implied probability of default for an imaginary 10 year High Yield bond, using the formula, p = (RR – RF ) / (1 –c + RR), where the Bond rate is RR, (the Bank of America High Yield Index currently has a 5.75% yield), the 10 year US Treasury (risk-free rate) is RF (2.35%) and the recovery rate is 0.5 (50% of the principal). [High Yield bonds do not generally have a 10 year maturity, so this calculation may understate the probability of default somewhat]

Using the above numbers, the outcome is 0.0575-0.0235/ 0.5575 = 0.061

The Implied Probability of NOT defaulting over a 10 year period is thus (1-0.061) ^10 = 53.3%

Alternatively, the market is suggesting a (1-0.533) = 46.7% chance OF default over the next ten years (which is almost a coin toss).

If one raises the recovery rate (to say 60%), the odds of default rise to 53.79% (and drops correspondingly, if one lowers the same assumption).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.